Business tensions with america underscore the extraordinary dependence of Mexico’s financial fashion at the international’s main financial energy.

Underneath the Biden management, the outlook for Mexico in the case of industry and funding has been sure because of measures such because the Anti-Inflation Act and expansion within the near-term ratio as a part of the reconfiguration of worth chains. Alternatively, those top expectancies were known as into query for the reason that re-election of Donald Trump.

For the Mexican govt, this context provides an extra degree of complexity to a scenario characterised via gradual financial expansion, the decline of the oil sector, constraints that weigh on public price range, and more than a few hindrances to socio-economic building and the power transition. Alternatively, Mexico now not represents the macroeconomic weaknesses of the Eighties and Nineteen Nineties, which brought about the stability of bills disaster of 1994.

Mexico, the primary provider to america

Carried out for the reason that Nineteen Sixties, the maquiladora fashion—the ones factories situated on Mexico’s northern border (but additionally within the heart of the rustic) that produce items for export—has structured a cross-border ecosystem that employs some 3 million Mexicans and advantages hundreds of American corporations.

Mexico has made probably the most of its aggressive benefits in line with its privileged geographic location, low exertions prices, and the North American Unfastened Business Settlement (NAFTA since 1994 and USMCA since 2020). Economies of scale were completed in some sectors, akin to cars, electronics and aeronautics.

In line with the United International locations Commercial Construction Group (UNIDO), Mexico ranked 9th in 2023 in the case of contribution to international production worth added (1.8%). Virtually 80% of its production exports are medium and top generation merchandise. On this space, Mexico ranks fourth on the earth, at the back of Taiwan, the Philippines and Japan.

Alternatively, native manufacturing basically is composed of meeting traces of carried out or semi-finished merchandise. Subsequently, home worth added embedded in exports is estimated at most effective 9% of Mexico’s overall exports in 2020, in line with the OECD’s Business in Price Added (TiVA) database.

Benefiting from the industry tensions that experience existed between Washington and Beijing since 2018, Mexico has grow to be the #1 provider to america in 2023. Confronted with the worldwide industry typhoon that has been caused for the reason that starting of 2025, the source of revenue from Mexican exports to america has proven excellent resistance up to now.

Evolution of the bilateral industry surplus of China and Mexico with america between 2000 and 2024 (in billions of greenbacks). Evolution of the marketplace proportion of China and Mexico in imports from the United States between 2000 and 2024 (in %). United States Division of Trade Bureau of the Census, IMF (DOTS), calculations equipped via the creator, Fourni par l’auteur

Mexico’s marketplace proportion peaked at 15.5% in 2024, in comparison to 13.5% for China (which used to be 21.6% in 2017). The percentage of Mexican exports destined for america larger from 79.5% in 2018 to 83.1% in 2024, most commonly manufactured or semi-finished merchandise, even if there also are agricultural merchandise and crude oil.

In particular criticized via Donald Trump, the bilateral industry surplus with america has larger ceaselessly since 2009 and can succeed in $247 billion (€210 billion) in 2024, score 2d on the earth at the back of China ($360 billion).

Ensure the continuity of T-MEC

The protection cooperation settlement signed on September 4, 2025 between Mexico and america seems to be a good fortune for President Claudia Sheinbaum’s negotiating abilities.

The deal follows a February announcement to deploy 10,000 Mexican troops to the border and extradite 55 drug traffickers to america throughout the primary 8 months of this 12 months.

The Mexican government take into account the revision of the Treaty between america, Mexico and Canada (T-MEC), scheduled for July 2026, and so they depend at the place of the Trump management to be much less radical and extra pragmatic than prior to.

The typical charge of price lists paid via Mexico in September 2025 used to be 4.72% (in comparison to 0.22% in September of the former 12 months). In 2025, the typical tariff implemented via america globally could be 11% (up from 2% in 2024) and 40% on Chinese language imports (up from 10% in 2024).

In line with the Mexican Ministry of Finance, in mid-2025, 81% of Mexican exports to america have been in compliance with the USMCA and would input the tariff-free territory, in comparison to most effective 50% in 2024. This build up is defined, specifically, via efforts made in the case of traceability.

As well as, Mexico seeks to diversify its buying and selling companions. The rustic is a signatory to fourteen different unfastened industry agreements with about 50 nations, now not counting the brand new modernized international settlement with the EU, concluded on January 17, 2025, which is within the strategy of ratification.

The Scheinbaum management additionally intends to improve industry members of the family with nations within the area. An instance is the settlement with Brazil, renewed remaining August, which contains the agriculture and biofuels sectors.

On the similar time, customs price lists of 10 to 50 % shall be imposed on positive merchandise imported into Mexico, particularly the ones from nations with which there aren’t any unfastened industry agreements. Merchandise from China and different nations with out such agreements shall be taxed as much as 50% to offer protection to employment in delicate sectors.

In reaction, China introduced financial retaliation in opposition to Mexico, which has grow to be a very powerful buying and selling spouse over the last decade, particularly within the car sector.

Stay sexy to traders

Mexico’s good looks to overseas traders might be threatened via the Trump management’s protectionist insurance policies, that have induced a wait-and-see perspective amongst some corporations and a imaginable evaluate in their technique to method america or different nations.

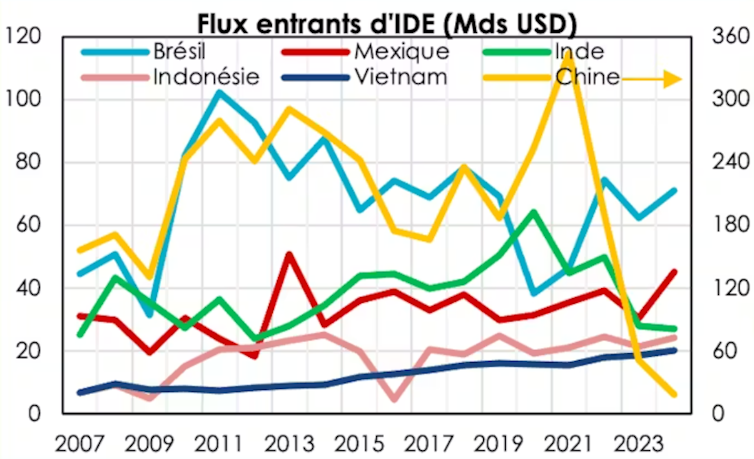

In 2024, Mexico won a document degree of overseas direct funding (FDI) since 2013 ($44 billion, or 37 billion euros, which represents 2.4% of GDP), turning into the 9th recipient on the earth and the second one amongst rising nations, at the back of Brazil and forward of India, Indonesia, Vietnam, whose FDI, above all, completed pl.

FDI inflows from Mexico, Brazil, Indonesia, Vietnam, India and China between 2000 and 2024 (in billions of greenbacks). IMF (DOTS), calculations equipped via the creator, Fourni par l’auteur

As of 2018, nearly all of FDI in Mexico got here from america. However the total stability remains to be ruled via Eu corporations (54%), forward of American corporations or those who have invested from america (32%), whilst Chinese language traders constitute only one% of put in FDI.

Even if overall FDI flows remained very dynamic within the first part of 2025 (+2% in comparison to 2024), they diminished within the production sector. Because the re-election of Donald Trump and the adoption of the Mexican judicial reform, funding tasks were canceled, suspended or postponed.

In line with the Industry Coordination Council, an self sufficient frame representing Mexican corporations, greater than $60 billion (€50.9 billion) in funding is these days frozen.

Chinese language government, as an example, would deny producer BID permission to open a automobile manufacturing unit in Mexico with 10,000 jobs at stake.

Deal with sturdy exterior accounts

The world context these days does now not carry a lot fear in regards to the chance of a deviation of Mexico’s exterior accounts within the quick or medium time period.

The present account deficit is structurally reasonable (-0.9% of GDP on reasonable over 10 years and -0.3% of GDP in 2024) and is roofed via web FDI flows (2.1% of GDP on reasonable over 10 years). Foreign currency echange reserves are relaxed and the Central Financial institution does now not interfere within the forex marketplace, leaving the peso to flow freely. Exterior debt may be reasonable (36% of GDP).

The present account completed document revenues from tourism ($33 billion, or 28 billion euros, or 1.8% of GDP in 2024), which decreased the deficit within the stability of services and products and above all remittances, i.e. cash transfers from the diaspora ($64 billion, or 54 billion euros, or 240% of GDP 3.2%).

However those remittances, 97% of which come from america, fell via 6% within the first part of 2025 in comparison to the primary part of 2024. It’ll be essential to observe their building, given their position in supporting the buying energy of many Mexican households. Shipments now not made via twine switch, an identical to three-quarters of the whole quantity, shall be topic to United States tax starting in January 2026.

Alternatively, Mexico’s overseas industry construction explains Mexico’s issue in producing sustainable industry surpluses (except for the Covid length), with a industry deficit of 0.4% of GDP on reasonable over 10 years.

If truth be told, inside North American business integration, Mexican imports of intermediate merchandise constitute up to 77% of overall imports since 2010. This has brought about a powerful correlation between import and export dynamics and restricted native web worth added.

On the similar time, Mexico’s power stability has been in deficit since 2015 (-1.2% of GDP), because of a lower in oil manufacturing and dependence on subtle merchandise from the United States.

The stability of the present account may be suffering from an important deficit within the stability of number one source of revenue (-2.7% of GDP in 10 years). This reality refers back to the repatriation of income and dividends of a large number of overseas corporations established within the territory.

Take fee of your economic future

Briefly, tensions with america carry questions on Mexico’s financial fashion.

Mexico, an rising nation, has stagnated financial expansion on the reasonable degree of evolved nations within the remaining 20 years (1.7%), which puts it a few of the ten least dynamic rising and creating nations. The extent and volatility of expansion illustrate the constraints imposed via the hyperlink with america marketplace. It additionally displays the absence of tough endogenous expansion levers (intake, private and non-private investments, financial institution financing of the financial system).

Conserving the benefits of its geo-economic place, diversifying export markets and a extra self sufficient expansion fashion via strengthening home call for are its major financial demanding situations within the coming years. As a way to reply to them, it is going to be vital to put in force long-delayed reforms, particularly in fiscal and effort problems, public management and the industry setting.

Financial coverage orientations shall be key to retaining public price range and, on the similar time, responding to essential wishes in the case of social spending, pensions and infrastructure, with the intention to unlock expansion doable and ensure macro-financial balance, socio-economic building and effort transition of the rustic.