One 3rd of the speech of central banks now offers with the theme of climatic adjustments. How did those establishments, historically, directed inflation, reached there? Our learn about – from greater than 35,000 speeches by way of central bankers since 1986. years – indented this modification and able to measuring the consequences on monetary markets.

Local weather alternate has turn into an very important topic of central banks, establishments that ensure worth steadiness and fiscal gadget. They amassed since 2017. within the Community for the greenery Monetary Machine (NGFS) since 2017. they warn double threat. At the one hand, multiplication of maximum climatic occasions threatens the firmness of the monetary gadget by way of devaluating belongings uncovered, and the provision chain dysfunction and subsequently costs. Alternatively, too overdue for power transition to chance destabilizing whole portions of the financial system and developing inflationary pressures.

If those dangers are actually widely known and mentioned, a number of key problems stay unanswered: How, when and by way of what establishments seem those issues? What dynamics pushes central bankers to become involved within the local weather nation? And above all, to what extent do their warnings set up to steer monetary markets?

In a up to date article, we ask us to respond to those questions. To take action, we amassed the unique database greater than 35,000 speeches by way of central bankers since 1986. years, amassed from greater than 140 establishments and translated into greater than thirty languages.

This unheard of assortment lets in us to systematically file the illusion of local weather issues amongst central bankers, to know diversifications between establishments and measure results.

Hongkong Horizons Tragedy in London

In contrast to a well-anchored bribe, the speech of the Governor of the Financial institution of England Mark Carney at the “Tragedy of the Horizon” in September 2015. It isn’t the primary intervention of the central banker in this matter. David Carse of the Hongkong Financial Organ warned, from November 2000. years, triple dimensions of local weather dangers for banks – chance of loans, felony and respective dangers. It additionally underlines alternatives for financing the transition of environmental coverage.

Right through the following decade, the case stays marginal within the conversation of central banks, with only some dozen speech every year. Those talk most commonly seem in Southeast Asia, but in addition in Italy or New Zealand. Subjects addressed are very numerous.

Some talk discover investment to conform climatic failures. The remaining into query the social prices of transition, others stay making an allowance for the impact of carbon inflation tax.

Local weather speaks over the years.

The speech of Mark Carney signifies a turning level in 2015 years. The English Financial institution Governor proposes to method the issue of local weather alternate as a case of economic dangers. Refuses again to the concept that non-governmental NGOs driven NGOs that decide the life of carbon bubbles. This method persuades many Western establishments of the significance of local weather for its missions, first for monetary steadiness, but in addition for worth steadiness.

Making a community for greenery monetary gadget (NGFS) in 2017 speeds up this dynamic. Local weather problems are regularly changing into necessary within the Neighborhood of Central Banking Financial institution. If the go back of inflation in 2021. 12 months slows down on this advance, the local weather stays the principle fear: Within the closing 3 years, one in 3 speeches discussed him once or more.

Advertise or warn

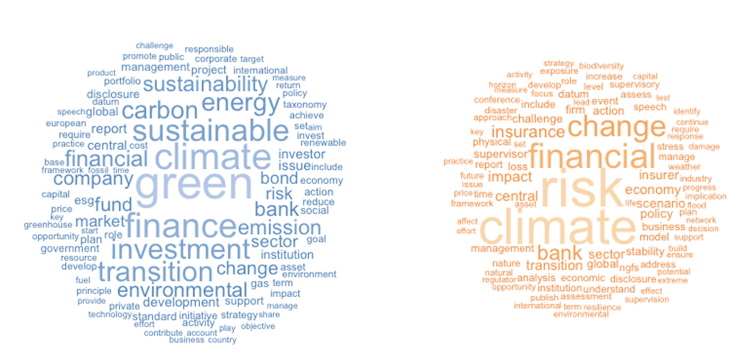

Alternatively, now not everybody speaks nearer to the local weather in the similar means. Our modeling of latent respondents unearths two very alternative ways of conversation round local weather alternate. The primary adopts a promotional point of view. In those speeches, central bankers emphasize sustainable funding alternatives, name for “green” markets and speak about monetary inventions which might be prone to accelerate low carbon transition. This method targets to toughen the improvement of recent funding tools and techniques in conformity with local weather problems.

Nuage phrases of promotional and creditworthy narratives. Provided the creator

By contrast, some other method adopts a credit-controlled point of view, specializing in taking local weather monetary dangers. In those speeches, the Central Financial institution requires the development of transparency of economic establishments when it comes to their publicity to those dangers. Additionally they consider how local weather dynamics can endanger worth steadiness. As a substitute of selling green-construction budget to stabilize the local weather, the problem is extra to make sure financial steadiness within the local weather dynamics face.

Why do a little central banks talk extra about climates than others?

It may well be idea that publicity to climatic dangers determines the best way central banks keep up a correspondence at the matter. International locations liable to herbal failures could be much more likely to actively advertise inexperienced budget. Massive co2 transmitters would extra focal point at the control of economic dangers related to transition. Horny speculation … however which appears to be our statistical regression qualified. Nor vulnerability of herbal failures or carbon printing of the rustic impacts the occurrence or nature in their central financial institution speech at local weather.

Those are the institutional traits of central banks that provide an explanation for absolute best in the event that they discuss local weather and the way they do.

The 3 components seem in particular: the stage of participation in monetary supervision, the scope of the objectives arrange within the Central Financial institution and on-line club for the Inexperienced Monetary Machine (NGFS). The extra Central Financial institution without delay screens the monetary sector, the extra it has a tendency to keep up a correspondence on the local weather, particularly within the coloring packing containers. In a similar fashion, central banks with wider mandates of worth steadiness extra incessantly discuss local weather alternate. After all, NGF club considerably strengthens local weather conversation, confirming the significance of peer networks within the evolution of the follow of the Central Financial institution.

Response of economic markets

If the necessary speaks of central banks are necessary, it’s vital as a result of they’re financed by way of monetary markets. They are able to carry out a realization of funding in anticipation of brokers within the efficiency of the best way.

Our research of the American Inventory Change presentations that once the Federal Reserve inspires local weather problems, essentially the most unstained corporate surpasses its extra pollutant competition. This development has been verified on a much wider pattern of 41 nations for which we have now on a regular basis monetary knowledge.

The variation between the variations between nations and industries presentations that the central financial institution communicates about local weather, environmentally pleasant firms see that their marketplace worth is expanding. This impact is in particular marked when discourse makes a speciality of local weather dangers. Unquestionably as a result of this creditworthy method resonates the safety of its investments?

The climatic speaks of central banks subsequently have an overly actual affect on monetary flows. Alternatively, this affect seems within the quick time period, giving most effective the present incentive for the least polluting firms.

This energy of affect in phrases, subsequently will have to now not save you central banks to regulate their movements. The brand new equipment seem to toughen this transition to the structural means: Preferential rates of interest for inexperienced loans and even regulate assets purchases to regularly exclude firms for regularly pollutant firms.

This text merged with Ginevra Scalisia, a doctoral scholar on the College of Pisa.