For the primary time since Global Battle II, Germany plans an enormous plan of EUR 500 billion in power funding, military and infrastructure. The paradigm switches opposition to the ordeal philosophy of “debt brakes” and keep an eye on of the deficit. A choice for historical past?

The primary milestone seems in Germany. Conservatives, Social Democrats and environmentalists and environmentalists have reached the reform of the “debt brake” -or Schuldenbrembra in German – and developing an funding fund of 500 billion euros. This settlement, received after a traumatic negotiation, marks a destroy with a strict fiscal coverage that prevailed in fresh a long time.

The longer term Chancellor Friedrich Merz accrued ecologists to approval that the 5th fund or 100 billion euros will probably be devoted to environmental transition. In go back, they agreed to take away their opposition to the alleviation of Schuldenbrembrema, influenced within the Charter. This compromise opens the right way to use “Budget Baseles”, which permits investment for important investments in infrastructure, protection and effort.

Exam of finances dogmi

From the monetary disaster in 2008. 12 months, Germany prominent the experimental strict, noting some years of Viškova “Gemini”, and monetary and at the stability of bills. This self-discipline allowed him to scale back his debt, and nationwide and the world over.

The debt of Germany (mild blue), as a proportion of GDP from 2007. to 2023. years, in comparison to OECD nations (darkish blue). Oecd

The present geopolitical and financial context pushes Berlin to study its technique. The battle in Ukraine, the will for infrastructure modernization, power transition and business competitiveness imposes a brand new method. “Debt brake”, which Caps The finances deficit within the quantity of 0.35% of GDP will probably be quickly preoccupied to permit for outstanding prices of strategic spaces. Protection, intelligence, civil coverage bills, help in Ukraine and effort transition will probably be excluded from this strict rule.

5 hundred billion euro funding

The particular fund of 500 billion euros persecute a number of main targets. Its function is to modernize infrastructure – shipping, power and virtual – whilst supporting the improvement of renewable power assets and toughen garage infrastructure. Any other elementary part refers back to the strengthen of Lander, an envelope of 100 billion euros, which is particularly meant for them. In any case, above all, an important a part of the Fund is devoted to strengthening the Bundesvehr, particularly through accelerating orders for the protection business, in an an increasing number of risky geopolitical context.

Lengthy reluctantly build up its army intake, Germany recently evaluations its strategic posture in Europe. Berlin needs to satisfy his extend whilst closing under ambitions that confirmed a few of his best friend, equivalent to Poland, which objectives for 4.7% of GDP for his protection in 2025. And 5% long-term. This alteration after all is in large part motivated through expanding global tensions and modern exclusion of america of the Eu Theater.

Monday to Friday + week, obtain analyzes and deciphers from our mavens free of charge for some other view of the inside track. Subscribe these days!

Power transition: at all times related, however …

Germany should organize the results of its power transition, or power, with the dashing of the journeys of nuclear and dependence on Russian gasoline. His funding plan envisages greater diversification of power assets in opposition to extra terrestrial and sea wind, photovoltaic sun, inexperienced hydrogen and biomass. It’s deliberate to support electrical infrastructure building of recent high-voltage strains: “Sudlink” from the northern winds within the southern and “Nordlink” business areas, which connects Germany to Norway.

Based on the power disaster, the German executive has established a brief ceiling at the cost of gasoline, warmth and electrical energy. It additionally licensed an important relief in electrical energy tax, transferred from 1,537 central in line with KVH to 0.05 central in 2024. And 2025. This relief was once directed to remove darkness from accusations of businesses and strengthening their competitiveness. As well as, in December 2024. The German corporate licensed a subsidy of one.3 billion euros of intent to scale back electrical energy prices 2025. years.

Enhance business

German Commercial Coverage should face the chance of export falling, each in stagnation and in China in recession, fourth export marketplace – simply lower than 7% exports, in 2023. years. It is also confronted through slowing down in america, the primary buyer of Germany, together with the dynamics of enlargement.

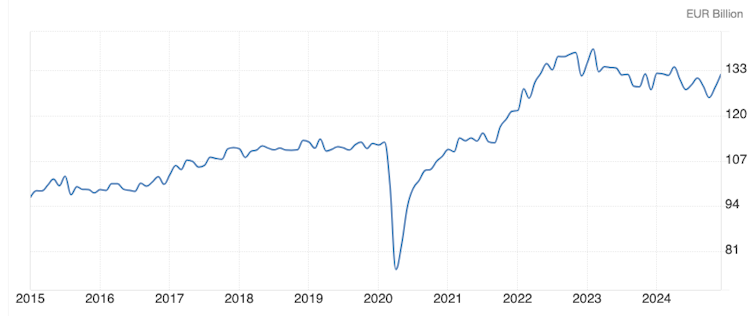

German export from 2015 to 2024 (in one billion euros). TradingEconomics, CC Bi-NC

Explicit help was once carried out for business with excessive power intake, with a view to make amends for local weather coverage prices. German conservatives plan to actively strengthen the golf green business, placing a undeniable emphasis at the manufacturing of batteries and the improvement of electrical cars. In parallel, they intend to lighten the taxation of businesses, a measure this is accompanied through administrative simplification.

Keynesian inspiration … beneath the running restrict

Softening “debt brakes” manner flexibility of finances coverage, however Berlin stays opposite to out of control restoration. This technique appears to be impressed through a key method consisting of inciting the financial system in opposition to public bills. The elimination of the German Ordoliberal custom stays, which is dedicated to finances steadiness and minimum state intervention.

In France, ordoliberalism is regularly mirrored within the in any case, mistrust of Germany, which is skilled as rigorous, centered by itself pursuits and connected to a strict budgetary self-discipline. An image that feeds sure stereotypes …

On the other hand, this studying additionally has an affect of facilitating German companions in addition to for political elections followed jointly. On this context, the investments deliberate through the longer term Chancellor MERZ will probably be “targeted and measuring” to keep each the sustainability of German public funds and the ones of the Eu Union as an entire. The luck of its undertaking is dependent upon its skill to stability enlargement and finances self-discipline, in an an increasing number of unsure context.

German financial restoration

At the French facet, the affect of Keines’ theories stays, with a marked religion within the Keineesian multiplier, in line with which the expansion of public call for can be automatically inspired through financial enlargement. Against this, Germany was once a part of the custom of finances self-discipline and tax rigorka. Marked through Ordoliberism, and Conservatives and their Social Democratic Companions (SPD) imagine that the state should no longer “manipulate the” lengthy build up in its prices within the hope of a really useful affect at the financial system.

If the brand new funding program is very easily welcome, it might be extra illusory to pray for a powerful German financial restoration in response to mass public spending, so long as this OrderEnral doctrine stays dominant …