Lending issued within the monetary markets via the state or corporate for financing tasks particularly in reference to the surroundings, inexperienced liabilities are between two water. At the one hand, the inclined of Donald Trump to finish local weather insurance policies. Then again, bloom on this marketplace with $ 530 billion in 2024. Years.

With opting for Donald Trump, the Inexperienced Finance Actors run their tooth. The American president reacted via deciding to go out the Paris Settlement. Between 8,100 and 9,000 billion greenbacks consistent with yr till 2030. years. It’s cash that are supposed to be mobilized to reach international climatic targets in step with the local weather coverage initiative. To take away those colossal sums, governments and corporations are an increasing number of turning to inexperienced responsibilities.

In a find out about on the USA since 2008. till 2022. years, we examine the best way this legal responsibility contributes to lowering climatic dangers. Like typical responsibilities, inexperienced liabilities are loans – and thus money owed – issued in the marketplace via states or firms. Those inexperienced liabilities are meant most effective to finance environmental actions. Which ends up are with?

$ 51.1 billion in the USA

The US, after ranked Parisia, set formidable targets: aid of greenhouse gasoline emissions via 50 to 52% to 2030. Yr in comparison to 2005. Yr. As a way to succeed in those targets, he betted on inexperienced budget nationally.

As early as 2020, the USA used to be the sector’s biggest transmitter of inexperienced bonds, with $ 51.1 billion issued according to the Local weather Bonds. This development endured, reached $ 550 billion in 2024. years, drawing near $ 588 billion established in 2021. years. Fannie Mae, the group makes a speciality of the ensure of actual property, used to be a pioneer in inexperienced responsibilities.

Inexperienced bond emissions via apples between 2016 and 2024. years. Fannie Mae, which used to be gained via the writer

Apple amounted to its first inexperienced legal responsibility in 2016. years, and the volume of $ 1.5 billion, thus identify an important turning level within the sustainable financing sector for the technological corporate. After a slight fall in 2017. years, the emissions higher from 2019. years, attaining $ 4.5 billion in 2024. Years.

Financial lack of confidence

Our find out about at the American marketplace analyzes the length from 2008. till 2022. years. It takes into consideration a number of main occasions, such because the signing of the Paris Settlement, but additionally financial crises, such because the monetary disaster in 2008. years and Pandemia CVIVI-19. Financial shocks – comparable to disaster 2008. Or struggle in Ukraine – will increase uncertainty. They make inexperienced responsibilities extra horny as refugees. Larger financial uncertainty, extra inexperienced responsibilities display their resilience via lowering climatic dangers.

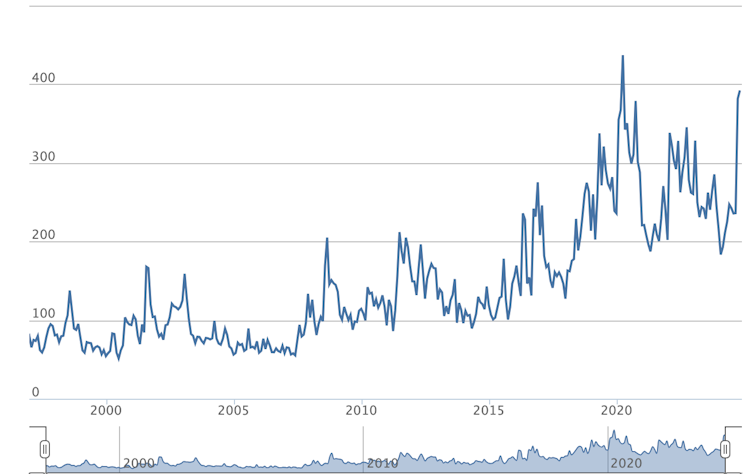

The important thing level of this analysis is the have an effect on of financial uncertainty on inexperienced responsibilities. As a way to measure, we used the commercial coverage lack of confidence index or uncertainty of financial coverage (EPU), in addition to the local weather summary of the index or local weather summit index (CSI). Those strains replicate the best way wherein political occasions and local weather responsibilities impact monetary markets.

Financial coverage lack of confidence index from 1996. till 2024. years.

Econometric effects display that inexperienced responsibilities play a an important position in lowering climatic dangers. On the other hand, the potency of those responsibilities is qualification. For instance, when political responsibilities in desire of local weather are low, the affect of inexperienced responsibilities is restricted.

Extra inexperienced responsibilities, fewer climatic dangers

As a way to enforce this research, we used a statistical approach referred to as Regression Quantile-Surkuantile MultiVariate. This system permits size of the have an effect on of responsibilities that can be asymmetrical according to the length of low or sturdy financial uncertainty. They permit the find out about of a dynamic connection between inexperienced responsibilities and climatic dangers in step with other marketplace situations.

Our effects display that even if the golf green connection marketplace remains to be underdeveloped, their talent to scale back climatic dangers is extra restricted. On the other hand, as a inexperienced bond marketplace develops, their certain have an effect on on climatic chance aid is extra pronounced. In different phrases, the higher query of inexperienced bonds is said to an important drop in climatic dangers.

Incentive regulatory framework

The potency of inexperienced responsibilities depends upon climatic insurance policies carried out right through world peaks of the measured local weather summit indices. We discovered that the responsibilities had been carried out right through those peaks immediately influenced the Inexperienced Bonds marketplace. When governments take strict measures to scale back carbon emissions, call for for those responsibilities will increase, which strengthens their certain have an effect on on local weather aid.

Monday to Friday + week, obtain analyzes and deciphers from our mavens free of charge for some other view of the scoop. Subscribe these days!

Our find out about presentations that local weather index decreases via about 16%, when the problem of inexperienced bonds may be very prime, illustrating their vital impact within the muffling of local weather chance. On the other hand, when the local weather sum index is low, the impact of inexperienced responsibilities to scale back climatic dangers is restricted, reduced via about 12%.

Those effects underline the desire for an incentive regulatory framework for the promotion of inexperienced connection marketplace and maximizes their potency in fighting local weather alternate.

3 courses

Our find out about gives a minimum of 3 sensible suggestions for decision-making and buyers to maximise the affect of inexperienced responsibilities.

Determine a forged incentive framework: To set public promises, to be able to cut back monetary dangers related to inexperienced responsibilities and thus draw in a bigger selection of buyers.

Determine transparent requirements: exactly outline the factors that meet the golf green legal responsibility. This may build up the transparency and accept as true with of buyers, on the identical time strengthening the integrity of the marketplace.

Facilitate get right of entry to to inexperienced bonds, particularly for small companies and institutional buyers, via growing a devoted business platform comparable to Luxembourg business.

Amplify to rising nations

Inexperienced connections aren’t restricted to a easy monetary device. They constitute a robust lever to boost up environmental transition, cut back local weather dangers and stabilize monetary markets within the face of financial and political lack of confidence. On the other hand, our find out about issues out an important restrict: The effects most commonly center of attention on the USA, a mature monetary marketplace. It will be vital to enlarge the realm of research to rising nations, the place local weather dangers and financial uncertainty are frequently marked.

In 2023. yr inexperienced connection emissions in rising markets higher via 34%, attaining 135 billion greenbacks. Those figures emphasize the expanding doable of those tools in those areas. The long run survey may just examine how those responsibilities can meet the particular wishes of rising economies, a rustic wherein the local weather chance is frequently upper, in addition to political lack of confidence.