As a way to stabilize France’s public debt, the rustic should scale back its deficit. Along with elevating taxes, it should additionally scale back its bills. However ahead of you chop them, it’s a must to understand how those prices have advanced over the last thirty years.

Ancient research of presidency spending may also be helpful in making price range choices nowadays. What did they finance? Agent salaries? Purchasing items and services and products? Transfers? What forms of public items did they permit to supply (schooling, well being, protection, and many others.)?

The long run nationwide price range should take into accout those previous tendencies and any ensuing imbalances, whilst understanding that those budgetary alternatives can have an have an effect on on enlargement and inequalities particular to the intake into consideration.

Nearly 30 billion in financial savings had been introduced

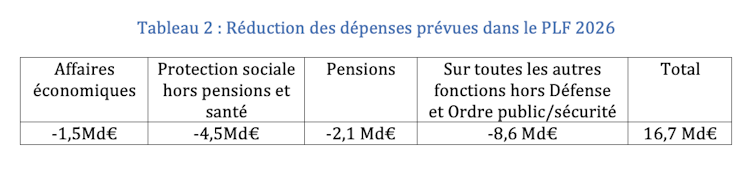

The Finance Invoice recently being regarded as for 2026 foresees financial savings of €30 billion, which represents 1.03 p.c of GDP. Those financial savings are received by means of decreasing spending by means of 16.7 billion euros (0.57 issues of GDP) and lengthening taxes by means of 13.3 billion euros. The general public deficit, which is projected at 5.6% in 2025 (163.5 billion euros for 2025), would subsequently be diminished by means of most effective 18.35%. To succeed in the objective of stabilizing the general public debt, this effort should be stepped up within the coming years to save lots of roughly 120 billion euros (4 issues of GDP), or 4 occasions the financial savings deliberate within the PLF for 2026.

Those upcoming spending cuts are available context. On reasonable, within the Nineties, public spending represented 54% of GDP. All through the 2020s, they larger by means of 3 issues, then they represented 57% of GDP, i.e. an extra annual expenditure of 87.6 billion euros, which is greater than 5 occasions the financial savings incorporated within the PLF for 2026. Since 2017, those expenditures have larger by means of one level, 2 billion GDP, i.e. financial savings in PLF for 2026). Given those robust previous will increase, spending cuts are conceivable with out calling into query the French social style. However what prices will have to be minimize?

Increasingly social transfers

Every merchandise of expenditure is composed of purchases of products and services and products (B&S) utilized by the federal government (extensively, this is, all central, native and public social safety administrations) for manufacturing, wages paid to brokers and transfers paid to the inhabitants. Which place has grown considerably since 1995?

Desk 1 presentations that during 1995, 40.2% of expenditures had been transfers (ie 22.05 issues of GDP), 35.5% had been purchases of B&S (ie 19.45 issues of GDP) and 24.3% had been salaries (ie 13.33 issues of GDP). In 2023, 44.1% had been transfers (+3.06 issues of GDP), 34.5% had been purchases of B&S (-0.15 issues of GDP) and 21.4% had been salaries (-1.07 issues of GDP). The price range is subsequently closely reoriented against transfers. Expenditure on salaries has advanced much less temporarily than GDP, with the burden of those advantages in expenditure falling sharply.

Creator equipped (no reuse)

Studying: In 1995, transfers represented 22.05 issues of GDP, or 40.2% of overall expenditures. The determine in parentheses signifies the participation of those expenditures in overall expenditures. Δ: the adaptation between 2023 and 1995 in GDP issues and the determine in parentheses of the percentage trade.

The state subsequently curbed those B & S purchases and diminished its payroll, although the team of workers larger by means of greater than 20% (FIPECO information). On the similar time, the employment of paid and self-employed individuals within the non-public sector larger by means of 27% (INSEE information). A smaller building up within the hard work pressure than within the non-public sector and an expanding percentage of state manufacturing in GDP expose a more potent building up in hard work productiveness within the public sector. However this didn’t result in an building up in public advantages. To the contrary, the salary hole between the private and non-private sectors has narrowed considerably over the length, transferring from +11.71% in 1996 in want of the general public (Insee (1999) information for the general public and Insee (1997) for the non-public), to five.5% in 2023 (Insee (Insee)20b for personal information (2022) (20). public).

This primary decomposition presentations that the group of presidency manufacturing (B&S purchases and wages) has now not complex, however that redistributive expenditure will increase (+3.06 issues of GDP in thirty years) have larger considerably. Those will increase in transfers correspond to a few quarters of the financial savings vital to stabilize the general public debt.

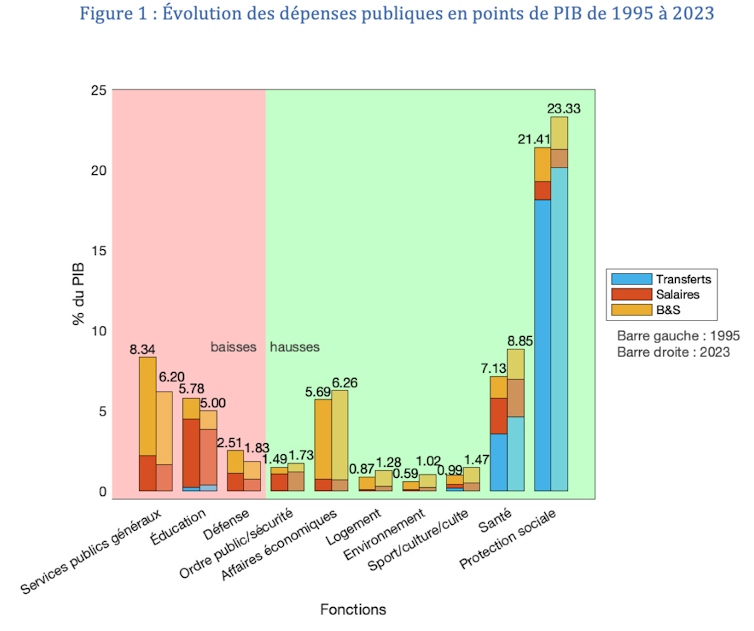

Much less and not more cash for college students and protection

State expenditures are damaged down into other services and products, this is, into other purposes (schooling, protection, social coverage, and many others.). Determine 1 presentations that spending on common services and products, schooling, and protection has grown much less abruptly than GDP since 1995 (crimson house). In reality, their budgets in issues of GDP fell by means of 2.14 issues, 0.78 issues and nil.68 issues of GDP. If the decline within the first place may also be defined, partially, by means of the explanation associated with the usage of knowledge applied sciences, and in the second one by means of the tip of the army legal responsibility, the schooling is extra unexpected.

The entire extra so as a result of Aubert et al. (2025) confirmed that 15% of this price range incorporated (i.e. 0.75 issues of GDP) pension expenditure which subsequently “should” be reallocated to pensions for larger transparency. The secure enlargement of this contribution to pensions within the schooling price range signifies that spending on scholars is in sharp decline, which may also be related to the deterioration of French scholars’ ends up in the Pisa exams. In any case, within the present geopolitical context, protection price range cuts might also appear “not very strategic.”

Creator equipped (no reuse)

Studying: In 1995, welfare expenditure represented 21.41 issues of GDP, together with 18.14 issues of GDP in transfers, 1.16 issues in wages and a couple of.11 issues in B&S; in 2023 they represented 23.33 issues of GDP together with 20.16 issues, 1.12 issues in wages and a couple of.0 issues in G&S.

Increasingly for well being and social care

The fairway house in Determine 1 aggregates the purposes for which their budgets grew quicker than GDP, from the bottom building up (public order/safety, by means of +0.24 issues of GDP) to the most important (well being, +1.72 issues of GDP, and social coverage, +1.92 issues of GDP). Those two expenditure pieces constitute 65.3% of the rise. That is adopted by means of the sports activities/tradition/consecration, atmosphere and housing budgets, which similarly percentage 24% of the full building up in spending (so roughly 8% each and every). In any case, the industrial affairs and public order/safety budgets give an explanation for the rest 10.7% enlargement in spending, up 6.4% for the previous and four.3% for the latter.

If we center of attention at the greatest will increase, specifically well being and social care, the explanations that give an explanation for them are other. As for social coverage, working prices are virtually strong (B&S and salaries), whilst advantages are emerging sharply (+2 issues of GDP). Well being spending additionally recorded an building up within the services and products introduced (+ 1 level of GDP), however it was once characterised by means of an building up in operational prices: + 0.6 issues for B&S and + 0.12 issues of GDP for salaries of well being team of workers, whilst reimbursement within the public sector, as an example, instructional brokers, went from 4.28 to a few.47 issues of GDP (-3.47 issues of GDP).

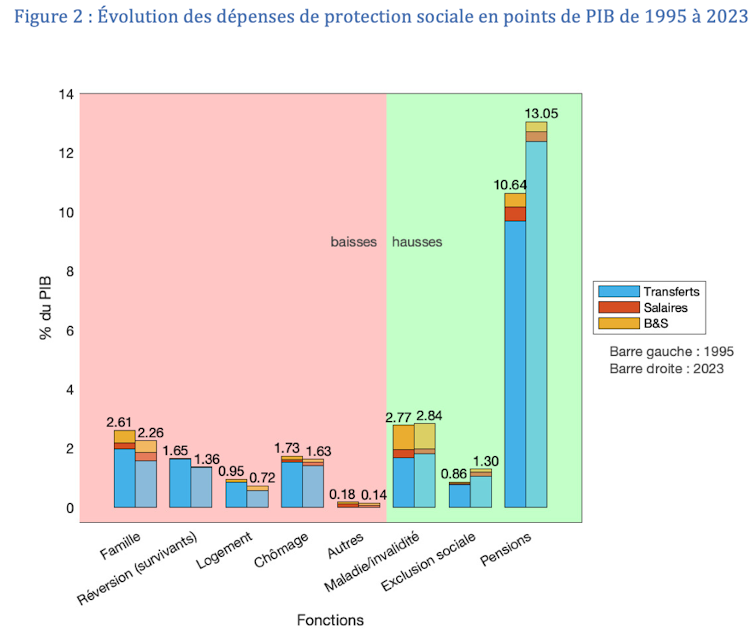

In social coverage, increasingly for unwell depart and pensions

Social coverage, the most important merchandise of expenditure (23.33% of GDP), unites the other sub-functions offered in Determine 2. Except for for the sub-function of sickness/incapacity (+ 0.07 issues of GDP), social exclusion (+ 0.43 issues of GDP) and pensions (+ 2.41 issues of GDP) and pensions (+ 2.41 issues in terms of social coverage have diminished their sub-functions in overall GDP). (floor in crimson). Pension reforms have subsequently been inadequate to stop pensions from turning into the quickest rising value.

Creator equipped (no reuse)

In any case, if we upload the portion of social care expenditures associated with sickness and incapacity to well being expenditures (see Determine 2), then this overall well being spending larger by means of 1.79 issues of GDP between 1995 and 2023.

What classes may also be discovered?

Those tendencies recommend that long term budgets would possibly center of attention on financial savings in well being care prices and pensions, either one of that have already grown considerably previously. It’s obtrusive that a few of these will increase are associated with the inevitable growing old of the inhabitants. However any other comes from expanding the costs paid to each and every person. For instance, the common pension has larger from 50% of the common wage within the Nineties to 52.3% in 2023. The price of treating a myocardial infarction has larger from 4.5 SMIC within the Nineties to five.6 SMIC within the 2020s.

France 24 October 2025

Alternatively, catching up in schooling and protection turns out vital given previous underinvestment and long term demanding situations. The remuneration of public officers should even be reviewed. Desk 2 presentations that PLF 2026 proposes measures that in part reply to this rebalancing by means of decreasing expenditures for social coverage, particularly pensions. In any case, the PLF for 2026 envisages an building up within the protection price range, whilst a discount of €8.6 billion within the budgets of purposes apart from protection and public order spares schooling.

Creator equipped (no reuse)

Along with those arguments for rebalancing, price range alternatives should even be in accordance with an overview of the have an effect on on process (enlargement and employment). Analyzes by means of Langot et al. (2024) recommend that discounts in previous earnings-indexed transfers (comparable to pensions) may have a favorable impact on enlargement, thereby facilitating public debt stabilization, in contrast to tax will increase.

Favoring the manufacturing of public items on the expense of transfers could also be justified in the case of geopolitical and local weather problems, and likewise permits the aid of inequality (see Andre et al. (2023)).