From 13. to 24. June 2025. 12 months, an instantaneous soldier of the battle towards Israel to Iran. How did the marketplace markets react? Do investors speculate in this pattern? With a view to resolution those questions, we studied instability (it’s, amplitude of will increase and decreases) oil and gold fee.

The direct soldier between Israel and Iran was once introduced 13. June 2025. years, known as “12-day war”, hostile two regional powers within the middle of figuring out strategic house for world power flows. That is very true of a space of ormuse, necessary arteries for oil exports, with concern of redistributing world financial dynamics, particularly during the outbreak and instability of uncooked subject matter fees.

This text goals to research the affect of instability (build up and decreases) inventory exchanges on uncooked fabrics throughout this era.

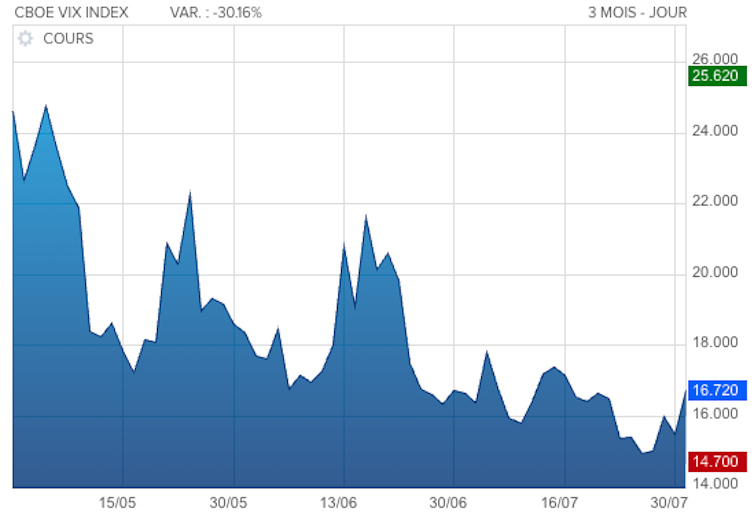

Actions The cost of signs on fanatics (VIK) suggests, within the first days of “12-day war”, the placement again. As gold and oil marketplace has a provide be offering from call for, their direction is less than that of this second. Particularly, this fee fee at the phrases of the contract, between the fast time period and long-term, inspired greater investors hypothesis.

Petroleum markets build up 8.28%

Authority des Marches (AMF) known 5.2 million transactions in France in France in France (industry of traded finances or ETF), after 2.8 million in 2023. years. Uncooked Fabrics and, particularly (lengthy) contracts on uncooked fabrics, at the moment are used: possible covers on inflationary drive, diversification and possible financial replacements.

The Ormuza registrar is a key passage for international industry in oil that Iran regularly threatened to dam in disaster eventualities. Leaflet-Cherla, Omar Kamal / AFP

From the primary alternate of assaults, oil markets reacted with excessive anxiousness. 13. June 2025. 12 months, Brent Brown oil recorded an build up of 8.28%, attaining $ 75.10 and the cost of crude Western information of Texas afternoNo was once 8.8%, nearly $ 74 had reached.

Those will increase are defined via concern of blockading the matica ormuza that exceeds about 20% of global oil. The oligopolistic construction of oil marketplace, some nice exporters dominates, makes it specifically delicate to geopolitical interference.

Those considerations had been inspired via monetary operators to get vastly emerging on phrases (long run), emphasizing lessons instability.

Now as have shyed away from worth

There are two instability in monetary markets: ancient volatility signifies the instability of titles throughout the former duration and implicit volatility or belief of chance, suits instability equipped via the marketplace. We measure the instability IMPLICIT FROM VIK INDEX, which corresponds to the values of the temporary choice at the S & P500. This inventory marketplace index is in keeping with 500 massive firms indexed in america.

Educational analysis supplies us with many articles concerning the courting between instabilities and uncooked fabrics. One underscores the adaptation between gold as a shelter. For instance, gold was once have shyed away from throughout the 3 monetary crises in 1987, 1997. and 2008. years. The valuable ore is used as a protection, as a result of its returns are certain (on moderate) when returns of monetary belongings (movements or bonds) are adverse.

Vic, Concern Index

Different researchers acknowledge gold as bolies the price throughout the marketplace duration, with low correlation with the greenback and movements. Gold has a adverse and demanding courting with movements on relief, however no longer on the Bull marketplace, as a result of gold is at all times thought to be dwelling values. In different phrases, we purchase much less gold when markets bloom, a lot when they’re part a mast. Subsequently, some researchers use Vic as a hallmark of the belief of worldwide dangers.

Vik is a hallmark of the volatility of the monetary marketplace of america. Whether or not the Chicago Board Choices Change is established. Pouch

Vic and oil are adverse in correlation, expanding concern in monetary markets comes to lowering call for within the power marketplace. The VIK monetary station indicator Vik Monetary Marketplace Vik, known as the worry index, expresses and measures implicit instability or early instability of monetary markets. It has an empirical, economically important lengthy impact on a number of uncooked fabrics similar to oil and gold.

Possibility belief

As a part of this text, we analyze the relationships between the belief of worldwide chance and uncooked fabrics. For this, we use information from the day prior to or intra, throughout the “12-day war” duration.

The belief of chance or implicit instability is measured via the index of america Requirements Requirements index. As for uncooked fabrics, we focal point on oil and gold fees.

The cost of oil is measured in two indices: Brent-price oil references, Africa and Center East and VTI-prices in oil with New York Mercantile Change.

Our econometric style in this duration displays that the amplitude of accelerating and lowering the wik inventory marketplace is 60% upper than the ones uncooked fabrics.

Empirical research display that (lengthy) northern yields of contracts on uncooked fabrics underneath the affect of chance belief (implicit volatility). Particularly, the cost of gold will increase when this belief exists. This pattern confirms the concept traders at all times enjoy gold as have shyed away from, to shop for expanding higher marketplace instability.

However, the oil has a adverse correlation with chance belief. The cost of oil falls when this implicit volatility is to be had. Those effects are in step with the analyzes of earlier research. Brent, which is the usual of oil within the Center East, has a better (adverse) correlation on this duration from VTI. The concern of last the dad or mum arts of the Ormuse felt extra.

Fearing hypothesis

With a view to entire our research, our style integrates, in the second one step, a hallmark of the volatility of the American monetary marketplace was once based at the day by day alternate of Chicago, VXX. If the VIK index is the size of the predicted marketplace instability, VKSX is subtitles that observe contracts at (long-term adventure at the inventory marketplace, which makes use of a temporary contract portfolio to the S & P500-VIK index.

VXX titles may also be bought or offered, similar to movements. VXX is in most cases used because the roof of marketplace instability. By way of maintaining lengthy or buying marketplace positions, you’ll be able to purchase choices or time period contracts to give protection to towards a surprising fall available on the market, throughout the find out about duration.

All the way through the duration of top instability, they may be able to achieve the highest, providing investors the facility to milk quick actions of costs and speculative buying and selling alternatives. VKSX from 12. to 13. June 2024 higher. Yr, which matches from 51 to 55. This motion signifies possible concern speculations.

We verify that army battle deteriorates instability and has higher speculative conduct in a part of staff in markets. This conduct throughout the battle merits extra consideration of educational analysis.

Thankfully for the whole thing, the warfare ended 24. June.