The commercial conflict is ongoing. However Donald Trump may just persevere within the method of battle with Beijing, given the hazards of financial and fiscal destabilization, mutual habit and priori is hard to exchange the US and unmistakably, which Chinese language government are appearing

Even supposing globalized capitalism of the winner gained the theory of ”capitalism of finets”, because of normal consciousness of the restricted persona of planetary sources, industry, technological and financial installments intensifies between the US and China. And at this level, Chinese language leaders glance resolved to react than all through the primary cut-off date Donald Trump.

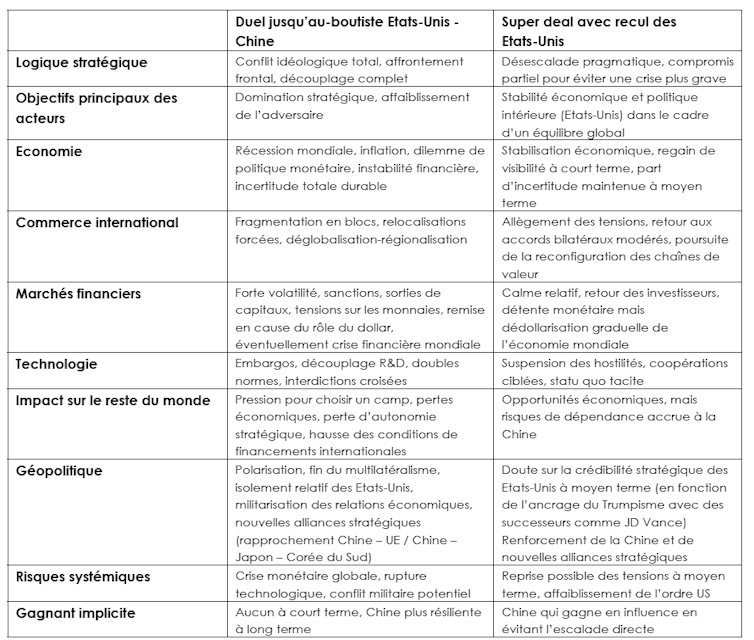

Objectively, the US isn’t within the place of energy in any respect ranges, which might make them choose “super agreement” with Beijing (see desk infra). Alternatively, within the excessive situation of mountain climbing synoamic tensions, the chance is of significant destabilization of the sector financial order, even tilting geopolitical and army nation.

Mirrors and saving mirrors in Larvenes

Sino-statistics – Sunny financial courting summarized the primary international macroeconomic imbalances, within the accounting recreation with 0 sum, illustrated internet exterior positions of 2 nations. Those imbalances would possibly remaining or step by step keep an eye on step by step via adjusting cooperative or unknown, however convergent actions in financial and society fashions. None of those choices imaginable, within the very brief time period, given mountain climbing within the steadiness of presidency between the US and China.

Web exterior place (in billion bucks, 2023) IMF (DOS), submitted via creator

The Trump Management venture is a replicate in Larka. At the one hand, it’s dedicated to relocating investments and reindustrialization (which is able to remaining the most efficient years) to give a boost to the employment and strategic autonomy of the rustic, depreciation of greenbacks “harmonized with partners.” However, he strives to handle a hegemony of greenbacks as a world spare forex, whilst preserves the patron fashion.

Monday to Friday + week, obtain analyzes and deciphers from our professionals without cost for any other view of the scoop. Subscribe these days!

This double antinimatic objective at the buck till these days till these days till these days, materialized all through the suspension of the conventibility of greenbacks in gold, beneath which the buck used to be to satisfy two irreconcilable objectives: balance as measuring caliber for currencies and items and lack.

With the specter of dragging from American safety promises, customs price lists are threatened as pressured guns and negotiations against the remainder of the vasalized international. Double employment, they’re additionally regarded as price range, at easiest to exchange taxes for imports on home taxes, harking back to the US via crossing the 20 th century.

As for China, it’s introduced to his certificate of its business and export drive, scheduling a technique in line with reprisals of triptych reprisal-adaptation-diversification. However doubt there are in its talent to rebalance its fashion of enlargement against intake, within the context of an over the top sparrow of a pronounced post-pandemic atmosphere.

The disaster of actual property, deflation, nice debt (corporations and native communities), a structural slowing down of financial enlargement and demographic falling the spectrum of the “early Japanese” level. Similarities with Japan Putaja may just also be an higher imaginable new Foreign money Birthday party Settlement similar to 1985. years.

World industry: crises and fragmentation Decrease facet card, Arte (2023)

Two world device powers is every unfastened, every in its personal manner, actual regulations of festival and world industry. The USA (nonetheless) benefit from the conduct of buck privileges and her colleague, particularly the extraterritarianities of American legislation. China supplies its world marketplace stocks (14% in general and 22% of produced items) subsidizing their strategic sectors and training the type of dumping, which is an American government that the American government that regarded as inadequate via American government.

China, from providers of the US to an immediate competitor

4 a long time, the synoiceric courting higher from cooperation to “cooperation”, to damage in 2018, as a result of China modified from the standing workshop of low price added direct festival to cutting edge, technological, inexperienced and top added products and services.

Within the center of the Chinese language “first industrial revolution” from the Nineteen Eighties and a pair of,000, beauty for international traders, particularly throughout the distribution of particular financial zones (unfastened zones) and era transfers, they gave themselves in a virtually scumpetarian financial system innovation. This “second industrial revolution” has been bolstered via “synizing” the objectives of the price chain, technological independence, in addition to self assurance and protection of power and meals and meals.

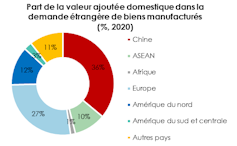

OECD / Tiva (Copyright). Click on to amplify., Delivers creator

Conventional marketplace producer at the international marketplace for uncooked fabrics, China has turn out to be acutely aware of the significance of important and strategic metals (because the Nineteen Eighties), a website during which it has a dominant place, particularly as a transformer with whole overcoming price chain transformer.

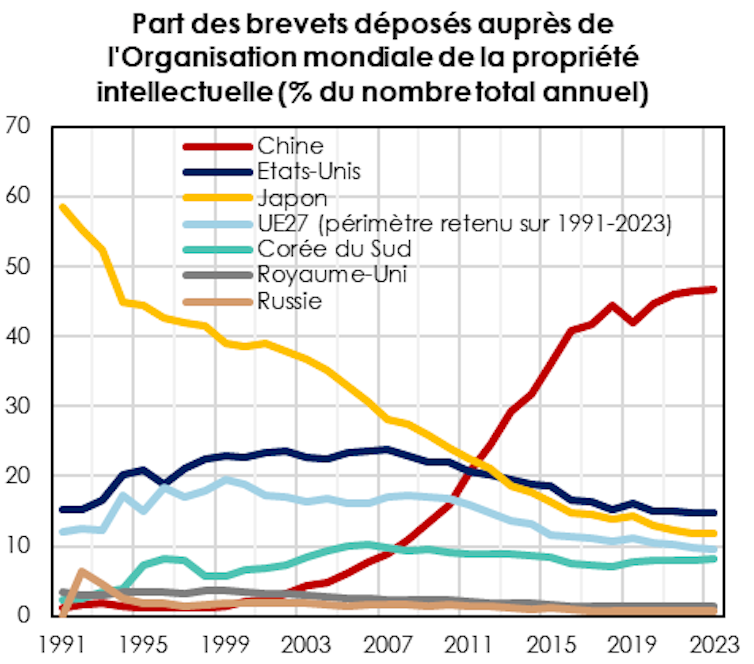

In 2020. years, Chinese language manufactured merchandise have completed greater than a 3rd added price on this planet industry of products produced. In 2022 years 56% of put in business robots in China had been in China, and 45% of global patents filed China between 2019 and 2023. years. It used to be even that the US held its management within the box of release, China lists 340 unicorns (personal start-up), of which within the synthetic intelligence sectors are excited about synthetic products and services and semiconductors.

Participation of patents submitted with a world-renowned highbrow group (% of the entire annual quantity) VIPO, funds submitted via the creator, which the creator submitted to the US dependency against China is hard to reject

In April 2025. years, the atypical stage reached bilateral customs and different non-assiffware measures destroyed synoic industry. Alternatively, the exceptions given via the Trump management on positive merchandise, together with computer systems and smartphones, illustrate the dependence of the US against China.

2024. Regardless of the lack of marketplace stocks in the US, from the primary time Donald Trump (14% towards 22% in 2018), america marketplace absorbed (and additional) 14.6% of Chinese language exports, aside from 3rd nations as Vietnam. The Chinese language buying and selling surplus of the US used to be $ 279 billion in 2023. years or 26% of its general surplus, whilst the US bilateral deficit used to be $ 340 billion, or 30% of its general deficit.

Some distance from anecdotal, the uncommon Earth extracted in the US is subtle in China, and American FDI in Chinese language soil represents vital manufacturing capacities within the electric automobile sector and batteries.

United States – China: Titan Surprise, France 24 (April 2025)

From the monetary disaster in 2008. 12 months, acutely aware of his over the top publicity to public information in The united states, China lowered its detention for 1361 billion US bucks in January 2025. years. This nonetheless vital quantity in absolute phrases represents handiest 2% of public debt in the US, in simply 22% of the non-population.

Even supposing the stableness of america bond marketplace is spreading in huge traders, the venture used to be pressured via the rustic’s public deficiency (change for extraordinarily long-menuity) or imposed taxes on international governments out of the country of international vouchers would possibly create a significant possibility via world monetary destabilization.

Tremendous settlement or fatal mountain climbing for the worldwide financial system?

American public opinion, financial lobbiri, monetary markets, gafami, management distractions, and even republican officers looking for re-recollection of forces that might impose a Donald Trump and even “Super Agreement” with Xi Jinping. Against this, stubbornness in prison customs tasks may just create a deep world financial and fiscal disaster and dislocation of world order.

On this calculation between Washington and Beijing Time, due to this fact performs to any other. The Chinese language regime is decided that China makes the primary international financial drive till 2049. years, for the centenary of the Folks’s Republic. He confirmed his talent for a very long time to lengthy venture and inspire the dose of adaptability of the “social market economy” fashion for his upkeep and will have to no longer give an explanation for his movements in poll bins.

In her courting with the sector, China continues its secular technique reserved facade reserves and provides an account open, unfastened nations, in search of an international team spirit, positioning for a multi-air be offering and within the reverse energy of the US. As a part of its cushy energy, the CLUB BRICS + and the initiative for belts and highway, China is numerous its world monetary property and invested in all rights to Asia, Latin and Africa.

Along with the rising aversion of world traders when it comes to the Chinese language corporate, Chinese language corporations may just proceed to go out funding out of the country within the close to web page and a detour process of protectionist boundaries, particularly in get right of entry to to the Eu marketplace.

The discharge of the US Multilateral framework may well be a possibility for China to beef up its affect in world our bodies, representing as the primary defender of growing nations, unfastened industry and world help within the type of price inversion.

In spite of the whole thing, the ambiguous place of the China at the conflict in Ukraine, his connections with Russia, North Korea and IRAN, its obtrusive objectives in Taiwan and its territorial expansionism within the sea of China are nonetheless assets of being concerned. China, which used to be no longer integrated within the armed battle of the Sino-Vietnam Battle in 1979. 12 months, if truth be told, if truth be told, in 2024. – However in all probability about $ 450 billion if truth be told, expressed in the US protection funds.

Geoeconomic eventualities

This is the intentional binary portray of imaginable geoeconomic eventualities, which don’t exclude different hypotheses similar to a mediator situation “raised universal trade war”, which contains EU, even different regional energy.

Geoeconomic eventualities. Provided the creator