The United States has been experiencing an extended “bull” inventory marketplace, this is fast enlargement in inventory costs, even though this week tech shares tumbled over the long run potentialities for US-built AI.

However may just the marketplace hit an important downturn right through Trump’s 2d time period within the White Space? To start with sight this turns out not likely as it did neatly right through his first time period, from 2016 to 2020 (see chart underneath). Alternatively, long run developments in the USA inventory marketplace expose a trend suggesting that inventory costs could be rather inclined right through his 2d time period.

The Nobel prize-winning economist, Robert Shiller, who research monetary markets thinks that the USA inventory marketplace has peaked, and long term returns can be a lot more modest than in contemporary historical past even though he does no longer recommend {that a} crash is at the horizon.

The marketplace beneath other presidents

Shiller’s information makes it conceivable to have a look at the connection between who’s the president and inventory costs since 1925. Through inspecting the efficiency of the inventory marketplace over that length we will be able to establish the level to which 8 Democrat and 9 Republican presidents have influenced the expansion of the marketplace.

Adjustments in inventory costs right through Republican presidents 1925 to 2024:

Creator supplied (no reuse)

The chart displays the share adjustments within the Same old and Deficient’s per thirty days inventory worth index (which supplies a snapshot of the marketplace), corrected for inflation, right through the incumbencies of Republican presidents since January 1925.

The typical building up in inventory costs for Republican presidents was once 25%. However the factor that sticks out within the chart is that 3 main crashes within the inventory marketplace additionally came about beneath those Republicans incumbents.

The primary of those, referred to as the Wall Boulevard Crash, took place on October 28 1929 when Herbert Hoover was once president. This was once the cause match for the Nice Melancholy of the Nineteen Thirties and ended in a fall of 64% within the inventory marketplace right through his presidency.

His response to the crash (when proportion values fell dramatically) was once to do not anything within the trust that the financial system would sooner or later recuperate by itself. This price him the 1932 presidential election when Democrat Franklin D. Roosevelt was once elected for the primary time. He was once therefore elected a document 4 occasions, due to his New Deal insurance policies for coping with the disaster.

The second one crash took place right through Richard Nixon’s incumbency. He would had been impeached by way of Congress had he no longer resigned in August 1974 following the revelations of the Watergate scandal.

This took place when the White Space hired burglars to damage into the Democrat celebration headquarters within the Watergate construction in Washington DC. As soon as Nixon’s try to secret agent on his combatants changed into public he was once pressured to surrender and total the inventory marketplace fell by way of 47% right through his incumbency.

The 3rd crash took place in December 2007 when George W Bush was once the president. It had its origins within the deregulation of the monetary sector which had took place in the USA after Ronald Reagan changed into president in 1980. Lax monetary rules ended in ever more and more dangerous property and buying and selling practices on Wall Boulevard beginning in the actual property marketplace.

US inventory marketplace opens.

The disaster unfold impulsively all the way through the arena’s monetary machine and a recession of the dimensions of the Nineteen Thirties was once best avoided by way of steered motion by way of the Federal Reserve chairman, Ben Bernanke, who labored with political leaders in different international locations comparable to UK high minister Gordon Brown to stabilise the machine. The inventory marketplace fell by way of 45% right through Bush’s length of place of business.

Many components are at paintings to give an explanation for this, however the overriding reality is that Republicans are much less more likely to keep an eye on the monetary sector, or around the board, than Democrats. Their electorate are much more likely to be positive in regards to the potentialities for the financial system, and subsequently to take dangers when making an investment within the inventory marketplace, when a Republican is within the White Space.

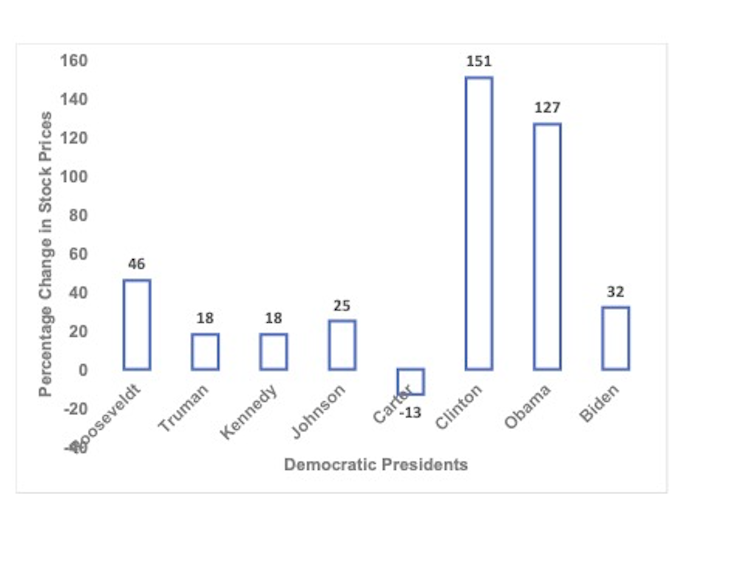

Adjustments in inventory costs right through Democratic presidents 1925 to 2024:

Creator supplied (no reuse)

The second one chart displays adjustments in inventory costs right through the incumbencies of 8 Democratic presidents right through this era. It is vitally other from the Republican chart, since, of the ones presidents proven, best Jimmy Carter left place of business with the inventory marketplace not up to when he arrived, and that by way of a modest 13%.

Invoice Clinton was once essentially the most a success president, reaching an building up of 151% right through his two phrases within the White Space. General, the inventory marketplace rose by way of a median of 51% right through Democrat incumbencies, greater than two times the dimensions of the Republican will increase.

Those effects are sudden for the reason that the Republicans are the normal celebration of huge industry and so could be anticipated to be just right for the inventory marketplace.

Donald Trump has promised to extend price lists on imports from the remainder of the arena, specifically the ones from China. As well as, there’s a burgeoning price range deficit brought about by way of the space between spending and taxation.

Maximum economists assume those insurance policies will create inflation and gradual enlargement.

Many buyers are these days rather worried a couple of conceivable recession after the lengthy bull marketplace of the previous few years. The drop in the cost of tech shares this week confirms this. One impact of this has been to motive a upward thrust in yields on US Treasury long-term bonds, reflecting fears of additional inflation.

Contemporary comparative analysis displays that international locations will pay a top worth for populist financial insurance policies. So, it will be neatly value Trump finding out the historical past of US inventory markets rises and falls, if he needs to steer clear of a serious financial downturn right through his 2d time period.