1966 The 2 occasions came about on the identical time: Credit score Surprise in the US and the Banking Disaster in Lebanon, with a outcome of chapter in inside (or throughout the financial institution) of the financial institution. Beginning? Integration of the “Swiss Middle East” within the Global Economic system. However how are those occasions similar? Who’s within the foundation? Who suffered essentially the most?

Are you aware the impact of butterfly, this idea consistent with which the rhythm of the butterfly in Brazil may cause a twister in Texas? Economics, if no longer existed as such, a credit score disaster in the US can also be one of the vital reasons of banks chapter in Lebanon.

That came about in 1966. years. Lots of the research attributes the Lebanese disaster to the chapter of Intra Financial institution or on systemic failure, motivated greed, preventing electrical energy and the bought pursuits of elites, with out deepening.

On the other hand, our find out about presentations that this chapter is in large part derived from recession American surprise, which ended in an build up in global rates of interest. Calls into query the concept the one chapter of Intra banks led to liquidity disaster. Even the other that there was once a disaster introduced by means of American surprise, ended in chapter inside and different banks, pushing global rates of interest.

Financial institution’s credit score disaster in the US

1966. America skilled an surprising decline within the credit score be offering of banks, led to by means of the marvel choices of the Federal Reserve, Central Financial institution, to restrict financial advent and restricted credit score provide. This American credit score surprise was once one of the vital spectacular within the post-war length. In November 1966. American rates of interest reached 5.75% of the highest.

In reaction, firms are in query in query trade results. Those temporary debt securities factor firms to fund immediately from traders, with out passing over banks. They’re compensated for adulthood within the quantity in their nominal worth (mounted from the query).

The once a year expansion price of industrial results was once exceeded 7.8% in 1966. at 46.6% 1966. years. This build up is defined by means of financial contraction, a common relief in value at the inventory change and to a lesser extent, by means of financing the Vietnam warfare.

Lebanon Golden Age

Financial surprise from 1966. It was once no longer most effective suffering from the US economic system, but additionally handed to Lebanon, as small, open and labored underneath the 1948 power. Years. In particular, whilst maximum nations followed a set change price regime right through 1950-1960. The foreign currencies price is in large part made up our minds by means of the marketplace reserved for banks, that are exchanged with over the top budget.

From the Nineteen Fifties to the Seventies, Lebanon was once offered as “Switzerland from the Middle East”, because of the presence of many banks. VikimediaCommons

Lebanon has skilled robust expansion within the Nineteen Fifties, about 8%. Regardless of the constraints in different nations, capital is loose to be aimed toward Lebanon. Petrodollars are inhabited there, attracting scholars, execs and corporations. Beirut turns into a monetary, highbrow and vacationer hub. The Regulation at the Banking Act of 1956. yr additional strengthens its monetary heart. In 1960, it has expanded this dynamics: the advent of the Central Financial institution in 1964. years, the improvement of the banking sector, the influx of capital and funding.

On this promising context, the surprise of Would possibly 1966 was once created. Years.

Of eleven banks 1950 to 79 1964 years

Because of the significance of the economic system of the US, the expansion of rates of interest within the nation of uncle will increase global charges, together with Lebanon. Lebanese charges started to extend in June 1966. yr, a month after Would possibly, from 5.62% to five.82% in June and six.07% in July. Expanding rates of interest in Lebanon is first restricted, because of extra liquidity in banks. On the other hand, this surplus must be temporarily decreased underneath the impact of summer season’s flight.

The Sixties, the Lebanese monetary device characterizes a powerful dispersion of financial institution deposits. Between 1950. and 1964. years, the choice of banks larger from 11 to 79, proscribing deposits by means of the establishment.

Simplest Intra Financial institution is an exception: 1965. years, just a quarter of deposits in Lebanon. Between 1955. and 1965, its deposits larger by means of greater than 40% in step with yr, in comparison to 26% for different banks. Intra-Financial institution was once given 1956 million Lebanese kilos in 1965. years. Not able to speculate native to its assets, it became to international markets and turned into a privileged financial institution investor within the Center East, particularly the bay.

“Hot money” and capital flight

At the moment, capital flows had been delicate to rates of interest (“hot money”). Those flows from one nation to every other assist you to reach a temporary benefit at the variations of rates of interest and / or early permutations within the path.

De facto, expanding rates of interest in the US, and in the UK reasons the capital flight Lebanon in those two winning markets, starting up liquidity disaster from 1966. years. Lebanese central financial institution, with out ok gear – a number of reserves, with out open marketplace (acquire or sale of public securities available in the market to control liquidity and results of rates of interest) – can build up native rates of interest.

The placement deteriorated in October 1966. when the Intra financial institution suspends its bills. Financial brokers, evaluating international charges to these in Lebanon, transmit their method in another country. This emphasizes the disaster, weakens the native liquidity and plays drive at the Lebanese e book. Between 1966. and 1970. years, the choice of banks dropped from 94 to 74.

Extra withdrawal from deposit

From 1. August 1966. an afternoon withdrawal in Intra Financial institution exceeded deposits. This pattern was once emphasised a number of weeks later by means of disaster rumors. A number of native and international banks take away about 18 million Lebanese kilos. The next are small harm, withdrawal 52 million between 3. And 14. October 1966.

On the identical time, within the context of accelerating rates of interest in another country, shoppers of Lebanese banks start to put across a part of their assets to establishments in another country. Being the principle financial institution within the nation and chronic goal of rumors, Intra-Financial institution submits withdrawals upper than the ones recorded in different banks.

6. October 1966. yr, control was once requested to assist Central Financial institution Lebanon, licensed by means of one-year of £ 15 million at a price of seven%, in opposition to actual promises.

Row in entrance of Intra Financial institution 1966. years. Supplies the writer

Due to this strengthen, Intra Financial institution takes bills from their savers, however budget are temporarily exhausted. The Financial institution calls for an extension of 8 million, rejected by means of Lebanon Financial institution. This refusal is defined basically by means of the truth that it’s nonetheless too younger and disadvantaged of enough budget to totally play its lender function within the remaining hotel. The absence of political consensus across the head of intra-banka Ioussef Beidas, Palestinian foundation, together with opposition to monetary elites, who attempted to redistribute their assets to different banks, in addition to systemic weight within, which might bankrupt chapter.

In the meantime, the financial institution’s control is attempting to go back to New York deposits Beirut. Along with persisted expanding rates of interest in the US, massive American institutional deposits have already withdrew maximum in their budget to invite them in other places.

Intra-Financial institution is in large part in nice difficulties and declares the termination of its bills on Saturday 15. October 1966. The disaster has affected different banks, savers boost up their withdrawal after understand inside.

The Lebanese E-book response in comparison to the greenback

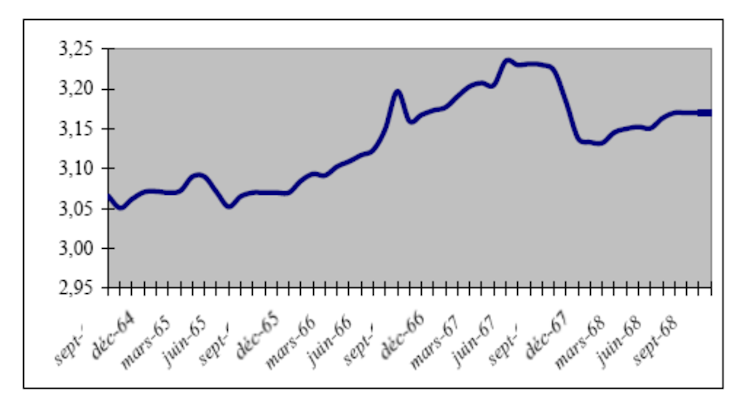

After the Limited American Financial Surprise from 1966. and till the Central Financial institution of Lebanon additionally has any budget to intrude within the foreign currencies marketplace to strengthen the nationwide forex, Lebanese books, and Lebanon books. The path exceeds $ 3.18 for the greenback on the finish of April 1966. to £ 320 in September. The typical price larger from € 3.07 in 1965 in 12 months. At 3.13 £ 1966.

The Lebanese E-book path since 1964. till 1968. years. Supplies the writer

Briefly, the 1966 surprise. Years disturbed expansion for a number of months. He led to liquidity disaster, contributed to the chapter of the most important financial institution within the nation (and the banking panic that adopted) and adjusted the construction of industry. It additionally led to expanding rates of interest, capital go out and nice instability of the path.

However Lebanon unearths some way out of the disaster. Deposits returned from 2.6 million in 1967. to two.9 million in 1968. years. Rigidity steadiness has progressed from -1.7 million in 1967. to 176.3 million Lebanese kilos in 1968. years. Nationwide source of revenue is 1968. years. The mortgage within the non-public sector continues from 2.3 million to two.4 million to two.4 million in 2.4 million of two.4 million in 2.4 million in 2.4 million in 2.4 million in 2.4 million in 1968. years. The disaster handed.