France is in debt to the remainder of the sector: -670 billion euros in 2024. On the other hand, the remainder of the sector will pay us extra in funding source of revenue than we do. Why this paradox?

In step with the newest file of the Banque de France, the web exterior place of France, i.e. the indebtedness of the population of France on the subject of the remainder of the sector, presentations -670 billion euros in 2024, or -22.9% of GDP. Particularly, the French won extra capital from out of the country than they invested there.

A debt place that ironically will pay off. Lengthy reserved for the US, this example, described as over the top privilege, additionally applies to France. That is defined by means of the construction of France’s exceptional quantities – receivables and assumed duties. Receivables are principally the results of investments by means of French multinational firms out of the country, which display extra successful charges of go back. France’s liabilities stem principally from the conserving of French public debt by means of overseas traders.

Even though the new build up in rates of interest on debt securities has diminished its quantity, funding source of revenue however continues to turn a favorable steadiness, which contributes to maintaining the French present account steadiness with reference to equilibrium.

Mass use of marketplace financing

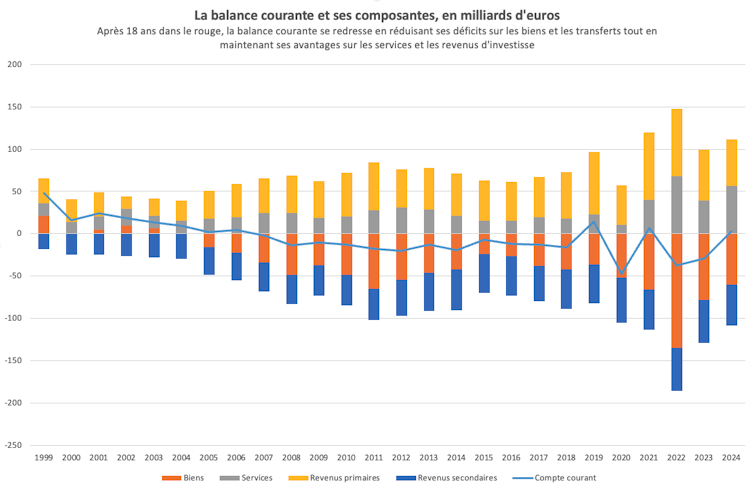

France’s present account steadiness hides very contrasting scenarios relying on the kind of funding (Graph 1).

The deficit place is essentially a result of the purchase of bonds or stocks grouped within the class of portfolio investments (-1.073 billion euros), particularly public debt securities owned by means of foreigners. Brief-term and long-term public management debt securities give a contribution round -1,400 billion euros.

By contrast, overseas direct investments (FDI) have a favorable place of 568 billion euros. French multinationals invested extra out of the country than overseas multinationals in France.

Equipped by means of the writer Funding price

The reimbursement of investments isn’t the similar relying on their nature.

Fairness investments, particularly overseas direct funding (FDI), are extra successful than debt securities. In 2024, the obvious go back on French FDI averaged 6%, in comparison to simply 2.4% for portfolio investments (in bonds and shares).

The overall belongings of France, i.e. all investments of French citizens out of the country, quantity to ten,790 billion euros. We’re speaking about 11,460 billion euros for liabilities, this is, all investments held by means of overseas citizens in France. De facto, the web exterior place is -670 billion.

Implemented to such quantities, even small variations in funding returns between belongings and liabilities could have an important have an effect on at the funding source of revenue France owes or will pay to the remainder of the sector.

Over the top privilege

The combo of belongings biased against shares and extra successful overseas direct funding (FDI) and liabilities biased against bonds, whose rates of interest are decrease, has enabled France to generate certain funding source of revenue for 20 years (Chart 2).

It’s exactly this example, function of the US (for this nation it’s associated with the dominant position of the greenback), that we qualify as over the top privilege. France may finance its spending by means of borrowing from the remainder of the sector, however with out paying the prices. Debt conserving by means of foreigners, particularly French public debt, is the counterpart to direct funding out of the country by means of French multinationals, whose returns are upper, and is admittedly an excessive amount of of a French privilege.

Web overseas place (at the ordinate) and steadiness of internet funding source of revenue (at the abscissa) as a % of GDP. FR for France, USA for United States, DE for Germany, IT for Italy, UK for United Kingdom, ES for Spain. PEN – Web exterior place. OECD, Writer supplied (no reuse) Funding source of revenue

Web inflows of funding source of revenue proceed as of late regardless of the new upward push in rates of interest, the latter being the larger charges on debt securities.

Web source of revenue from overseas direct investments (FDI) stays certain and critical – about 76 billion euros. The steadiness of source of revenue from portfolio investments is unfavourable as of late and quantities to 39 billion euros, virtually two times up to by means of 2022 (Chart 3).

The upward thrust in rates of interest is especially noticeable for different investments. Their obvious go back averages 3.5% in 2024, in comparison to 0.8% on moderate within the 2010s. Such a lot in order that hobby in different investments has worsened (-24 billion euros in 2024). On the other hand, yields on debt securities stay less than the ones on overseas direct funding (FDI).

So the funding source of revenue stays certain total, at +0.5% of GDP.

The writer supplied (with out reuse) Business steadiness development

In contrast to the US, France presentations a balanced present account. That is the case in 2024, but additionally in 2021 and 2019, i.e. all 5 years out of doors the disaster (chart 4). The buildup of present account deficits all through 2000 and 2010 ended in the deterioration of France’s exterior place, however that is now not the case within the closing length.

These days, the business steadiness is with reference to equilibrium, with the excess in products and services offsetting the deficit in items. The steadiness of the present account is now not because of the over the top French privilege and the funding source of revenue it generates, however to an development within the steadiness of products and products and services.

Writer supplied (no reuse)

The partial aid of the over the top French privilege, related to the new build up in rates of interest, does no longer entail an exterior sustainability possibility associated with France’s unfavourable internet exterior place.

The French funding construction of belongings and liabilities continues to generate certain internet source of revenue, regardless of the unfavourable place. The present account steadiness is balanced in 2024 (in addition to in non-crisis years from 2019).

As a reminder, on the morning time of the Eurozone disaster in 2010, Greece’s internet exterior place used to be -100% of GDP and its present account deficit used to be 10% of GDP, -107% and -10% respectively for Portugal, and -90% and -4% for Spain. Some distance from France’s -23% internet exterior place, close to present account steadiness and over the top French privilege in 2024.