UK chancellor Rachel Reeves would love Britons to speculate extra in shares – in particular UK shares – somewhat than stay their cash in money. She has even instructed the United Kingdom finance trade to be much less unfavorable about making an investment and spotlight the prospective features in addition to the hazards.

Inventory possession is essential for governments for quite a few causes. Boosting capital markets can inspire trade enlargement, task introduction and long-term financial enlargement. It will possibly additionally give other folks any other supply of source of revenue in later existence, particularly as long-term making an investment can be offering larger returns than saving.

However in the United Kingdom, with the exception of place of business pensions, best 23% of other folks have invested within the inventory marketplace, in comparison to just about two-thirds in the United States. Survey effects counsel that American shoppers are normally extra ok with monetary dangers.

And it sounds as if that a better stage of menace interprets into nearer political engagement. Throughout marketplace shocks pushed by means of US president Donald Trump’s tariff chaos, many American citizens tracked headlines – and their portfolios – intently. This contrasts with the United Kingdom, the place the general public stay their financial savings in more secure property like money financial savings accounts or top class bonds.

If Britons are extra risk-averse, media protection that has a tendency to be noisier when markets fall than after they get better could also be having an affect. Whilst considerations relating to marketplace volatility could also be legitimate, they may be able to overshadow the long-term advantages of making an investment.

One key alternative that many British shoppers have overlooked out on is the upward push of cheap, assorted exchange-traded finances (ETFs), that have made making an investment extra available and reasonably priced. An ETF permits traders to shop for or promote baskets of stocks on an change. As an example, a FTSE100 ETF offers traders publicity to the United Kingdom’s best 100 corporations with no need to shop for every one in my opinion.

That is precisely the type of long-term, cheap making an investment that Reeves seems to be selling. However must savers be fearful about present marketplace volatility – a lot of it pushed by means of business tensions and tariff uncertainty? One view, in fact, is that volatility is just a part of making an investment.

After sharp falls, inventory markets incessantly rebound briefly.

Creator equipped (no reuse)

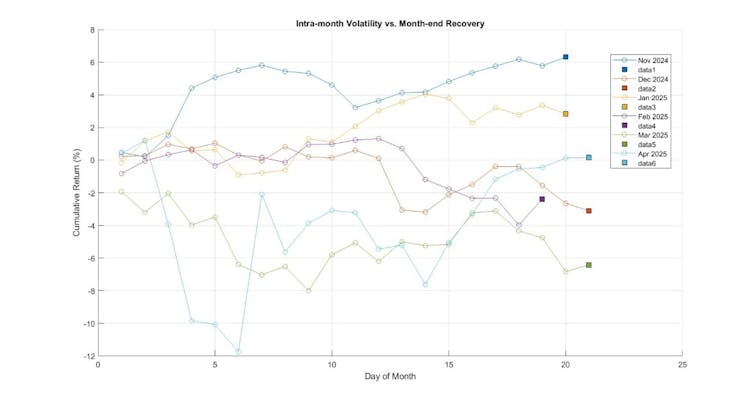

Inspecting day by day extra returns in the United States inventory marketplace from November 2024 to April 2025, I plotted cumulative returns (which display how an funding grows through the years by means of including up previous returns) inside every month. April 2025 sticks out. Regardless of experiencing a number of sharp day by day losses, the marketplace rebounded hastily within the days that adopted.

This trend isn’t new. Traditionally, markets have proven a outstanding skill to get better from non permanent shocks. But many doable traders may well be deterred by means of alarming headlines that, whilst factually correct, incessantly spotlight single-day declines with out broader context.

The truth is that the inventory marketplace is regularly a sequence of short-lived storms. Those are unstable, sure, however incessantly adopted by means of calm and restoration.

Worry and warning

Throughout marketplace downturns, it’s commonplace for other folks to check out to grasp why this time is worse or analyse if this crash is extra critical than earlier ones.

The concern those headlines generate may feed into boundaries to long-term making an investment in the United Kingdom. And that’s some of the demanding situations the chancellor faces in encouraging extra Britons to speculate.

For the ones already invested within the inventory marketplace, non permanent declines are a part of the adventure. They’re dangers that may be borne with the figuring out that markets have a tendency to get better through the years.

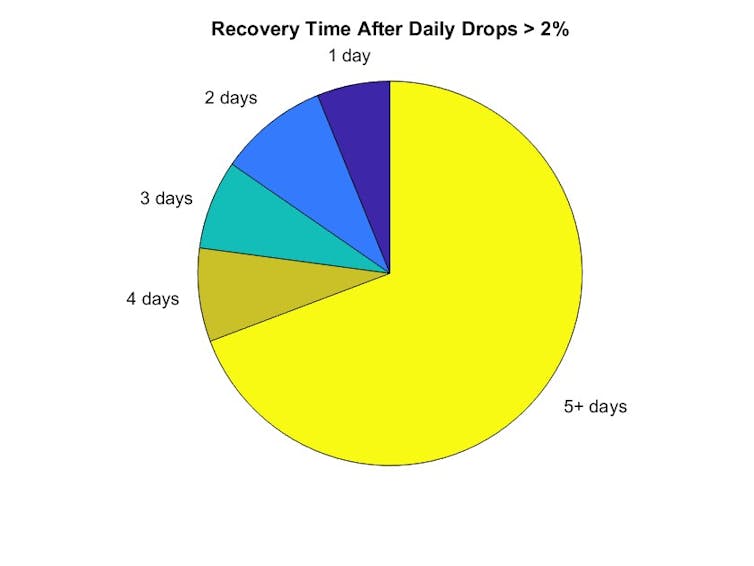

My research of day by day US inventory marketplace knowledge since 1926 presentations that when sharp day by day drops, the marketplace incessantly rebounds briefly (see pie chart underneath). Actually, greater than 1 / 4 of recoveries happen inside only a few days.

Creator equipped (no reuse)

However this resilience isn’t the point of interest of media protection. It’s way more commonplace to peer headlines reporting that the marketplace is down than to peer follow-ups highlighting how briefly it bounced again.

Analysis has proven that unfavorable financial data is more likely to have a better affect on public attitudes. As an example, a pointy drop within the inventory marketplace may dominate entrance pages, whilst a gradual restoration over the next weeks slightly will get a point out. The imbalance reinforces a way of disaster, even if the wider image is much less bleak.

Markets went directly to get better in April 2025… however did the headlines replicate this?

David G40/Shutterstock

Over the longer term, the adaptation between inventory marketplace returns and the normally decrease returns from govt bonds is referred to as the “equity risk premium puzzle”. Economists have lengthy debated why this hole is so huge. Some observers argue it’s going to slim one day. However many others, together with the chancellor, imagine that making an investment within the inventory marketplace stays a recommended long-term technique.

If extra persons are to have the benefit of long-term making an investment, it’s necessary to inform the total tale. That implies now not simply highlighting when markets fall, however following up on how they get better afterwards.