Believe to get up in 1932. Years in any US town. After ordering your morning espresso, understand that his value has doubled since remaining 12 months. This isn’t because of the loss of espresso, however as a result of new buying and selling limitations led to the cost of the import of Colombian espresso beans to shoot. The similar factor came about with sugar, tea and cocoa. On a regular basis gadgets unexpectedly change into luxurious.

This dramatic exchange arose from one of the vital commonplace choices in fashionable financial historical past: Smoot-Hawlei Act, followed in June 1930. this Regulation, which used to be the hands of Senator Reed Smoot and Congressman Willis C. Hawley, aimed to offer protection to American farmers in regulation since 1929. years.

On the other hand, the force from business lobbies supposed that it used to be temporarily expanded to hide over 20,000 merchandise, together with items produced. The price lists are on reasonable about 40% on reasonable, however in some circumstances they have been as 100% prime.

Some distance from serving to the economic system, this measure contributed to the cave in of global business, as a result of international locations like Canada, France, Italy, Germany and the UK imposed a pointy retaliation on American merchandise. This set a series response: global cooperation weakened, American exports fell through 61% between 1929. and 1933. years, and world business decreases over 60%.

This additional deteriorated nice despair. It hit economies that relied on global business particularly onerous and exacerbated geopolitical tensions right through the Nineteen Thirties.

Skyrocing inflation, mass destruction of labor paintings and the drop in residing requirements changed into an previous testomony for the failure of protectionism. The contraction of the worldwide business now not most effective the crippled key business, but in addition destabilized all of the economies that relied on exports to care for enlargement. The currencies have been devalued, quite diminished, and fiscal techniques collapsed one after any other.

Within the Nineteen Thirties, there used to be no witness now not most effective financial crises, but in addition the transformation of the global device used to be inspired, partial, misdemeanor political and business choices. This ancient lesson, as the present case of Trump price lists presentations, continues to be ignoring leaders which can be priorities to priorities for momentary populist measures because of world financial balance.

Why do price lists fail?

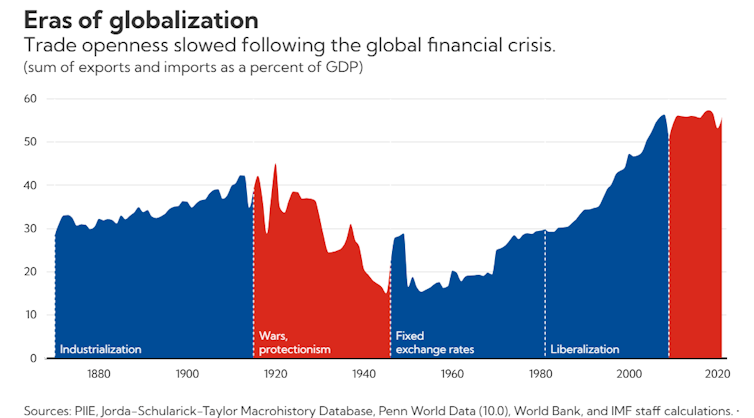

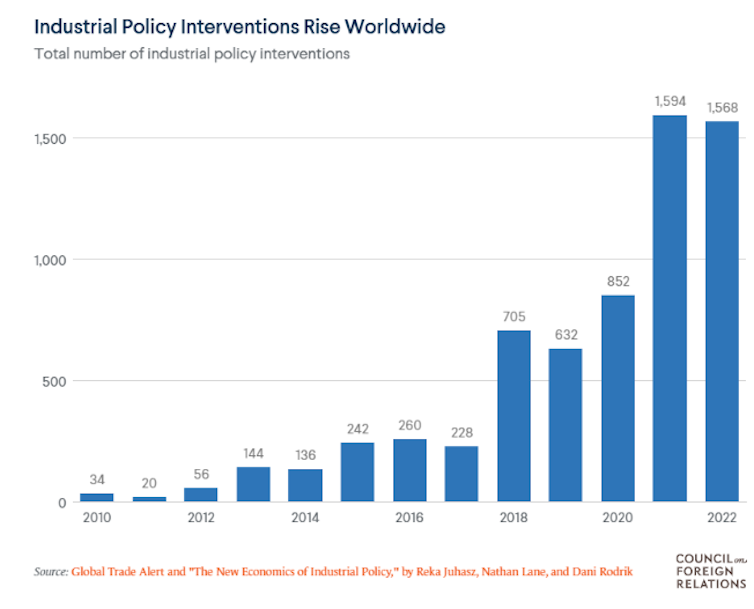

After a long time of development in liberalization of business – guided multilateral organizations such because the International Business Group, the United International locations and the OECD – classes looked to be realized. On the other hand, the second one presidential perception of Donald Trump revived aggravating parallels with Smoot Havley.

Historic and fashionable proof obviously display that price lists hardly serve as as an efficient manner of financial coverage. Within the mutual world device, provide chains go the a couple of limitations earlier than they succeed in the tip client. Larger price lists lift prices of manufacturing, accidents and customers and firms, even in international locations that enforce them.

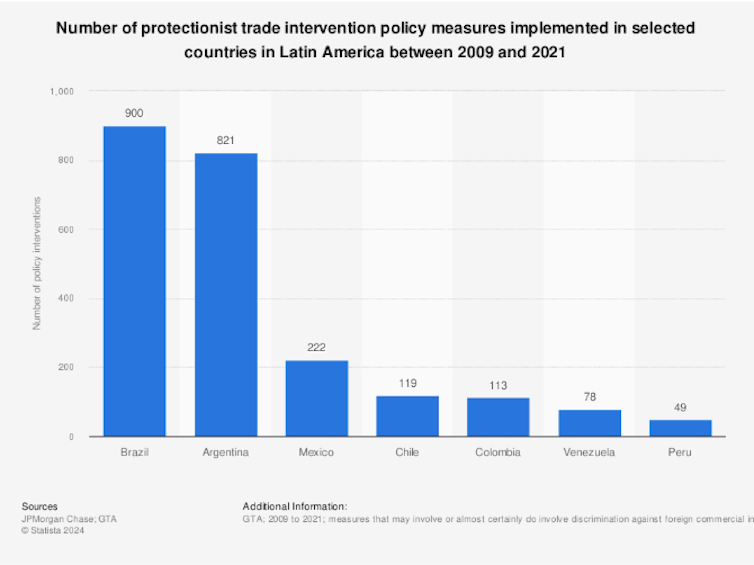

Along with the USA, different international locations additionally felt the damaging results of protectionism. As an example, Argentina has applied a coverage substitution with prime price lists and buying and selling restrictions for many years. Despite the fact that to start with brought on business building, it ended in a lack of competitiveness, prime inflation and dependence at the state to surrender the inefficient sector.

Brazil had equivalent revel in within the Nineteen Eighties and Nineteen Nineties. Its tariff limitations have been quickly safe through sure industries, but in addition diminished product high quality and stiffer technological innovation.

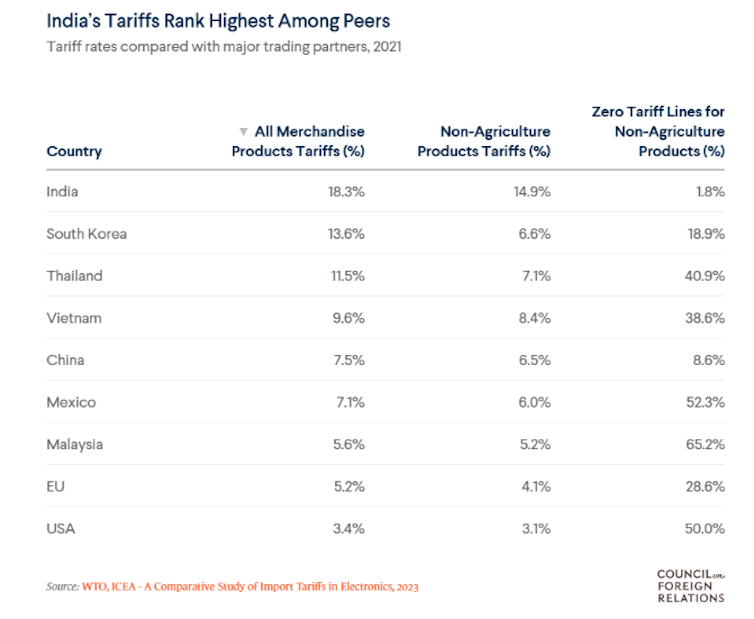

Till its financial reforms in 1991. 12 months, India had one of the vital greatest regimes on this planet, which restricted integration into world business and slowed its financial enlargement.

From those examples, we will be able to see that protectionism ceaselessly reasons a series response of detrimental, escalating influences:

The rising costs of customers

Lack of financial competitiveness and paintings destruction

Decreasing world financial enlargement because of uncertainty and diminished global business.

Making economies of extra cooperative and resilience

From Smoot-Hawlei Act in Trump’s present business conflict, financial historical past obviously presentations that protectionism is not just inefficient, however counterproductive. On this planet the place the chains of the values of world and innovation is dependent upon transnational cooperation, final financial limits weakening collective resistance.

Protectism may also be made an instantaneous method to financial crises and home pressures, however its long-term penalties are nearly at all times pricey than its evident advantages. As an alternative of strengthening the home industries, it isolates them. As an alternative of defending paintings, destroys long run alternatives.

The above cup of espresso in 1932. changed into an emblem of the economic system locked in itself. In 2025. It may well be electrical automobiles, drugs or elementary meals meals that reminds the prime prices negatively intrude in world business.

It’s now greater than ever earlier than, global cooperation, marketplace diversification and funding in sustainable competitiveness the one good way ahead.