Donald Trump set a cut-off date of July 9 2025 for business offers to be made sooner than he hits probably the most global’s greatest economies along with his arguable price lists. It’s unattainable to are expecting what’s going to occur at the day, however it’s already transparent that his financial insurance policies are destructive American pursuits.

Simply have a look at the state of US govt debt as an example. These days it stands at US$36 trillion (£26 trillion). And with overall financial output (GDP) price US$29 trillion consistent with yr, that debt is 123% of GDP, the best possible it’s been since 1946.

Govt money owed are alarmingly top in different nations too (the United Kingdom’s is at 104% of GDP, with France at 116% and China at 113%), however the USA is against the top quality.

The not too long ago handed finances reconciliation invoice (what Trump calls the “big beautiful bill”) is projected so as to add US$3 trillion to that debt over the following decade. With those varieties of numbers, there may be little prospect of striking US debt on a downward observe.

In 2024, the USA govt needed to borrow an extra US$1.8 trillion to hide spending now not supported by means of tax earnings (the finances deficit). That is identical to six.2% of GDP, a host this is formally predicted to upward push to 7.3% all through the following 30 years.

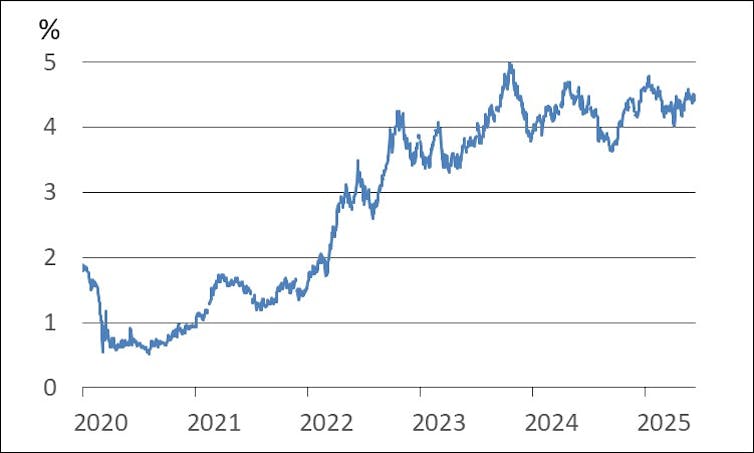

The emerging price of US govt borrowing.

Creator’s chart the usage of knowledge from Federal Reserve Financial institution of St. Louis, Creator supplied (no reuse)

The predictable result of this fiscal profligacy and the chaotic tariff programme is the top interest rates that the USA govt is having to pay for its borrowing.

As an example, the rate of interest on ten-year US govt debt (differently referred to as its yield) has risen from 0.5% in mid-2020 to 4.3% now. And as govt debt yields upward push, so do rates of interest on mortgages and company borrowing.

The facility of the buck

For many years, the USA has loved a top stage of consider within the power, openness and steadiness of its economic system.

In consequence, US bonds or “treasuries”, the monetary property that the federal government sells to boost cash for public spending, have lengthy been thought to be secure investments by means of monetary establishments all over the world. And the USA buck has been the dominant foreign money for world bills and money owed.

Once in a while known as “exorbitant privilege”, this standing of the USA buck as the sector’s reserve foreign money brings large benefits. It advantages US shoppers by means of making imported items inexpensive (albeit contributing to the business deficits (when US imports to a rustic are price greater than its exports) which trouble the president such a lot).

It additionally method the USA govt can borrow some huge cash sooner than doubts stand up about its skill to pay off. Buyers will typically purchase as many bonds as the USA government must factor to pay for its spending.

The dominance of the buck in world transactions additionally brings political energy, corresponding to the facility to exclude Russia from main international fee programs.

However this privilege is being eroded by means of the USA president’s tariff schedule. Financial motives apart, it’s the approach they’re being carried out – their measurement and the unpredictability – this is in reality sapping investor self assurance.

It’s expensive to regulate buying and selling patterns and provide chains in accordance with price lists. So when the scope of long term price lists is unknown, the rational reaction is to prevent making an investment whilst anticipating higher sure bet.

The buck has misplaced 8% in price because the starting of the yr, reflecting investor doubts about the USA economic system, and making imports much more dear.

Monetary markets are inclined

However in all probability the most important threat to US monetary markets is a surprising upward push in yields on govt debt. No investor needs to be left conserving a bond when its yield rises as a result of – as with every fixed-interest debt – the upward thrust in yield reasons the bond’s marketplace price to fall. It’s because new bonds are issued with the next yield, making present bonds much less sexy and not more precious.

A bond holder anticipating a upward push in yield subsequently has an incentive to promote it sooner than the upward thrust happens. However the upward thrust in yield can develop into self-reinforcing if the scramble to promote turns into a stampede.

Certainly, there used to be a soar in US yields after the will increase in business price lists introduced on “liberation day” in early April, with the yield on ten-year treasuries emerging by means of 0.5% in simply 4 days.

Broken buck?

Dilok Klaisataporn/Shutterstock

Thankfully, this upward push used to be halted on April 10 when the price lists had been unexpectedly paused, allegedly in accordance with the autumn in bond costs and an accompanying fall in percentage costs. The opinion of a senior central banker, that monetary markets were with reference to “meltdown”, used to be considered one of a number of such warnings.

The buck is not going to be temporarily dislodged from its pedestal as the sector’s reserve foreign money, as the choices aren’t sexy. The euro isn’t appropriate as a result of it’s the foreign money of 20 EU nations, every with its personal separate govt debt. Neither is the Chinese language yuan a most likely contender, given the Chinese language govt involvement in managing the yuan alternate charge.

However since March, international central banks were promoting off US treasuries, incessantly opting for to carry gold as an alternative.

On Trump’s watch, the recognition of the USA buck as without equal secure asset has been tarnished, leaving the monetary gadget extra inclined – and borrowing dearer.