Ultimate week, Bitcoin skilled its “Black Thursday”. Lengthy introduced as a separate asset, able to growing independently of conventional monetary markets, bitcoin is nowadays deeply built-in into international finance. Mockingly, this rising integration didn’t lead to stabilization of its value, however higher sensitivity to macroeconomic shocks and the emergence of latest dangers of monetary contagion.

In contemporary months, and particularly in contemporary days, Bitcoin has skilled episodes of volatility on an exceptional scale. In 4 months, the main cryptocurrency has misplaced 50% of its price. Inside of per week, the cryptocurrency marketplace misplaced $700 billion in capitalization.

In one in every of our present papers, we display that business or financial coverage bulletins from the USA may cause surprising diversifications in the cost of Bitcoin inside of hours.

Bitcoin value since 2016 Boursorama

This commentary contradicts the picture that has lengthy been related to this agent. Designed as a decentralized financial gadget, impartial of central banks and nationwide financial insurance policies, Bitcoin is continuously introduced as an software able to evolving out of doors of conventional monetary cycles. This promise of adornment is likely one of the pillars of its preliminary enchantment.

This studying is much less and not more suitable with the noticed fact. A ways from last remoted, Bitcoin has progressively inserted itself into the guts of worldwide monetary mechanisms. Nowadays it’s held, traded and built-in into portfolio methods along conventional sources equivalent to shares, bonds or commodities. This structural transformation profoundly modifies the character of its fluctuations.

How then are we able to provide an explanation for this paradox?

Bitcoin Volatility

Bitcoin now not simplest reacts to elements inside to the crypto-asset ecosystem. Its volatility is now carefully related to macroeconomic shocks, equivalent to diversifications in rates of interest, inflation bulletins or episodes of monetary pressure.

When a surprise happens, buyers modify their portfolios globally. Bitcoin can then be bought, no longer for its personal traits, however to hide losses, cut back chance publicity or meet liquidity constraints. It turns into, if truth be told, an adjustment variable like another.

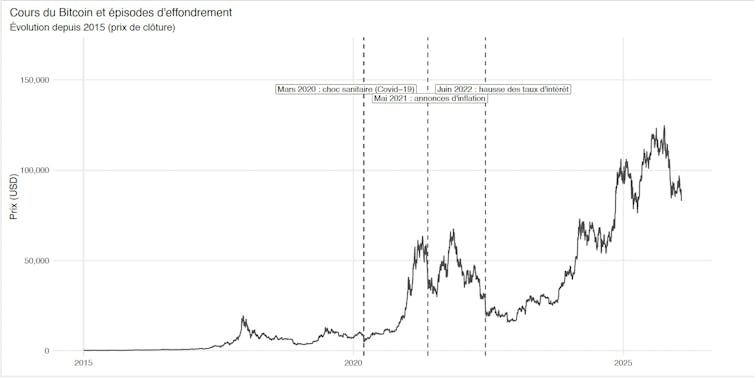

The graph beneath illustrates this dynamic. It presentations that a number of stages of bitcoin’s sharp decline coincide with main macroeconomic occasions. In March 2020, when the Covid-19 pandemic broke out, its value fell by way of about 40% in someday. In 2021, the announcement of top inflation in the USA leads to a cost drop of virtually 30%.

Bitcoin value and macroeconomic shocks. Authors

Those episodes recommend that bitcoin now not performs the position of protected haven this is every now and then said, however to the contrary reinforces sure marketplace dynamics during times of anxiety.

Rising integration with ETFs

The mixing of bitcoin into monetary markets has been sped up by way of the access of institutional buyers and the improvement of monetary merchandise that let publicity to it with out immediately protecting sources. Bitcoin-backed exchange-traded price range (ETFs) illustrate this building.

Through purchasing a bitcoin ETF, the investor does indirectly cling bitcoins, however a monetary safety whose price follows the evolution in their value. With regards to so-called “spot” ETFs, the issuers in reality cling the bitcoins to copy the fee. There also are “synthetic” ETFs, which don’t personal bitcoins however reproduce their efficiency. Those monetary merchandise create a right away hyperlink between the Bitcoin marketplace and standard monetary markets.

Bitcoin is now not seen as simply an experimental or marginal asset, however as an integral part of diverse funding methods. On the finish of 2025, virtually $115 billion (€96.9 billion) was once invested in those ETFs.

Fund managers who love bitcoin

This higher integration does no longer simplest fear particular person buyers. Institutional avid gamers now occupy crucial position within the ecosystem. Fund managers, funding banks and big publicly traded corporations have important positions in bitcoin or linked merchandise.

BlackRock, for instance, invested $217 million (€182.9 million) in bitcoin-related merchandise. Larry Fink, director of BlackRock, then again, said that its value may just ultimately achieve between 500,000 and 700,000 bucks (between 421,270 and 589,900 euros).

Within the Eurozone, this publicity passes thru avid gamers matter to monetary laws. Consistent with the Banque de France, institutional positions in bitcoin grew from round $13 billion (€10.9 billion) at the beginning of 2024 to greater than $33 billion (€27.8 billion) on the finish of 2024, for just about 2,000 uncovered establishments. If those quantities stay restricted on the subject of the whole capitalization of Bitcoin, their focus and their connection to the normal monetary gadget build up the hazards of transmission.

The virtually steady liquidity of the bitcoin marketplace, to be had 24 hours an afternoon, can boost up the propagation of shocks to different asset categories. Consistent with the IMF, right through a well being disaster, bitcoin volatility would provide an explanation for as much as 16% of the volatility of the S&P 500, and about 10% of the adaptation in its returns. In different phrases, Bitcoin fluctuations now not stay confined to the sector of cryptoassets.

A brand new problem for savers

For savers, this alteration represents a large problem. The presence of institutional avid gamers and the supervision of intermediaries may give the influence that bitcoin has grow to be an asset related to conventional monetary tools, and subsequently much less dangerous. This belief is fallacious.

In France, round 5 million people have already invested in crypto-assets, continuously with out good enough coverage or diversification equipment. All through the reversal stages, losses may also be fast and demanding. In 2022, Bitcoin misplaced virtually 60% of its price, whilst all the crypto-asset marketplace noticed a lack of round $1.7 trillion (€1.433 trillion). This Thursday, February 5, 2026, in forty-eight hours, Bitcoin fell by way of virtually 15%, falling beneath $70,000 (€59,000).

Bitcoin’s integration into international finance has subsequently no longer lowered chance, however fairly shifted it into broader and doubtlessly extra systemic macroeconomic dynamics.

This newsletter was once written solely in collaboration with Sami Es-Sniby, a pupil on the College of Lorraine.