Peugeot, Mulliez, Vendel… the entire giant French capitalist households use conserving firms. A historic and academic assessment to know this complicated felony and monetary device. The problem: to grow to be the worth produced by way of wide firms into personal wealth.

Whilst the French price range debate frequently brings taxation of the “ultra-rich” again to the desk, particularly after Gabriel Zucman’s proposal, public mirrored image focuses virtually completely on supporting the industrial device. The central query: the way to tax source of revenue and belongings after they’re created?

This means leaves the important thing level, positioned upstream, in shadow. Accumulation of wealth does now not happen on the stage of people, however first inside of societies, ahead of progressively reworking into personal wealth.

One of the vital key tools: a conserving corporate, an organization that doesn’t produce anything else, whose raison d’etre is solely the possession of alternative firms. Working out its position results in a shift in focal point from purely distributive problems to specializing in the mechanisms that make up wealth.

The query I studied in my thesis: working out its position within the modern separation of the non-public accountability of shareholders and belongings at the one hand, and the social accountability of the corporate at the different. From the manufacturing unit to the subsidiary, from the commercial team to the portfolio of belongings, then to the “Family Office”, pyramids of conserving firms orchestrate the upward thrust of the abstraction of capital, reworking jointly produced price into sustainable personal wealth.

A have a look at the historical past of conserving firms, from commendae within the Center Ages to circle of relatives places of work within the twenty first century, together with joint inventory firms throughout the Business Revolution.

From the Commendation within the Center Ages to the Business Revolution

Prior to we discuss historical past, let’s discuss financial principle.

First, from the instant capital is blocked in financial job or immobilized in accounting, as, for instance, within the spice industry, it’s not to be had for different doubtlessly extra winning investments. Then, with a view to be valued as personal belongings and handed directly to heirs, the capital will have to sooner or later be separated from the corporate. The conserving corporate responds to this paradox as previous as capitalism: the separation of economic accountability between the pro and private spheres.

From the tenth century, units such because the command established a separation between the investor, who supplied the capital, and the operator, who performed the economic undertaking, maximum steadily within the type of a sea voyage. They advanced in Venice and Genoa, contributing to the prosperity of each towns.

In Genoa, a commenda was once an settlement between an funding spouse and a touring spouse to run a business undertaking. Wikiwand

For the reason that fifteenth century, joint inventory firms had been created within the context of colonial conquests. That is the felony fashion of the royal monopolies, specifically the English, Dutch and French East and West India Firms. This felony shape introduces the divisibility of capital within the context of unsure industry, which calls for the immobilization of important capital.

Within the nineteenth century, along the industrialization motion in Europe, this separation of heritage and financial accountability was once formalized via sure felony entities.

Status quo of restricted legal responsibility firms

The French Industrial Code of 1807 presented a transparent difference between personal belongings and financial job, paving the way in which for the advent of public restricted legal responsibility firms (SAs). Via deleting the names of the shareholders from the title of the corporate, the restricted legal responsibility corporate turns into an impartial felony entity exercising its accountability. This new scenario leads many particular person buyers to benefit from the corporate’s source of revenue till it pronounces chapter, with out taking the effects.

The upward push of public joint-stock firms was once facilitated by way of the Legislation on Industry Firms from 1864. This felony shape allows the financing of the corporate by way of nameless buyers out of doors the corporate during the capital marketplace – in stocks or bonds. After Global Conflict II, it become the bulk.

The general public restricted legal responsibility corporate Tissus du Golbei (Vosges) was once created to enhance the expansion of the business of terry towels, handkerchiefs and different fleece articles. Wikimedia

Specifically, the restricted legal responsibility corporate, permitting financing on a broader foundation, additionally introduces a paradox. At the one hand, fairness house owners are not in my view answerable for the capital tied up within the corporate. Then again, a brand new downside seems: how can households of historic shareholders handle regulate over capital within the context of increasingly buyers?

On this context, the primary felony structuring of circle of relatives capital happens. Even supposing it’s inconceivable to speak about conserving firms this present day with out being anachronistic, the principles had been laid.

Development of commercial teams

In France, the development of huge business teams was once arranged from the past due Nineteen Sixties to the Seventies, beneath the management of the state and funding banks, akin to Lazare and Rothschild. Mergers, acquisitions and restructurings result in exceptional business teams, virtually all the time headed by way of conserving firms.

The tax reform of 1965 made it more uncomplicated to create and prepare the huge teams we all know these days. Via lowering the tax on dividends allotted by way of subsidiaries to their guardian corporate, it encourages corporations to construction themselves into a number of tiers of interconnected firms. The pyramid device is turning into common, progressively changing vintage monetary constructions, during which shareholders in my view owned stocks of businesses within the circle of relatives team.

The conserving corporate turns into the principle construction, centralizing possession, money go with the flow and decision-making energy, whilst holding the felony autonomy of subsidiaries. Those teams of conserving firms satisfy a number of purposes: monetary leverage, a device for exterior expansion and asset arbitrage, and organizational separation between capital possession and manufacturing job.

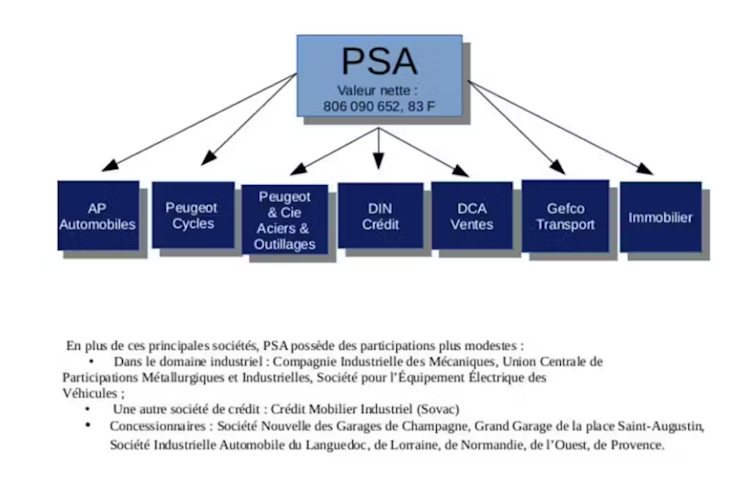

Report back to the Peculiar Common Meeting, October 1965, presenting the structural reform of Peugeot. BNF (4-VZ-24 09), writer supplied (no reuse)

The advent of Peugeot Societe Anonime in 1966 because the guardian corporate of a circle of relatives business team is a smart instance. Other actions – bicycles, equipment or automobiles – had been in the past controlled by way of impartial firms, immediately owned by way of shareholders, reporting to other branches of the circle of relatives. The conserving corporate Peugeot SA is managed by way of Fonciere et Financiere de Participation (FFP), a controlling circle of relatives conserving corporate based in 1929. This tax and felony construction promises the unification of the monetary control of the more than a few branches and the centralization of the control of circle of relatives capital.

Empires of capital

For the reason that Nineteen Nineties, as stagnation, acceleration of capital accumulation and financialization of the financial system set in, a number of opposed takeover operations have taken position. The primary French teams these days, akin to LVMH, Lagardere or Bollore, are shaped via large-scale monetary operations, roughly competitive.

Those operations are performed via conserving firms, which allow the centralization of money, and de facto to make use of the leverage impact for those investments – resorting to debt to extend the funding capability of the corporate. Legally and nominally impartial, they permit the corporate’s stocks to be purchased in a extra discreet means than via an organization bearing the circle of relatives title. This can be a technique that the Bollore team has time and again applied.

Protecting firms are due to this fact an increasing number of far away from the query of commercial building and an increasing number of nearer to the good judgment of economic optimization inside of those new empires of capital.

Personal Fairness Corporate

Those conserving firms are progressively remodeled into personal firms. They serve to enhance asset diversification methods and the deep recomposition of capital that we go along with financialization.

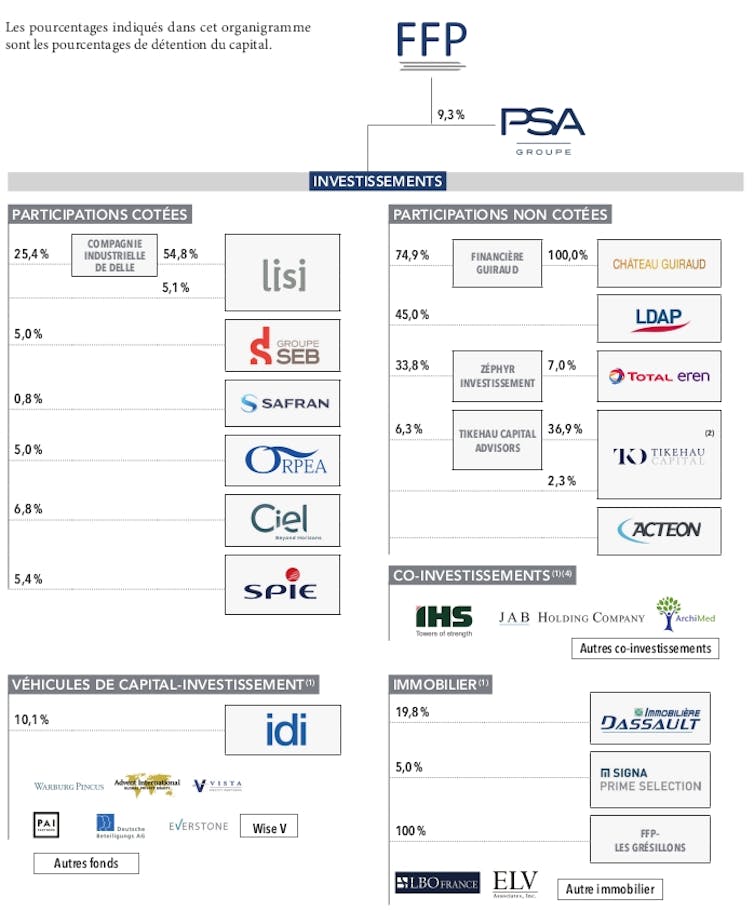

A conserving corporate is usually a way of diversifying circle of relatives capital, which doesn’t exclude the upkeep of commercial regulate. That is the case of FFP Staff, an funding corporate from the Peugeot circle of relatives, guardian of Peugeot Make investments. For the reason that 2000s, the motion in opposition to monetary diversification has sped up: the conserving corporate acquires stakes in a lot of teams, akin to Seb, Orpea, Ipsos, DKSH, Dassault Actual Property, Zodiac, Tikehau, Totan Eren, Spie, actual property firms, personal fairness price range, and many others. The Peugeot circle of relatives (beneath are the investments of this conserving in 2019).

Investments of the Peugeot Staff conserving corporate in 2019. Supplied by way of the writer Circle of relatives Administrative center, the conserving corporate of the conserving corporate

Buildings akin to “Family Offices” at the moment are being added to the higher flooring. They entire the transformation of financial capital into personal wealth for a variety of French dynasties on the best of the wealth record. Along with the engineering size of inheritance, those constructions be offering more than a few monetary products and services, but additionally the control of family members between shareholders and fogeys inside of those rich households.

This phenomenon is not unusual. The capital of the principle French dynasties is now arranged round conserving firms that shape roughly complicated constructions, however all the time with the principle monetary corporate: H51 conserving for the Hermès circle of relatives, Agache corporate for the Arnault circle of relatives, Tethis Make investments for the Bettencourt-Meiers circle of relatives, GIMD for the Dassault circle of relatives, Benefit France for the Saade conserving, NJJ, and many others.

Inside those circle of relatives empires, ranges of conserving firms shape the scales that permit the transformation of price produced inside of the actual financial system into personal wealth. Fascinated by financial problems by way of paying consideration most effective to the bottom stage, that of commercial subsidiaries, is due to this fact in large part incomplete.

Hanging conserving firms on the center of the research due to this fact permits us to keep in mind that enrichment is neither herbal nor computerized, however the manufactured from an exact institutional structure, in large part invisible in public debate.