The Center East area, house to each oil-rich economies and fragile, conflict-affected states, stays a number of the maximum underfunded within the international local weather panorama.

Equitable get admission to to world finance is very important to struggle local weather trade, in particular within the upcoming Baku to Belem Roadmap, which objectives to mobilise US$1.3 trillion (£1 trillion) in international financing for local weather motion at Cop30, the UN local weather summit.

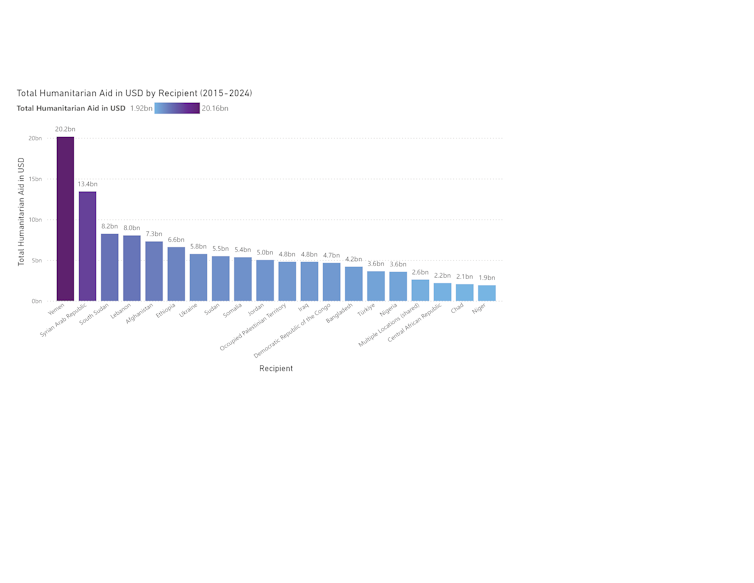

The Center East area is a ways from uniform. A number of fragile international locations within the area, together with Yemen, Syria, Palestine, Iraq and Lebanon, and host international locations of refugees equivalent to Jordan, have been a number of the best 20 recipients of humanitarian support during the last decade.

Wars and local weather trade are inextricably related. Local weather trade can building up the possibility of violent clash via intensifying useful resource shortage and displacement, whilst clash itself speeds up environmental harm. This text is a part of a chain, Conflict on local weather, which explores the connection between local weather problems and international conflicts.

Whilst Yemen, Syria and Palestine are a number of the best 3 recipients of humanitarian support, they obtain the least investment for local weather motion. But they continue to be a number of the maximum susceptible areas to excessive climate occasions equivalent to widespread drought, heatwaves, and flash floods.

Responding to conflicts within the area has now not best redirected finance to humanitarian efforts, but in addition driven local weather motion additional down the concern record. That is along with the truth that emissions from extended conflicts and the destruction of infrastructure are unnoticed as a result of they’re tough to measure or catch up on.

A world imbalance

Consistent with the thinktank Local weather Coverage Initiative’s (CPI) fresh record 2025, between 2018 and 2023, 79% of finance devoted to handle local weather trade was once basically mobilised in 3 areas: East Asia and the Pacific, Western Europe and North The us. This has left the Center East and North Africa area constantly underfunded.

The place finance has flowed into the area, greater than part has come from the personal sector, basically for renewable power tasks equivalent to sun photovoltaics and onshore wind. Globally, mitigation continues to dominate in 2023. Global local weather finance for mitigation was once 27 instances upper than for adaptation.

Local weather ambitions and the finance had to enforce them range throughout international locations within the area. The prices of imposing recognized local weather ambition via 2030 (so-called nationally made up our minds contributions) of eleven international locations (together with Egypt, Iraq, Jordan, Morocco, Tunisia and Sudan) quantity to US$570 billion. Egypt, Iraq and Morocco account for almost three-quarters that general quantity asked.

But world finance flows for local weather motion between 2010 and 2020 stay extremely concentrated in politically strong international locations in North Africa, equivalent to Egypt, Morocco and Tunisia, whilst conflict-affected states within the Center East are left at the back of.

Humanitarian Assist PNG CapTION the use of knowledge from https://fts.unocha.org/

Hala Al-Hamawi, Writer supplied (no reuse)

I’ve researched the predicted shift in international management in financing local weather motion following the USA withdrawal from the Paris settlement. I discovered that between 2010 and 2021, the USA distributed US$390 billion in international advancement help, of which simply over 11% (US$45.1 billion) went to the Center East and North Africa. But lower than 1% of this – best US$197 million – was once allotted to local weather motion.

A number of pairs of trainers laid on out on the earlier UN local weather summit, Cop28, to honour Gaza’s kids.

Hala Al Hamawi, Writer supplied (no reuse)

China, in contrast, has emerged as a significant international lender, committing US$314 billion over the similar duration, of which greater than 90% was once in loans. Alternatively, its local weather finance contribution stays opaque, voluntary and under-researched. Best round 6% of Chinese language finance reached the area, and the percentage devoted to local weather motion is in large part unknown.

The USA retreat from international local weather management, blended with China’s rising function, raises urgent questions on the way forward for local weather finance within the area, in particular thru era switch and investments.

Filling the shortfall

In spite of those demanding situations, new monetary tools would possibly be offering hope. Gear equivalent to inexperienced bonds, carbon buying and selling and local weather debt swaps may assist bridge the finance hole, in particular for indebted low- and middle-income international locations.

The area already has revel in with development-related debt swaps. A debt change is an settlement between a central authority and its collectors to switch sovereign debt with funding commitments towards advancement objectives (equivalent to schooling or environmental coverage), as a type of debt aid. Germany partnered with Jordan, France with Egypt and Sweden with Tunisia in previous development-focused agreements.

Structuring debt swaps for local weather functions might be advanced however probably transformative. Tasks to offer technical give a boost to for local weather debt swaps, equivalent to the ones via the UN’s Financial and Social Fee for West Asia, purpose to succeed in debt aid and advertise local weather motion.

The personal sector additionally has a the most important function in scaling up investments, in particular given the power shortfall in public finance from evolved international locations.

Those tools and private-sector investments could also be unfeasible in conflict-affected international locations because of deficient financial stipulations and restricted capital. Supporting those susceptible international locations calls for additional exploration, probably thru regional projects with close by strong international locations.

Final this financing hole calls for greater than humanitarian support to handle the antagonistic penalties of local weather trade. It calls for recalibrating international finance flows, recognising the area’s explicit vulnerabilities and fostering better innovation thru new equipment and partnerships. Equitable get admission to and allocation of the proposed US$1.3 billion might be very important. With out this, the area dangers being left at the back of within the race to evolve to and mitigate local weather trade.