A yr after the substitute intelligence summit in Paris, the global group will reconvene in New Delhi this week for the World Synthetic Intelligence Summit, which can particularly intention to make stronger the growth of the usage of synthetic intelligence in growing international locations. In Africa, funding in AI and era stays concentrated within the “Big Four” – South Africa, Egypt, Kenya and Nigeria – on the expense of alternative international locations around the continent. This research explores the reasons of this imbalance and the levers which may be used to raised direct capital.

Between 2015 and 2022, funding in African start-up firms skilled remarkable expansion: the collection of start-ups receiving investment larger greater than sevenfold, fueled via the growth of cellular applied sciences, fintech and large inflows of global capital. Then again, from 2022 onwards, tighter financial prerequisites have resulted in a “funding squeeze” (a discount in challenge capital funding) that has been harder for African start-ups than in different areas of the arena. This pattern additional larger the focus of capital within the international locations with essentially the most advanced start-up ecosystems, particularly South Africa, Egypt, Kenya and Nigeria.

Then again, there’s a robust case for making sure that those investments are extra frivolously allotted around the continent. Along with stimulating financial job, the technological inventions advanced via those start-up firms constitute a vital lever for construction, as they provide answers tailored to native contexts: centered monetary answers, progressed agricultural productiveness, reinforced well being and schooling methods and responses to precedence local weather demanding situations, and so forth.

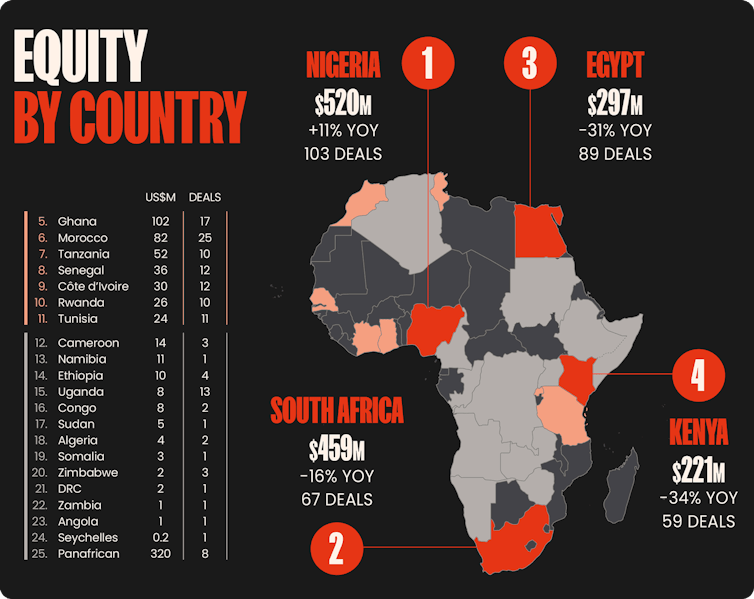

Traits in Fairness and Debt Financing Granted to Tech Get started-ups in Africa Between 2019 and 2024 Partech, 2024 Africa Tech Project Capital Funding Focus within the Large 4

Within the early 2020s, the time period “Big Four” emerged to explain Africa’s primary tech markets: South Africa, Egypt, Kenya and Nigeria. The time period, more than likely impressed via the time period Large Tech, suggests the life of a “country of champions” within the era sector.

In 2024, the Large 4 accounted for 67% of era fairness financing (investments made in alternate for stocks in era firms). In additional element, the stocks taken via every nation are allotted as follows: about 24% for Kenya, 20% for South Africa and 13.5% every for Egypt and Nigeria.

This investment cluster is not only geographical; it additionally has a powerful sectoral size. Capital is in large part directed against sectors which are thought to be much less dangerous, similar to virtual finance or “fintech”, continuously on the expense of spaces similar to edtech and cleantech – this is, applied sciences devoted to schooling and environmental answers.

An estimated 60%-70% of finances raised in Africa come from global buyers, particularly for investment rounds over $10-20 million. Those investments, continuously concentrated in additional structured markets, constitute essentially the most visual transactions, but additionally the ones thought to be the least dangerous.

Rising peripheral ecosystems and the prospective that continues to be insufficiently transformed into investments

Whilst the Large 4 pay attention many of the funding, a number of African international locations are actually demonstrating confirmed doable in AI and a lot of promising start-ups, with out shooting the size of funding commensurate with that doable.

Nations similar to Ghana, Morocco, Senegal, Tunisia and Rwanda shape an rising crew whose individuals have favorable AI basics however stay underfunded. This hole is much more hanging for the reason that Ghana, Morocco and Tunisia, all of that have dynamic start-up swimming pools, in combination account for round 17% of Africa’s tech firms outdoor the Large 4. On the similar time, native monetary buildings battle to fulfill those financing wishes in geographies thought to be peripheral.

This issue in attracting investments will also be specifically defined via institutional and trade ecosystems that experience but to be reinforced, because the efficiency of era firms will depend on the life of structured entrepreneurial ecosystems that supply get right of entry to to wisdom, professional hard work and make stronger mechanisms (accelerators, incubators and buyers).

In spite of everything, it is very important take into account that those weaknesses are a part of a much wider context: in 2020, all the African continent accounted for simplest 0.4% of world challenge capital flows and lately represents simplest 2.5% of the worldwide AI marketplace. Creating international locations outdoor the Large 4 are due to this fact automatically deprived in an already extremely concentrated festival.

Distribution a raffle capital (fairness) funding in African era start-ups via nation. Partech, 2024 Africa Tech Project Capital Managing investments to organize international locations for AI

To draw capital to AI start-ups, a rustic should be AI-ready. The adoption of AI on the nationwide point does now not rely simplest on technological elements. The AI Funding Doable Index (AIIPI), a analysis initiative, highlights that this adoption additionally will depend on financial, political and social elements. Because of this, expanding the rustic’s AI doable calls for now not simplest strengthening power and connectivity infrastructure, but additionally bettering governance requirements, public sector potency and human capital.

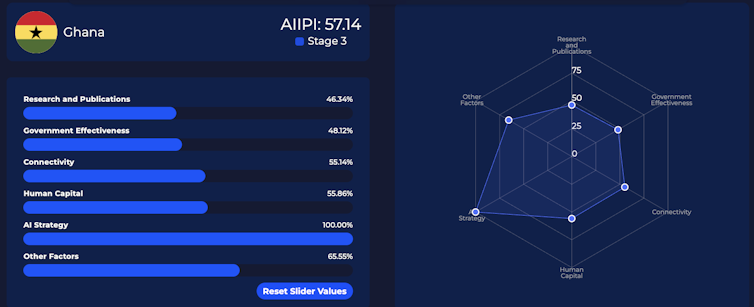

Precedence movements range relying on a rustic’s point of development in AI. In additional complicated international locations, similar to South Africa or Morocco, the problem is extra in supporting analysis, optimizing AI packages and attracting strategic investments. In international locations with extra reasonable effects, priorities have a tendency to concentrate on strengthening connectivity infrastructure, human capital and regulatory frameworks.

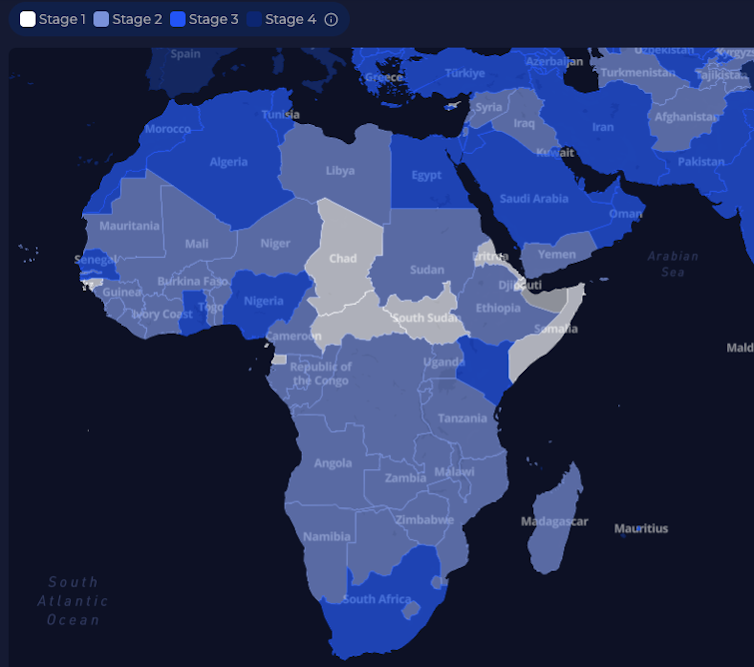

The aipotentialindek.org platform lets in, amongst different issues, to visualise the result of the index at an international point and to spot spaces by which international locations can make investments to extend their funding doable in AI (analysis, govt potency, connectivity, human capital, AI methods, and so forth.). AIIPI is helping buyers now not simplest establish international locations which are already complicated in AI, but additionally the ones with untapped doable. For public decision-makers and construction actors, it supplies a framework for prioritizing reforms and investments.

Visualizing the Funding Doable of Synthetic Intelligence in Africa: The Darker the Colour, the Higher the Doable. aipotentialindex.org

A rustic profile instrument carried out to Ghana. Ghana displays robust doable for funding in synthetic intelligence. Get started-ups similar to Virtual Africa-backed Ghana Likuifi, which facilitates invoice fee for SMEs, illustrate the rustic’s entrepreneurial dynamism. aipotentialindek.org State finances and tools devoted to new applied sciences

When defining a rustic’s AI funding technique, the query of AI financing tools arises. On the continental point, a number of tools devoted to era and synthetic intelligence are rising. Building finance establishments such because the African Building Financial institution or the West African Building Financial institution are launching tasks geared toward supporting the expansion of the continent’s virtual economic system.

On the nationwide point, African Sovereign Wealth Finances (ASFs) supply an extra channel to make stronger AI and start-up investment around the continent. Those finances, such because the Mohammed VI fund in Morocco or the Pula fund in Botswana, mobilize public financial savings for long-term financial construction and paintings in partnership with construction banks.

Partnerships as robust levers for financing start-ups

Investment virtual and synthetic intelligence infrastructure on my own isn’t sufficient to construct a startup ecosystem that may gasoline financial expansion. Global public-private partnerships additionally play a very powerful position. The Select Africa 2 initiative, led via AFD and Bpifrance, goals to handle the monetary constraints going through entrepreneurship around the continent, particularly on the earliest levels. Reinforce mechanisms, similar to Virtual Africa, which deliver in combination public actors and native companions, permit small investments in early-stage “Tech for Good” start-up firms whose applied sciences create strategic, social and environmental affect.

Whilst those mechanisms on my own aren’t enough to right kind funding imbalances, they are able to nonetheless assist to increase get right of entry to to finance past ecosystems which are historically the most efficient sources.

Central political, strategic and prison management

Monetary funding on my own isn’t sufficient and should be supported via robust political ambition. Legislative and strategic frameworks established at nationwide and continental ranges are key structural levers for the expansion of virtual start-ups in Africa.

At the one hand, methods led via the African Union, together with the Virtual Transformation Technique for Africa, the Continental Technique on Synthetic Intelligence and the African Virtual Compact, supply roadmaps that permit international locations to boost up virtual transformation. There also are national-level tools, similar to Tunisia’s “Start-up Act” or nationwide AI methods, similar to the only revealed via Ghana, which units out the rustic’s ambition to turn out to be Africa’s “AI hub”.

In spite of everything, ultimately April’s World AI Summit in Kigali, the place 52 African international locations introduced the introduction of a $60 billion African AI Fund, combining public, inner most and philanthropic capital, a big political dedication used to be made. This initiative illustrates a continent-wide strategic ambition: positioning Africa round those new technological demanding situations. Then again, those AI-focused finances can face control and fiscal structuring demanding situations. There’s nonetheless a chance that they may reproduce the asymmetries already seen in state finances if transparency mechanisms aren’t installed position. Their affect will due to this fact rely at the status quo of requirements and control tools tailored to new technological demanding situations.

Those frameworks create the preliminary prerequisites wanted for the emergence of native AI answers and supply a structural strategic framework. Their affect on investor self assurance will, alternatively, rely on how successfully they’re aligned with suitable monetary mechanisms and reinforced native capacities.

This text used to be written in collaboration with Anastasia Taieb, Innovation Officer at AFD and Emma Pericard, Virtual Africa EU Consultant.