After the struggle, the Customs, welcome to the struggle of sovereign money owed. Trump Control suggests to not atone for its credentials, of which China is a component. Are we witnessing the tip of the awesome greenbacks?

The brand new Trump management experimented so much in financial issues. She realized that customs, despite the fact that expanding tax revenues, additionally growing inside issues. They result in industrial reprisals, shape the international items costlier and thus purpose inflation – or building up costs. It is so excellent up to now.

The new advice now conjures up a selective malfunction within the American rainbow. In step with the finance time quote, Trump advised it

“Elon Mochuring Team responsible for improving government efficiency would find irregularities when testing data from the Ministry of Finance American Treasury Treasury, which could lead to the United States to ignore certain payments.”

The time period “ignoring certain payments” is underestimation. It’s transparent that this implies attention of selective harm, in different phrases that they don’t compensate all their collectors … People as neatly.

No longer providing your credentials lets you voluntarily come to a decision to pay some, however there are not any others. Trump states this as a way of geopolitical drive or as a supply of source of revenue for the state. The defect reduces state debt. However it is a dangerous concept. Threaten accept as true with within the buck. Who desires to shop for state bonds that may be price 0, in step with the temper of sovereign?

Tax international buyers

Economist Barry Eichengheen lately enlisted the buck at the first web page of economic time, on it. In step with Eichenseen, Stephen Mirana’s proposal – Trump’s major financial guide – taxation of international holder’s federal titles for treasure dangers to hazard world monetary steadiness. The function is to devalue the buck to make American export extra aggressive. Formally, the management is making plans a “use commission”, which is charged to passion paid via international buyers. It might be important to pay to make use of the buck, owned via america.

Monday to Friday + week, obtain analyzes and deciphers from our professionals without cost for every other view of the scoop. Subscribe as of late!

Trump Executive The sport about phrases reversed the “Commission for Use” tax. This direct debit on passion allows the avoidance of world tax contracts. In observe, best international buyers who pay. Disguised discrimination.

Whilst Brad Setser lately pointed on threats to social networks, greater than part of the American Lengthy Lengthy Holder Proprietor house owners – are folks or American firms … who usually are spared with this impairment. So who else has this debt? The 2 governments are on the most sensible of the listing: Japan and China.

China: 4% of American bonds

Japan remains to be an allied nation for now and may also be launched. Even though the Trump management presentations fewer enthusiasm to Europe and its ancient companions, the Geopolitical Union with america may just proceed to play a job.

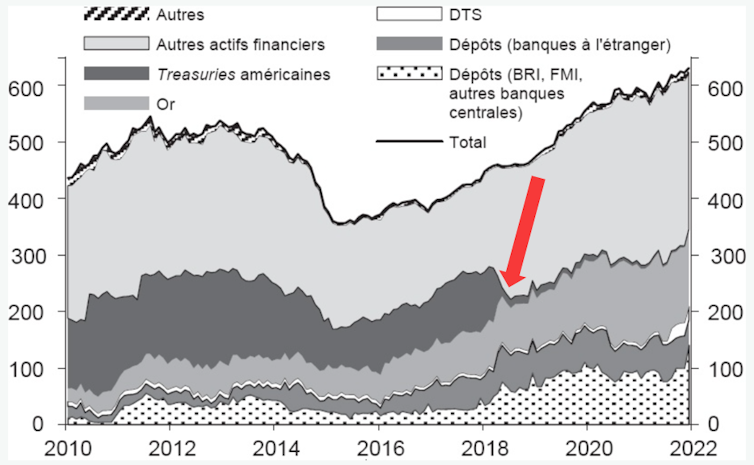

China, alternatively, nonetheless has about 4% of American responsibilities in movement. If this determine can appear low, it represents important sums. What’s extra essential, China has cash in dice, with greater than $ 700 billion set in its authentic change reserves, most probably taking into account unofficial reserves. Chinese language semi-public establishments, corresponding to banks and big firms, doubtlessly have much more amounts.

Brad Setser lately indicated on the threads that China step by step reduces its belongings to US state accounts. We have no idea that the precise amounts are offered, however transactions that cross thru Euroclear, Belgium be offering an summary. Since 2014. years, China in reality turns out step by step except from america buck. He went from a creditor with 18% of American movements to relatively greater than 4% as of late.

China stays the second one aspect of the landlord of American bonds. Consider that the canine or different shut trump comes to a decision now, for the explanations for home coverage, selective harm against China.

Areas with Ukraine

Geopolitics may just play in two instructions. China would scale back its exhibition prior to the ideologist close to Trump took the initiative. On the other hand, it will perform its geopolitical targets fighting this chance preventively avoided from long run tensions.

Russia additionally liquidated all their American responsibilities prior to they attacked Ukraine. The danger of selective harm or monetary assault was once too large. When I used to be within the Central Financial institution, my colleague and I spotted it best after the invasion, despite the fact that the guidelines was once prior to our eyes (which we offered within the article after the reality).

Gross sales of state data in america prior to Russian invasion on Ukraine. Supply: Camille Macaire, Alain Naef and Pierre-Francois Weber (2022). To promote American bonds?

China nonetheless has a considerable amount of American bonds. That she hesitated to take this daring geopolitical maneuver, it will be approached within the state of affairs during which it will be given from the monetary standpoint inexperienced mild. The theory of selective harm may just, on this method, boost up the gross sales of American bonds via China.

If selective harm was once actually intended to occur, geopolitical penalties would now not essentially be the primary fear. This could imply essentially for terribly gas monetary investments world wide to be disenchanted. The responsibilities of American treasury constitute, via definition, the most secure equipment to be had, in step with the manuals of macroeconomics.

If that is an lively lively one who decays, capital will in an instant search safe haven in every other position with out essentially discovering it. For instance, there are inadequate German govt data, and the ones from different international locations are extra riskier. This accurately meets the definition of the worldwide monetary disaster. We without a doubt don’t seem to be there but. But when the Trump management was once to experiment with selective errors, as it sort of feels with customs tasks, the results could be a lot catastrophic and rapid.