In spite of the trade lagging international chief BID, Tesla’s inventory continues to upward push. As of April 2025, the main electrical automotive maker in the USA has fallen at the back of its Chinese language competitor relating to gross sales. How are we able to provide an explanation for this hole between inventory marketplace price and turnover?

Tesla has lengthy embodied the economic forefront of electrical automobiles. Then again, the aggressive panorama has modified profoundly. Chinese language producers, led via BID, but additionally NIO and XPeng, have now taken a measurable lead in volumes, marketplace stocks and value regulate. As of April 2025, BID has develop into the worldwide chief within the sale of electrical automobiles.

Ironically, this build up in business power has now not translated into an similar rebalancing within the inventory marketplace: Tesla maintains an especially prime price, BID falls.

Tesla inventory worth since 2016 Boursorama

Those discrepancies carry a central query in marketplace finance: What do buyers in reality price in Tesla?

BID percentage worth since 2016 Boursorama Commercial extend on BID

These days, China is the sector’s greatest marketplace for electrical automobiles. In 2024, 10.9 million electrified automobiles shall be bought there, or 47.6% of general automotive gross sales. It is massive. Producers like BID are suffocating the contest with 4.3 million automobiles bought in 2024.

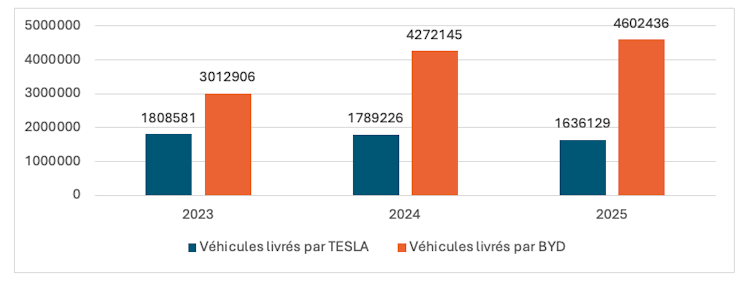

Consistent with information from the China Affiliation of Automotive Producers (CAAM) and the World Power Company (IEA), BID in large part dominates this marketplace, with gross sales volumes a lot upper than Tesla’s. By means of comparability, BID has bought about 1.7 million battery electrical automobiles (BEVs) in 2024 and about 2.25 million in 2025.

Automobiles provided via Tesla and BID. Morning Megastar

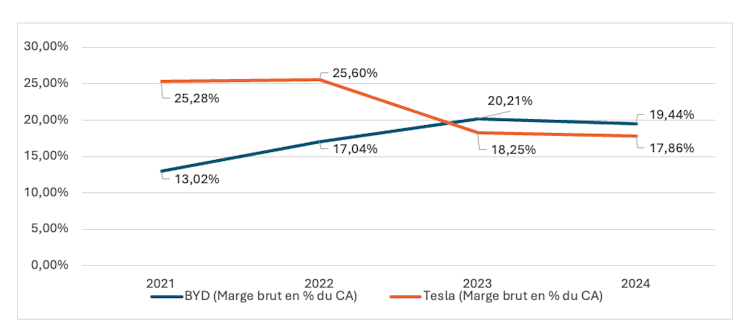

Along with scale, the good thing about Chinese language producers is in line with intensive vertical integration: BID produces its personal batteries, motors and embedded device, which permits it to scale back manufacturing prices and higher regulate high quality. This inside regulate provides it upper margins and bigger flexibility in comparison to the contest. Consistent with those key dimensions, Tesla is not the undisputed chief it was once ten years in the past. Those low cost benefits allowed BID a considerably upper gross margin than Tesla.

Inventory valuation remains to be remarkable

In spite of this relative trade decline, Tesla continues to showcase a marketplace price a ways more than that of its Chinese language competition. This overvaluation turns into transparent when Tesla is in comparison to BID.

Marge brute de Tesla and BID. Morningstar, creator equipped (no reuse)

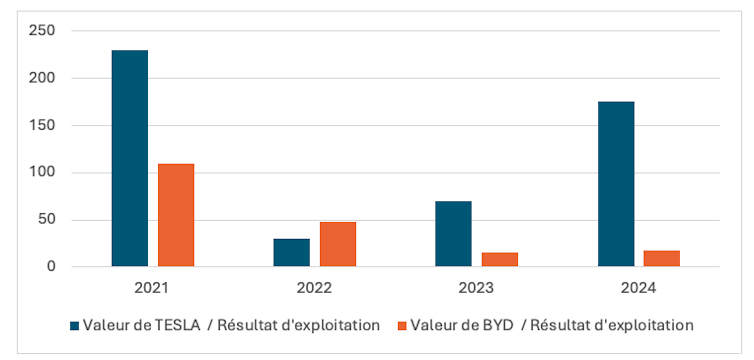

The more than one price at the chart confirms this paradox. The “company value to operating profit” ratio presentations how a lot buyers pay for every euro of benefit an organization generates earlier than taxes and pastime. A prime ratio, like Tesla’s, presentations that the marketplace values the corporate excess of its present earnings would justify, having a bet on its expansion and long term plans. This ratio stays considerably upper than BID, apart from for 2022 when BID seems “more expensive” than Tesla.

In truth, this result’s because of a brief lower in working benefit after the large investments of the BID. Certainly, in 2022, BID invested vastly in its business capability: the price of its tangible mounted property reached 131.88 billion yuan (roughly 16.13 billion euros), an build up of greater than 115% in comparison to the start of 2022, which translated into greater than 6 billion yuan in manufacturing line (15 billion euros). factories all over 12 months.

Anticipations de domination long term

This hole between trade efficiency and inventory marketplace valuation is in large part defined via the function of expectancies.

Our marketplace finance analysis presentations that the price of a indexed corporate will also be separated from its fast monetary effects. The inventory marketplace does now not most effective price present earnings, but additionally buyers’ expectancies about long term actions in money flows and earnings.

So long as the strategic narrative stays credible, buyers are keen to pay a prime percentage worth, which is able to stay the entire valuation at a sustainably prime degree. Tesla exemplifies this mechanism: its valuation essentially displays the marketplace’s expectancies of its long term possible, now not its present efficiency.

Make the most of Tesla and BID. Morning Megastar

Tesla is valued now not most effective as a automotive producer, but additionally as a era participant with more than one strategic choices – synthetic intelligence, self reliant using, robotics, and so on. This belief is fueling a chronic inventory marketplace top rate.

The long-term evolution of the Tesla inventory worth illustrates this phenomenon. In spite of stages of margin power, higher pageant and an trade slowdown, the inventory’s trajectory stays remarkably prime via car requirements. In February 2025, the inventory marketplace percentage at 428.60 US bucks, i.e. 360.59 euros.

An phantasm at the inventory marketplace?

Tesla isn’t an remoted case in monetary historical past.

Markets have ceaselessly assigned prime premiums to corporations observed as main primary disruption, akin to Amazon, whose valuation has lengthy exceeded its fast earnings via having a bet on its long term dominance in logistics and the cloud.

This phenomenon isn’t new: since its beginnings, monetary markets have skilled equivalent episodes, such because the tulip mania in Holland within the seventeenth century, the place the cost of a tulip bulb may just achieve the cost of a small citadel, or the bubble of the South Sea Corporate in 1720, when the cost of its stocks multiplied via 8 months with none actual financial expansion in only some months.

Those scenarios can remaining a very long time, so long as the strategic narrative stays credible. The chance is apparent. The broader the distance between promise and trade fact, particularly within the face of more and more environment friendly Chinese language pageant, the extra fragile the valuation turns into. If expectancies had been revised, the adjustment might be brutal.

Tesla’s problem, then, is twofold: to atone for its business hole with Chinese language producers, whilst proceeding to persuade markets that its long term nonetheless warrants an peculiar inventory top rate.