Decrease or mount rates of interest: This can be a vintage symbol of economic coverage. Then again, the Eu Central Financial institution (ECB) realized to care for any other similarly key lever: speech. From the disaster 2008, she has multiplied bulletins, thus advanced the clarity in their monetary markets choices.

The euro zone is going through “with risks and uncertainty”, in step with Christine Lagarda, the President of the Eu Central Financial institution (ECB). Originally of 2025. The ECB introduced a decline in its 25 fundamental issues. 6th decline in simply 8 months. That is this sort of spotted “conventional” financial coverage Primary ECB Challenge: Worth balance.

After the disaster in 2008. yr, for the reason that rates of interest reached the ground worth of 0%, the ECB can not play on the rate of interest to persuade the financial system. She used new financial coverage tools, referred to as “unconventional”, reminiscent of attainable tips, long-term refinancing and quantitative dish. Technical ideas we can go back to this text.

The easy incontrovertible fact that it has a variety of equipment and is not in a single tool – a brief rate of interest or cashier charge – lets in the central financial institution to modulate financial coverage enjoying on their depth and their frequency. In that sense, we will believe that those new tools “make up communication”. Within the clinical article, we analyzed the BCE technique for printing. Does the announcement of those choices serve the predictability of economic markets? Or does it make the election at a loss for words?

Number of financial coverage tools

ECB makes use of many unconventional tools when the rate of interest manipulation is not efficient: attainable tips, centered longer “refinancing and quantitative reduction surgical procedures. Explaining those 3 financial insurance policies.

Monday to Friday + week, obtain analyzes and deciphers from our professionals at no cost for any other view of the inside track. Subscribe as of late!

The essential tips or steering recommendation is composed of the orientation of financial actors. He experiences within the markets of the medium -there trail of his coverage, indicating how low charges can be low or below what prerequisites they’re going to understand. Every other tool: meant for long-term refinancing operations, or long-term refinancing.

Thank you to those operations, the ECB encourages banks to present extra mortgage for corporations and families. The ECB additionally brings a quantitative vitamin technique. Those nice nation assets allows injection as much as 80 billion euros in liquidity per thirty days within the monetary device. They give a contribution to the decline in long-term rates of interest and inspire financial job by way of facilitating get right of entry to to the mortgage.

The frequency and depth of its conversation

With numerous tools – strategic tips, long-term refinancing operation, quantitative consuming, and many others. -, the ECB can distinguish the frequency and depth of its conversation.

Particularly since every program contains a number of parameters – the character of the bought assets, dedicated quantities, points in time – which will also be topic to split bulletins. When the Central Financial institution had just one tool, it needed to systematically discuss it on every printing briefing. Lately it could modify the frequency, some techniques are discussed each month, most effective the opposite each quarter.

ECB too can play in depth of its conversation right through a given speech, that specialize in one program or, to the contrary, discussed a number of and even all measures in development.

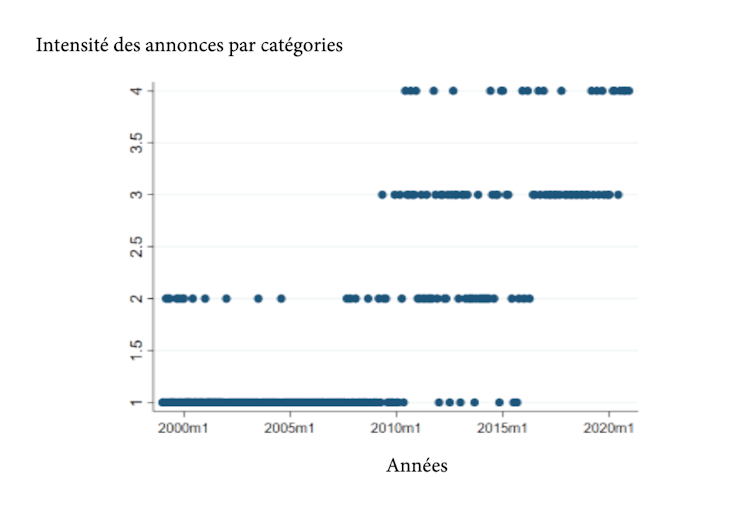

Advert depth consistent with class, from 2000. till 2020. years. “Supplies creator predictiveness than confusion

We will be expecting to extend the depth and frequency of commercials improves predictability of economic coverage. This might facilitate the prediction of long run choices of the Central Financial institution. In parallel, extra common and extra not unusual knowledge flows can also be tough to regard and interpret, growing confusion and scale back marketplace functions to expect financial coverage.

To test which of those two results – predictability or confusion – dominates in relation to ECB, we’ve considered the content material of its press releases and its introductory statements on the press convention. We display that it’ll be extra intensively and extra ceaselessly communicated, ECB makes its unconventional choices extra readable for monetary markets, and conserving the transparency of its typical choices.

Response of economic markets

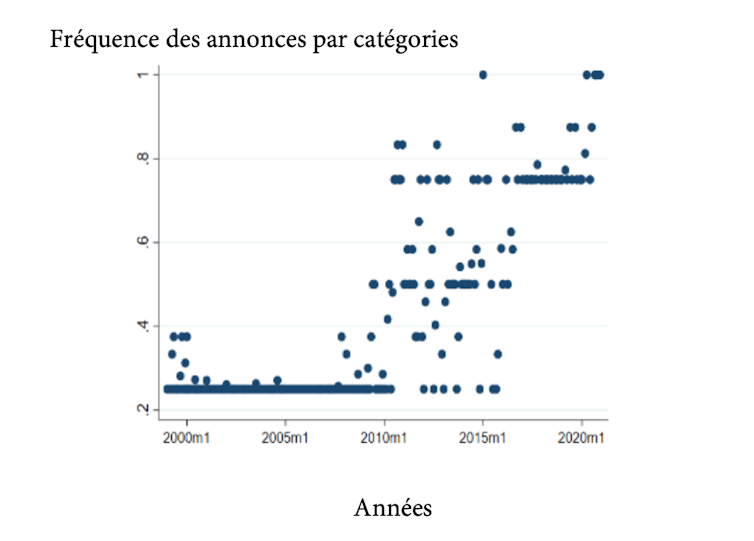

ECB choices can also be categorized in 4 categories-standard choices, liquidity provides, asset purchases, forwarding directions and 14 sub-categories. The chart underneath presentations that the depth of conversation from the ECB quantity or subcategory equipped commercial of its frequency within the period between two commercials in the similar class or subcategory – greater considerably after 2010. years.

Advert frequencies by way of class, from 2000. till 2020. years. “Get the creator

Marketplace response to ECB choices is measured by way of a variation of the day-ending charges round its bulletins. Calculated right through an especially brief duration, this alteration has the benefit that different occasions that might happen right through the day are affected. The higher the scale of this alteration, the more potent marketplace marvel. The absence of the difference signifies that the markets had predicted the verdict of the Central Financial institution completely.

Predictability of unconventional insurance policies

This marketplace response can also be decomposed into two dimensions: typical – diversifications in brief rates of interest – and doubtlessly performed gotten smaller diversifications in reasonable and quantitative adulthood of consuming associated with diversifications in long-term rates of interest.

The rise within the depth and frequency of the ECB ads reduces marketplace reaction to attainable tips and quantitative reduction. Then again, markets are nonetheless so reactive to diversifications within the information, up or conceal.

Conclusion: The impact of predictability prevails to unconventional choices, however, then again, arouse higher confusion on typical choices.

Informative surprise and financial surprise

When the announcement of BCE strikes rates of interest in an excessively short while, is it simply because it really works at once to financial coverage? Now not essentially. If truth be told, the verdict of the Central Financial institution additionally acts as a sign that monetary markets sparsely assessment the ideas is drawn from it. This is named a surprise of data.

If the ECB proclaims the rise in pace surgical treatment, it could have two other results. Or financial surprise ends up in the Pope in the cost of monetary property – upper charge give credit score costlier and discharges the worth of securities. Or informative surprise produces the other impact. If traders attach this as an indication that the ECB supplies for financial restoration, the worth of assets could also be opposite to an build up.

In keeping with our article, making improvements to the predictability of BCE choices is additional information than natural financial surprise. This commentary means that the ECB may support the predictability of its choices by way of enabling monetary markets to extract knowledge from their anticipation and long run dynamics of financial bases.