9. July, Donald Trump needed to come to a decision whether or not Customs introduced at the “execution day” 2. April 2025, after which pauses every week later, it is going to in any case be implemented or no longer. The chance to withdraw the evolution of American protectionism since returning to the writer of Donald Trump. What ultimate tax: 5%? 16%? 25%?

From January 2025. Trump management gave an software to the center of its industrial technique for which it’s believed to be deserted: Customs. In a couple of months, all u.s. industry companions have paid the cost. A sequence of measures, unseen for a number of a long time, hit them. For Trump management, this tariff coverage goals to rebalance the decreases of bilateral scales. Particularly, build up the price of overseas merchandise to give protection to the native economic system and source of revenue.

However how does the customs actual activity paintings?

To calculate moderate customs Customs, from data to be had with regards to merchandise known as “Prices Lines”, there are 3 major strategies. A easy moderate is to characteristic the similar weight to each and every customs correctness. The weighted moderate is in keeping with business streams between the 2 international locations, the place it’s extremely imported extra in an international indicator. In spite of everything, the process decided on for the Cepii Tariff database, MACMAP-HS6, known as “reference groups”. It’s in keeping with reconstructed import profiles from samples from related international locations. Those calculations display that the technical alternatives of customs aggregation have an effect on the belief of industrial insurance policies.

“Oslobođenja Day”

With regards to industrial coverage, 2025. years, 4 distinguished has been marked thus far.

First was once between 20. and April 1. April. Mass will increase in strategic merchandise reminiscent of metal, aluminum and cars, deleting earlier personal tastes and are imbued on all overseas providers. The Business Settlement with Mexico and Canada (Aceum) has now integrated 25% of the rights for merchandise imported to america that don’t seem to be in step with the foundations of the Settlement. Chinese language merchandise are taxed through two consecutive increments to result in an build up of 20 share issues (PP) – PP signifies a variation of the share.

Monday to Friday + week, obtain analyzes and deciphers from our mavens at no cost for some other view of the inside track. Subscribe nowadays!

Every other emphasis happens 2. April, “Oslobođenja Day”, inaugurating the brand new golden age in The usa. Washington establishes customs certified as “reciprocal”. Then again, they don’t seem to be in keeping with tariff coverage measures, however to the imbalances of bilateral business balances with america. 10 share issues are maintained (fundamental price) to seriously upper charges for a listing of 57 international locations: 34 PP for China, 20 PP for the Eu Union, and many others. Positive strategic crude fabrics, spared provide causes.

Direct war with China

The 3rd act was once direct war of words with China. Each and every of the 2 giants inflict mass reimbursement on some other: 125 share issues right through the purpose of culminating pressure between two forces. This mountain climbing recreation is from mid-Would possibly, the newest distinguished this collection. Washington begins partly to lighten sanctions, with out returning to the view of the assessment.

Within the American marketplace, an build up in customs in Chinese language merchandise returned from 125 PPs to ten pp, in addition to for different international locations from 9. April, in China, American merchandise handiest practice handiest 10 pp dietary supplements. Those measures have deeply modified the typical stage of u.s..

However why, on this regard, other figures circulating?

3 strategies of calculating

To calculate moderate customs Customs, from data to be had with regards to merchandise known as “Prices Lines”, there are 3 major strategies.

A easy moderate is to characteristic the similar weight to each and every customs correctness, irrespective of its financial importance. Simple to make use of and thus somewhat common, alternatively, this system offers a biased imaginative and prescient of preliminary ranges and up to date adjustments. The artificially includes moderate, overlaying the scope of accelerating strategic sectors.

To cut back this bias, some analysts want the weighted moderate (extra weight of imported merchandise) through buying and selling flows seen between the 2 international locations. This way is healthier reflecting the real affect of the best to replace. Sturdy imported merchandise are extra accounted for within the international indicator. This technique suffers from nice injury that economists qualify as endogenicity: nice customs rights decreases, and even cancellation, product import so taxed. Theoretically, if the product is taxed at 200%, however isn’t imported, its customs clearance disappears right through the calculation of the typical, because it multiplies with 0. Decreases the typical customs regulation.

In spite of everything, the process decided on for the CEPIA tariff database, MACMAP-HS6, known as “reference groups”, brings a realistic approach to endogenous issues. As an alternative of the use of bilateral flows that experience if truth be told spotted, which we’ve simply observed that they are able to have sturdy bias, is in keeping with imported import profiles from samples from related international locations. Each and every nation of imports belongs to the reference team that make identical international locations. This procedure supplies a extra strong indicator that may have interaction in world comparability.

Customs Evolution

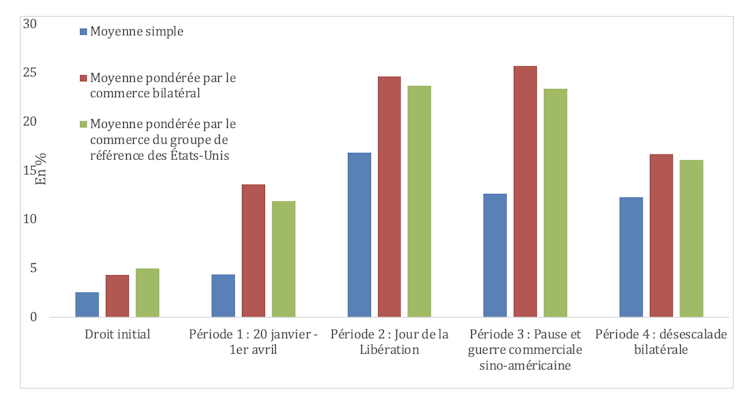

The variations between those strategies are a ways from marginal. At the start of 2025. years, america has proven the typical stage of Customs of five% consistent with MacMap-HS6 strategies. 4.3% on moderate weighted buying and selling. With virtually 60% 0 customs, a easy moderate is way decrease: handiest 2.6%.

Evolution of American moderate customs (most up-to-date upward push in American customs on metal and aluminum isn’t taken under consideration on this chart). »Supplied the writer

Between 20. January 2025 (the day of the inauguration) and “Day of Leaving”, a easy moderate, consisting of allocation of the similar weight on each and every customs regulation, will increase through only one.8 share issues (PP). With the MacMap-HS6 strategies of reference teams, the center customs regulation has higher through 6.9 pp, to be 11.9%. Much more, 9.3 pp, on moderate weighted bilateral business, achieving 13.6%. Certainly, customs customs basically refers to main merchandise or industry companions for america. Their vital weight in American imports (or in the ones of reference teams) build up their affect within the weighted moderate finances bilateral business.

The knowledge “of the exemption day” are extra homogeneous. Expanding rights for all international locations, however the weighted moderate display marked overturning protectionist. The duration between the “date of release” and section of breaks and mountain climbing with cinema leads to an important drop in a easy moderate to 4.2 p. What the time period “pause” can recommend. However making an allowance for the construction of bilateral business in america (on moderate weighted), this coverage will increase for +1 pp; Customs in China higher considerably and this nation is an important a part of American imports! In 2024. Yr American imports from China reached a worth of greater than $ 400 billion.

Between 16% and 25%

These days, the typical are very prime, between 16.1% and 16.7%. 12.3% of the straightforward moderate underestimated the level of outrage surprise beneath america, particularly in specifically focused sectors and aluminum and cars. 9. July American coverage can be no less than 16.1%. This might be returned to the highest “Dan of Release”, which, taking into consideration the construction of the import of america or the reference team of about 25%.

This collection underlines that technical alternatives of customs aggregation have an effect on the belief of industrial insurance policies. Floor studying may just result in underestimation to extend coverage. Rigorous research, making an allowance for the prejudice of endogenousness, to the contrary at the dimension of the American protectural milestone, particularly within the sectors – metal, aluminum, automobiles – and explicit international locations – China, Canada, Mexico. Thus, those methodological elections don’t seem to be impartial: they situation financial diagnoses, but additionally modeling situations in promising workout routines of normal steadiness.