Historical past does now not repeat itself, nevertheless it rhymes – and financial historical past isn’t any exception. In 1964, a Labour govt got here to energy in the United Kingdom with a pledge to curb inflation and to ship expansion. The expansion plans had been brief lived. In 2024, in a cost-of-living disaster, Labour once more gained an election with a promise to “kick-start economic growth”. Most effective 18 months in, and plans have stalled once more.

Susceptible financial expansion has resulted in questions on whether or not the United Kingdom is as soon as once more the “sick man of Europe”. This echoes an previous trope, the “British disease”, which described Britain’s deficient financial efficiency from the Nineteen Fifties to the Nineteen Seventies. In comparison to different Ecu international locations, Britain noticed low funding, low productiveness and coffee financial expansion.

The British illness time period peaked within the overdue Nineteen Seventies, then slipped out of use as the rustic’s financial efficiency progressed from the Eighties via to the early 2000s. However Britain’s newer cave in in productiveness expansion has resulted in a brand new time period: the “productivity puzzle”. Possibly, as an alternative of a puzzle, this will have to be understood as relapse into the outdated British illness.

In essence, the British illness described the relative decline of a country that had led the arena throughout the economic revolution. It was once the wealthiest nation on this planet for far of the nineteenth century, however by way of the early twentieth century it have been overtaken by way of the USA. This stemmed from Britain’s gradual uptake of the inventions of the second one commercial revolution (mainly vehicles, chemical substances and aerospace).

Britain underperformed within the Nineteen Fifties and Nineteen Sixties and its expansion efficiency was once slow when put next with international locations in western Europe, which quickly overtook Britain.

Within the Nineteen Sixties, a staff of economists from the USA and Canada studied the British economic system for US thinktank the Brookings Establishment. Their 1968 record, Britain’s Financial Potentialities, concluded that British expansion was once vulnerable because of low funding and productiveness.

A part of downside was once the excessive degree of presidency intervention within the economic system after the second one global conflict. The federal government was once closely concerned with commercial coverage however had a deficient observe file of choosing winners. The historical past of British commercial coverage is affected by high-profile disasters.

On the lookout for a treatment

Was once there a treatment for the British illness? Economists have disagreed over the last few many years. Writing in 1977, British economist Henry Phelps Brown noticed that North Sea oil and fuel manufacturing supplied a brief remedy via internet power exports.

Then again, any other British economist, Nick Crafts, argued in 2011 that the British illness was once cured by way of the rise in pageant that got here from becoming a member of the EU, and the function that Britain performed in creating the only marketplace.

Fellow British educational and economist George Allen argued that the one treatment was once an entire overhaul of UK establishments, in particular universities, the place trade and science topics have been unnoticed in favour of classics. Now, after all, trade and science topics are actually extra broadly taught.

Even supposing those remedies had been efficient previously, they aren’t efficient nowadays. The United Kingdom has left the EU and North Sea oil and fuel has an unsure long run with new exploration actively discouraged.

Reform of the college sector is essential to stop Britain falling additional at the back of. The rustic continues to path its friends relating to the selection of engineering scholars. If those are the answers that cured the British illness previously, they can’t vanquish the resurgent pressure nowadays.

How GDP expansion has slowed:

Creator supplied (no reuse)

Britain’s financial expansion has skilled a slowdown since its heyday of the Nineteen Fifties and Nineteen Sixties. From 1992 till 2007, GDP in keeping with capita expansion averaged 2.34% in keeping with yr. Since 2008 this has fallen to 0.46% in keeping with yr. Expansion has successfully flatlined since 2023. A key issue has been the function of Brexit – a up to date estimate urged that the United Kingdom’s GDP has been lowered by way of between 6% and eight%.

The illness is not confined to Britain. From the Nineteen Seventies, maximum evolved international locations additionally skilled a slowdown in financial expansion. In a similar fashion, the productiveness puzzle could also be happening in different related international locations.

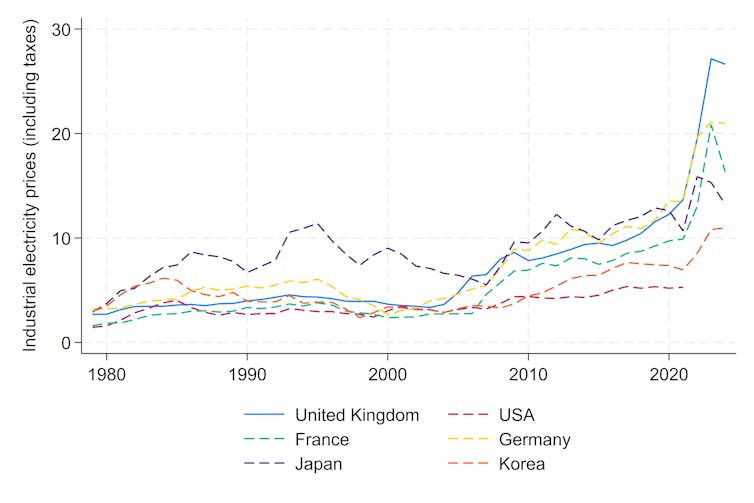

One of the vital greatest spaces the place Europe as complete, and the United Kingdom specifically, are falling at the back of is in power. The United Kingdom now leads in the case of the most costly power for commercial use in Europe. Pressing reforms are wanted if the rustic is to keep away from entire deindustrialisation.

The United Kingdom’s excessive commercial power prices:

IEA/ONS.

Creator supplied (no reuse)

One broadly touted panacea for the productiveness puzzle is synthetic intelligence (AI). Alternatively, two fresh Nobel prize-winning economists have presented very other checks of AI’s possible for productiveness, starting from a modest 0.53% building up over a decade to estimates a number of occasions better.

Within the interim, there’s no longer a solitary “sick man of Europe” however quite a malaise affecting a lot of the continent. Quick-term therapies is also to be had, however over the long run, radical motion and a renewed working out of the reasons of the illness are wanted. The metaphor of acute sickness might itself be deceptive. Reasonably than a situation that may be cured, the illness resembles a prolonged dysfunction that should be controlled.

A word of warning from the insights of the economist Mancur Olson could also be glaring in the United Kingdom revel in: when commercial coverage turns into captured by way of passion teams, coverage and subsidy displace innovation and pageant, entrenching financial stagnation quite than correcting it.