Following the price lists imposed by way of Donald Trump, we’re seeing a vital reorientation of Chinese language business from the US to the Eu Union thru… small applications. Clarification in photos and graphs.

The impressive building up in price lists imposed by way of the USA on imports from China (57.6% in past due August, after a height of 135.3% in April in keeping with calculations by way of the Peterson Institute for Global Economics) is in large part remaining the US marketplace to Chinese language exporters. The large drop in Chinese language exports to the US that adopted, down just about 25% in June-August 2025 in comparison to the similar months in 2024, testifies to the size of the surprise.

The danger is that, confronted with the closure of one among its two major markets, Chinese language exporters will search to redirect their exports, leaving doubts a couple of large shift to the Eu Union (EU). With this in thoughts, the Eu Fee has established business diversion tracking to spot merchandise topic to fast will increase in imported volumes and falling costs, of all origins blended.

Seasonal dynamics

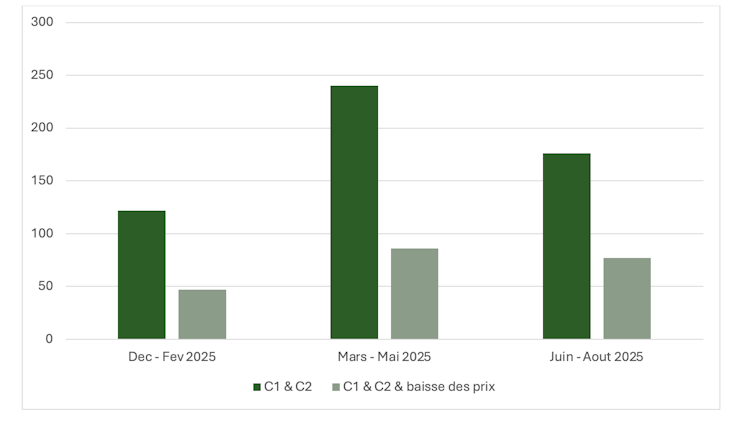

The primary chart displays that since February, the decline in Chinese language exports has been accompanied by way of an building up in exports to the Eu Union. Research of previous occasions, then again, finds that the rise noticed in the second one quarter of 2025 in part corresponds to the seasonal rebound noticed on the similar time in earlier years and related to the Chinese language New 12 months, whether or not for the Eu Union, the US, Vietnam, Japan or South Korea. It is important to interpret contemporary occasions within the mild of the seasonal dynamics of earlier years.

Chart 1 – Chinese language exports by way of vacation spot marketplace. CEPII, supplied by way of the writer (no reuse)

Watching an building up in imports isn’t sufficient to conclude that Chinese language business is being diverted from the US to the Eu Union (EU).

With the intention to turn out this sort of phenomenon, the similar merchandise will have to be concurrently suffering from an building up within the quantity of exports from China to the EU and a lower in america. As an example, the rise in Chinese language electrical car exports to the EU can’t be thought to be a business shift as a result of those merchandise weren’t prior to now exported to the US.

Likewise, merchandise topic to exemptions from the tasks offered by way of Donald Trump, reminiscent of positive digital merchandise, positive mineral fuels or positive chemical merchandise, are not likely to be diverted. This doesn’t imply that expanding import flows of those merchandise does now not elevate competitiveness and pageant problems for French or Eu gamers. However those problems are of a distinct nature than the ones related to the natural diversion of Chinese language business following the closure of the US marketplace.

Two complementary standards

To spot the goods for which the closure of the USA marketplace has resulted in a redirection of Chinese language business to the Eu Union (EU), we mix two standards:

If, yr after yr, the amount of product exports to the EU will increase quicker than 3 quarters of different Chinese language merchandise exported to the EU in 2024.

If, yr after yr, the amount of product exports to the US declines quicker than that of three-quarters of different Chinese language merchandise exported to the US in 2024.

Most effective merchandise for which Chinese language exports to the US had been important sufficient sooner than the closure of the American marketplace had been retained. This is, 2,499 merchandise for which the US’ percentage of Chinese language exports exceeded 5% in 2024. For 402 of those merchandise, China’s export quantity recorded a pointy decline between June-August 2024 and June-August 2025.

Nearly 176 merchandise affected

By means of combining those two standards, within the duration June-August 2025, 176 merchandise had been affected (graph 2), or 44% of goods whose gross sales declined considerably in the USA marketplace. Amongst them, 105 seek advice from merchandise for which the Eu Union has a published comparative merit, this is, for which the rise in imports is in response to Eu specialization.

Lower than part of the 176 merchandise are experiencing sharp value drops on the similar time, suggesting that a part of China’s business diversion is resulting in price battle within the Eu marketplace.

Chart 2 – Collection of merchandise diverted to the EU in keeping with standards. This graph analyzes the diversion of goods exported by way of China by way of combining a number of dimensions: (i) a vital building up within the amounts exported to the EU (C1), (ii) a vital lower within the amounts exported to the US (C2), and (iii) a vital lower in the cost to the EU (if, yr by way of yr within the following yr, the cost of a Chinese language product falls quicker to a few instances the cost of a Chinese language product within the EU of goods exported to the EU in 2024). CEPII, supplied by way of the writer (no reuse)

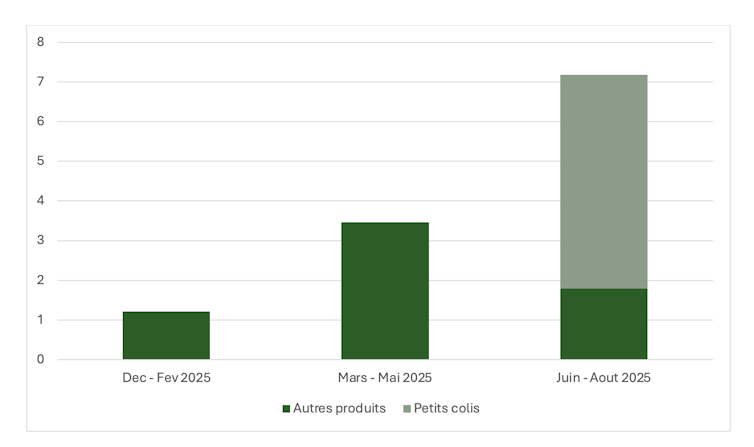

With regards to price, the 176 known merchandise constitute 7.2% of China’s exports to the Eu Union in the newest to be had duration, and the fad is obviously upward (Chart 3). This building up is in large part defined by way of an building up within the waft of small parcels diverted to the EU since in April 2025 the US ended the exemption from price lists on parcels originating in China.

Chart 3 – Percentage of the worth of goods diverted in Chinese language exports to the Eu Union. CEPII, Writer supplied (no reuse) Equipment, Chemical substances and Metals Sectors

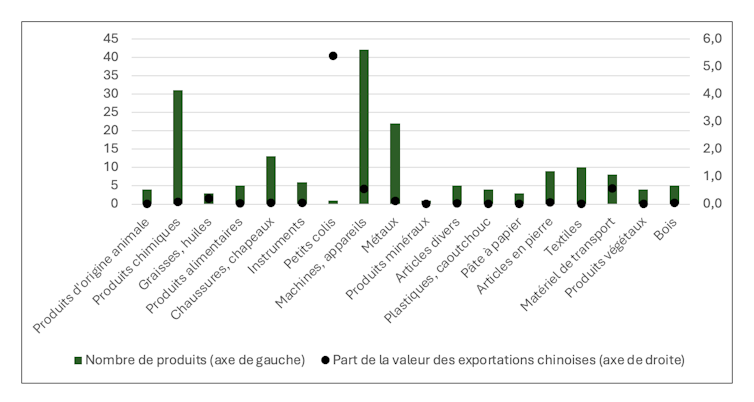

Merchandise which are topic to redirection to the Eu marketplace are very inconsistently disbursed amongst sectors (Graph 4). They’re numerically concentrated within the sectors of machines and units (42 merchandise), chemical substances (31) and metals (22). In price phrases, then again, the sectors most influenced are by way of a long way small parcels (representing 5.4% of bilateral business in June-August 2025) and, to a lesser extent, shipping apparatus, oils and equipment and kit.

Chart 4 – Sectoral distribution of goods diverted to the Eu Union. CEPII, supplied by way of the writer (no reuse)

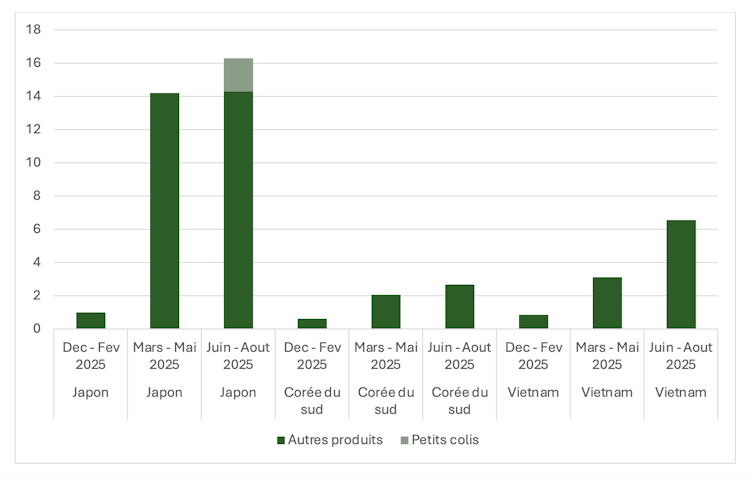

By means of comparability, Japan is extra suffering from China’s business reorientation as 298 merchandise had been known in June-August 2025 (Chart 5). Those merchandise constitute a miles greater percentage of China’s exports to Japan (16.2% in June-August 2025). Equivalent dynamics had been noticed in South Korea (196 merchandise, representing 2.7% of its bilateral business with China) and Vietnam (230 merchandise, 6.5% of its bilateral business with China).

Chart 5 – Percentage of product price diverted in China’s exports to Japan, South Korea and Vietnam. CEPII, Writer supplied (no reuse) Finish of simplified customs regime

Conscious about the danger they constitute, the Eu Fee plans to, as a part of the following reform of the Customs Code, put an finish to the simplified customs regime from which those small parcels lately get advantages. This reform is predicted to go into into drive sooner than 2027. Till then, some member states are looking to transfer quicker.

In France, the federal government not too long ago proposed, as a part of its monetary legislation, to introduce a flat tax fee in line with plot. However, with out Eu coordination, there’s a threat that the measure might be circumvented: applications may just merely go thru an EU nation with much less taxation.

Excluding small applications, quite a few different merchandise also are topic to a fast building up in imported volumes, which is more likely to weaken Eu manufacturers, however they constitute a restricted percentage of Eu imports from China. Developments that must be showed by way of common tracking within the coming months.