The query echoes in espresso stores, circle of relatives dinners and WhatsApp teams of new graduates. Is it lifelike to discuss financial savings in an inflationary context the place we’re slightly making ends meet? In step with INE, the ones beneath the age of 25 won a mean wage of one,373 euros gross per thirty days in 2024, 45 % lower than the nationwide reasonable.

The era now coming into the exertions marketplace faces a monetary landscape this is radically other from that in their oldsters, and the aspiration to shop for a house sooner than the age of thirty has change into inconceivable for many. In step with the Observatory for Emancipation of the Spanish Formative years Council, handiest 15.2% of younger Spaniards controlled to change into emancipated in 2024, the worst determine on report. However giving up monetary making plans altogether may be now not a viable long-term possibility.

So what can younger execs do to construct an financial long run? The solution calls for forsaking nostalgia for the style of earlier generations and fascinated by a brand new technique: the transition from an financial system of mounted property to an financial system of liquid property and human capital.

Alternative value: reassessing liquidity

As of late’s pessimism is incessantly born from measuring wealth only in sq. meters of assets. It’s true that the barrier to access for mortgages is excessive. In step with the Formative years Council, the common acquire worth (€197,210) is identical to a 14-year formative years wage, however the obsession with purchasing a space at an early age involves important alternative prices which can be hardly assessed.

The immobilization of the most important a part of the to be had capital on the enter for an asset with low liquidity and utilized in one geographical location represents, from the viewpoint of institutional portfolio control, a technique of excessive focus of threat. Concentrating all wealth in a single asset, in a single town, denominated in a single forex, violates essentially the most basic concept of prudent control: diversification.

A tender skilled might reevaluate hire now not as a sunk value, however as an possibility value. In a world financial system, exertions mobility is a strategic merit. With the ability to transfer to Barcelona, Berlin or Boston to multiply your wage is beneficial. Purchasing a house in a specific location gives steadiness, however can restrict agility to profit from skilled alternatives in different places, appearing as an anchor throughout occasions when mobility is wanted.

Chance Structure: Figuring out the Spectrum

If we settle for that housing does now not should be a compulsory first step, the place is extra capital successfully allotted? Right here, the younger investor must suppose extra like an institutional supervisor and no more like a conventional saver.

The placement every asset elegance occupies at the risk-reward scale. Supply: Marks, H. (2011). An important factor, image 6.1. Columbia Trade College Publishing, writer supplied (don’t reuse)

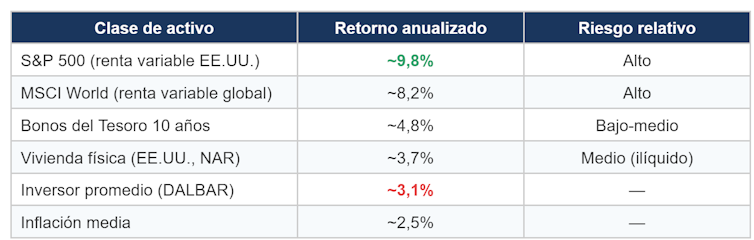

In step with professor Asvath Damodaran’s ancient information, even supposing diverse shares (indices similar to S&P 500, IBEX35, CAC40, and many others.) constitute extra volatility within the quick time period, they systematically be offering awesome returns over lengthy horizons: roughly 9.8% annual go back (alternatively lengthy the funding could be) in comparison to twelve months in comparison to twelve months. 3.7% for bodily housing.

Annual go back by means of asset elegance (approx. 2003-2023). Supply: Personal elaboration in line with information from Aswath Damodaran (NIU Stern), Nationwide Affiliation of Realtors (NAR), JPMorgan Asset Control, DALBAR., Supplied by means of the writer (don’t reuse)

Essentially the most revealing is the knowledge of the common investor who, in step with research by means of JPMorgan Asset Control, won handiest 3.1% in line with 12 months. Why does the investor earn lower than the marketplace? In step with American investor Howard Marks, it is as a result of cognitive biases: euphoria that activates purchasing at excessive costs and concern that activates promoting at lows. A successful technique calls for now not handiest selecting the proper asset (inventory), but in addition getting rid of the human issue via automation.

Compound hobby: when time works for you

If monetary capital is scarce at first of a profession, the time horizon is ample. That is the place essentially the most tough power in finance comes into play: compound hobby (kind of the hobby generated is added to the preliminary capital and the brand new quantity generates new hobby).

A easy instance illustrates this energy: 100 euros per thirty days invested with a go back of seven% in line with 12 months for 30 years generates greater than 120,000 euros, with handiest 36,000 contributions. The opposite 84,000 euros comes solely from compound hobby, the place the yield brings a go back.

Simulation of compound hobby (€100 per thirty days at 7% in line with 12 months). Supply: personal construction, supplied by means of the writer (don’t reuse)

A 23-year-old who systematically invests modest quantities has an arithmetical merit this is not possible to replicate for a 45-year-old who invests 3 times as a lot: the exponential time issue. World markets present investor persistence in some way that conventional financial savings can’t mirror.

Human capital: a supply of price

A tender guy’s general wealth is not only what he has within the financial institution as of late. That is plus the existing price of the entire salaries you can earn over your running lifestyles. A qualified who earns 30,000 euros a 12 months and works for 40 years will succeed in 1.2 million euros in gross source of revenue, now not counting wage will increase. In step with the INE Wage Construction Survey, college scholars earn a mean of €2,983 gross per thirty days in comparison to €1,595 for the ones with undergraduate levels; a distinction of 87%.

If human capital is a conservative and solid asset, a portfolio of monetary investments must act as a counterweight, assuming higher publicity to expansion property. Additionally, the funding with the perfect go back after 25 years is incessantly now not in monetary markets, however in expanding the worth of human capital: specialised coaching, skilled certifications, construction of technical abilities. A grasp’s stage that completely will increase wage by means of 20% has the next go back than any index fund.

Conclusion: strategic optimism

Is it conceivable to construct wealth within the present context? Completely, but it surely calls for a psychological paradigm shift. Monetary good fortune within the twenty first century does now not imply replicating the parental style, however changing into a world, versatile and disciplined investor. Present equipment (low cost index finances, virtual platforms and available world markets) are democratizing methods similar to diverse fairness, which have been in the past unique to high-net-worth folks.

Housing does now not disappear from the equation, it merely ceases to be the primary obligatory step. In all probability it is going to come when the pro state of affairs is consolidated and it’s transparent the place one needs to anchor one’s lifestyles. The objective is that by means of then capital will be capable to gather in world markets and, crucially, the worth of human capital can be maximized.

You do not need to possess a space by means of 25 to have a forged monetary long run. You wish to have to know 3 ideas:

Diversification (now not concentrating all wealth in a single asset).

Time (it’s the maximum tough aggressive merit younger other folks have).

Human capital (the facility to generate source of revenue is essentially the most precious asset).

Given the trouble of having access to the normal actual property marketplace, the solution can’t be paralysis or pessimism, however strategic optimization. This isn’t resignation, it’s an clever adaptation to an international that has modified.

And clever adaptation, traditionally, has all the time been a successful technique.