With Bitcoin’s “Black Thursday” and falling from $126,080 (€106,365) in October 2025 to lower than $70,000 (€59,000) in early February 2026, the parable of virtual gold appears to be crumbling. A proof of Bitcoin’s historical decline thru Strategi, a hedge fund that holds best Bitcoin as an asset. A disastrous “one financial product” technique?

On February 5, 2026, the stocks of Technique, the symbolic determine of bitcoin vault corporations, those corporations whose belongings consist nearly completely of bitcoins, misplaced 17% in their worth. The marketplace that day as it should be predicted the announcement of a lack of $12.6 billion (€10.6 billion) within the fourth quarter of 2025, in an instant after the shut of the day.

Its worth skilled a powerful technical restoration day after today with reassuring phrases from managers about its money glide. On the other hand, on February 6, at $135 (greater than €113), it confirmed a 70 % drop in comparison to the all time top of $473 (€399) on November 20, 2024, simply after the re-election of Donald Trump.

The corporate’s strategic value since 2016. Boursorama To start with it used to be Bitcoin

In an editorial printed in The Dialog France in November 2017, we had been reminded of the real nature of Bitcoin: a virtual asset with none of the traits of a forex – a unit of account, a compulsory manner of cost and a shop of worth -, necessarily of 0 worth, in contrast to gold which may be a steel helpful for trade.

The preliminary set of rules units the Bitcoin restrict at 21 million tokens. The divisibility of the encrypted asset to eight decimal puts, the satoshi, named after its inventor, lets in each Earthling to shop for it, since 100th of a greenback provides a minimum of 10 satoshis – 1 bitcoin is split into 100 million satoshis. That is how Bitcoin turns into the improve for a world speculative bubble extraordinary in historical past.

In March 2025, in those columns, we analyzed the reasons of the impressive upward thrust of Bitcoin because the election of Donald Trump. Once the result of the vote are introduced on November 6, 2025, the cryptocurrency strikes from $70,000 to $90,000 (from €59,000 to €75,900), to height on January 20, 2025, the day of the legitimate announcement, through 7:00 p.m. (105,000 euros).

The brand new president, a former critic of Bitcoin, is popping right into a fierce cryptocurrency fanatic, aiming to make the US its first marketplace. We emphasised that the mass arrival of recent traders, satisfied on social networks that the cryptocurrency will in the end achieve the million greenback mark, created an ecosystem that enhances Bitcoin thru new applied sciences and the emergence of cryptoasset trackers (mutual price range to be had to everybody).

“Trump’s” Bitcoin Kick Crashes

Since our March 2025 article, two choices through the government have fueled hypothesis.

The primary is the advent of the Strategic Bitcoin Reserve, an legitimate bitcoin reserve held through the USA govt. Up to now, this has best been fueled through confiscations (that have at all times been matter to criminal problem) with out marketplace purchases for a complete of 200,000 bitcoins, or 1% of the rest bitcoins.

The second one is the passage through the USA Congress in July 2025 of the Genius Act which facilitates the expansion of stablecoin bills. Those virtual greenback tokens are increasingly more used as a way of fast cost with out charges around the globe, together with through massive corporations.

Pushed through hypothesis, Bitcoin hit a top of $126,080 (€106,365) on October 6, 2025 earlier than falling underneath $70,000 (€59,000) in early February 2026.

Technique, an enormous hedge fund with one product

This correction brutally exposes the fragility of the crypto-asset ecosystem. A shining image of this new global, Bitcoin vault corporations shape a bunch of businesses whose primary, and steadily best, objective is to assemble cryptoassets, through elevating capital within the type of stocks or bonds. The objective: to make the most of the meteoric upward thrust in costs and the impressive enthusiasm of the marketplace.

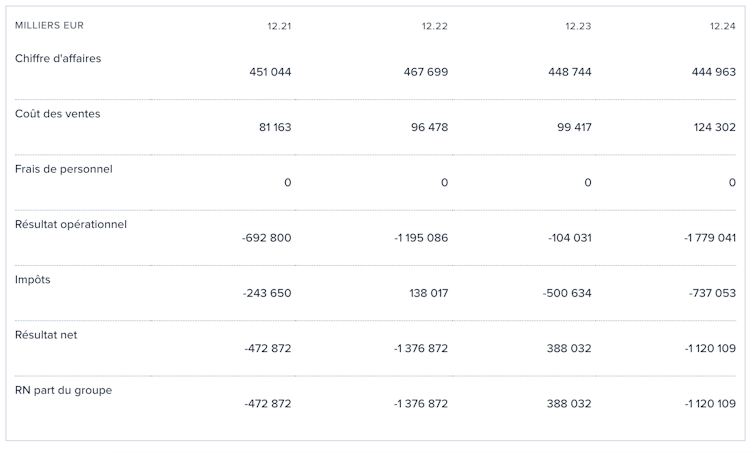

Essentially the most emblematic of those corporations is for sure Strategi, an difficult to understand device corporate referred to as Microstrategi through 2025. It generates slightly 500 million greenbacks (greater than 421 million euros) in turnover in its core industry, the improvement of knowledge research device for industry control and cellular programs.

Source of revenue remark Corporate technique from 2021. Boursorama

On August 11, 2020, its founder Michael Saylor made a strategic and ontological flip through pronouncing an preliminary acquire of $250 million (€210.8 million) of bitcoins – 21,454 bitcoins at $11,650 (€9,827) – to spice up returns. The primary investments that end up to achieve success, he multiplies the purchases on moderate upwards. This vintage inventory technique amongst reckless speculators generally ends very badly, as recalled within the American investors’ bible Recollections Of a Inventory Operator, which we translated in 2005.

The purchases will building up in 2023 and 2024, financed through a plan introduced in October 2024 referred to as “21/21”, this is, through elevating price range available in the market of 21 billion greenbacks (17.7 billion euros) of shares and 21 billion greenbacks of bonds. In November 2024, simply after the election of Donald Trump, the corporate had already declared to the Securities and Trade Fee (SEC) that it held 279,420 bitcoins at a median value of $42,700 (simply over €36,000).

The deregulatory insurance policies of the Trump management are inflicting a wave of frenzied purchasing through Strategists, basing their technique at the trust within the persisted enlargement of Bitcoin. Valued at $92 billion in December 2024, the corporate sensationally entered the extremely selective Nasdaq 100 index on December 23, 2024.

That is how Strategi remodeled into an enormous hedge fund that on February 6, 2026 holds about 713,500 bitcoins at a median acquire value of $76,000 (greater than €64,000), i.e. a complete acquisition value of $54.5 billion (4).

What are the hazards for the stakeholders of the Technique?

Since its document top in August 2025, with a marketplace capitalization of 104 billion (€87.7 billion), the corporate’s valuation has adopted bitcoin’s decline. On February 6, 2026, it used to be best 45 billion greenbacks (about 38 billion euros), which is underneath the funding in cryptocurrencies.

These days, the corporate’s complicated inventory change engineering has resulted within the advent of 3 primary varieties of issued securities:

The average inventory, with $28 billion (23.6 billion euros) raised, will pay a dividend that may be stopped at any time.

5 classes of so-called most well-liked stocks, with 7 billion greenbacks (or 5.9 billion euros), are non-redeemable securities that make up the fairness capital. They pay a concern annual dividend of between 8 and 10% however no ensure in case of accounting losses.

Convertible bonds, with 8 billion greenbacks (about 6.7 billion euros), are money owed of the corporate. They do not pay any coupons, however permit their proprietor to take pleasure in the upward thrust in shares (and due to this fact Bitcoin) through merely changing the bonds into shares at a definite time. If the stocks fall, they’ll should be repaid at par in 2030.

Up to now, the Technique is in a position to meet its monetary tasks with money glide exceeding a thousand million greenbacks and a constantly certain steadiness sheet. Then again, Bitcoin falling underneath $10,000 would result in a damaging steadiness sheet and an illiquidity state of affairs, particularly since there may be some uncertainty about using money.

Bitcoin Cave in: A Systemic Chance?

Within the match of a panic sale of all cryptoassets, weighing round $2,500 billion (greater than €2 billion) on February 6, 2026 (55% for bitcoin and 10% for ethereum) in comparison to $4,200 billion (or €3,500 billion) on the height,25 could be dispensed amongst many losses in October 2020.

The losses of bitcoin vault corporations could be absorbed through shareholders or bondholders. A state of affairs paying homage to the cave in of Terra in Would possibly 2022, because of which 30 billion greenbacks (greater than 25 billion euros) disappeared in a couple of days with out penalties for monetary balance.

In spite of the troubles of the Eu Systemic Chance Board printed on September 25, 2025, the banking sector would stay in large part immune. Usually, it’s tricky to measure the affect of the cave in of the cryptocurrency sector at the economic system. On the other hand, it’s evident that the reversal of the wealth impact, i.e. the lack of worth of traders who spend in line with the valuation in their crypto-asset portfolio, would have an effect on the morale of all financial actors.

However, within the present turmoil, the parable of virtual gold has collapsed at the side of the cost of Bitcoin. Greater than ever, the one asset this is in the end authorised around the globe stays gold, whose costs are at maximum above $5,000 (greater than €4,200) according to ounce.