Created for sports activities, footwear have transform an all-terrain shoe. Some pairs have even transform creditors’ pieces, and even funding pieces. However how a lot is that this funding value? What dangers does it constitute for what go back?

To diversify their belongings, families would possibly gain collectibles in anticipation of resale earnings. If artistic endeavors and comfort watches were in a position to play this function for generations, younger families nowadays produce other totems. After CSGO skins, cryptos or NFTs, a brand new collectible has seemed within the ultimate ten years: sports activities sneakers, also referred to as footwear. Is that this a easy cultural fad or a related funding?

Footwear have come far since Keds in 1916. First, sensible sneakers, then sports activities, turned into a cultural image, inseparable from city actions, comparable to hip-hop. This evolution speeded up within the Eighties, particularly with the collaboration between Nike and basketball superstar Michael Jordan, which resulted in the enduring Air Jordan.

Greater than one billion greenbacks in turnover in 2019

Nowadays, sneaker manufacturers crew up with track, sports activities and web icons to create extremely coveted restricted editions. A secondary marketplace used to be even born and StockX, its main platform, exceeded a thousand million US greenbacks in turnover in 2019.

Whilst maximum pairs promote for a number of hundred euros, some uncommon fashions succeed in the utmost at public sale. In 2021, a couple of Nike Air Yeezys offered for $1.8 million. A 12 months later, Nike Air Drive 1s signed by way of Virgil Abloh fetched $25.3 million at a Sotheby’s public sale. Those examples draw in the eye of buyers. Alternatively, can footwear now be regarded as a real asset magnificence?

A systematic method: construction a worth index

To reply to this query, in an editorial to be printed within the Magazine of Choice Funding, we analyzed the sneaker marketplace from December 2015 to April 2023, the use of information from StockX (greater than 2,000 pairs produced sooner than 2016 – particularly Adidas, Jordan and Nike), some of the biggest on-line resale platforms.

Inspecting the efficiency of this sort of asset is advanced. Not like shares or bonds that experience standardized costs, every pair of footwear has distinctive traits (fashion, dimension, colour, 12 months of factor, and many others.) that impact its price. Due to this fact, we use the similar approach as the true property value index, bearing in mind variations in housing traits to extract the cost development, the hedonic index. This system turns out to be useful for finding out the evolution of marketplace values through the years when the traits of the products being exchanged is also other from length to length.

Graph 1: Evolution of the cost index of hedonic footwear (quarterly)

authors, Equipped by way of the creator

The full development is obviously upward, with costs accelerating post-Covid-19. Alternatively, an research of returns over all of the length displays that the marketplace is a ways from being a easy river. Certainly, footwear have a profile reasonably very similar to that of different collectibles, possessing each prime returns and important volatility. Which means that their costs can range all at once and briefly. Woe to the one that buys prime and sells low.

A maturing marketplace

Alternatively, we display the life of a structural destroy, which happened in mid-2019, within the go back of the sneaker marketplace. Prior to this date, the marketplace used to be in complete swing, characterised by way of very prime returns and prime volatility. It used to be an age of speculators and passionate creditors, the place each unlock of an unique fashion may purpose over the top enthusiasm.

After mid-2019, our information signifies a gentle decline in returns, but in addition a discount in threat (volatility). This construction is an indication of the rising adulthood of the marketplace. The improvement of platforms, comparable to StockX, Goat, Stadium items, professionalized resale, higher the frequency of gross sales and lowered value uncertainty (liquidity). This marketplace is turning into extra structured, much less topic to excessive permutations, and due to this fact extra predictable for buyers.

Benefits of footwear

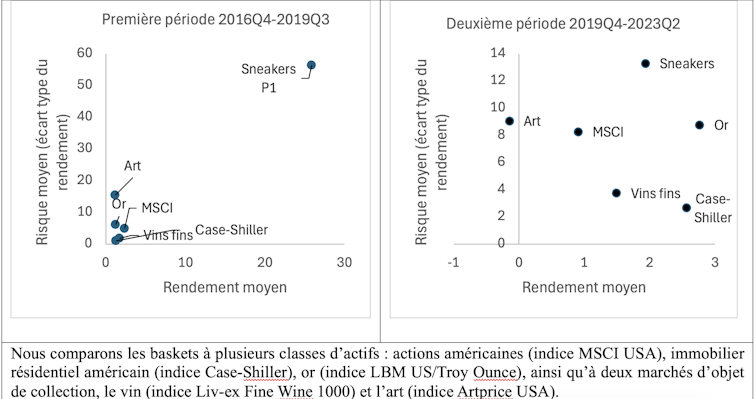

To evaluate the opportunity of footwear, let’s examine their go back and threat with the ones of different belongings, whether or not conventional (stocks-MSCI international, gold) or choice (artwork, wine, actual property). Alternatively, let’s watch out to differentiate between pre- and post-Covid-19 efficiency.

Throughout the primary length (graph 2), footwear display the standard profile of collectibles: a prime go back (round 50%) that compensates for the disproportionate threat (150%) to which the investor is uncovered. The second one length (post-Covid) displays the rising adulthood of footwear with a threat this is now nearer to different belongings (40%) for a go back this is routinely lowered. Alternatively, in comparison to the danger, the go back on footwear post-Covid is on the subject of the go back on actual property and exceeds that of gold.

Credit, supplied by way of the creator (no reuse)

However the largest benefit of footwear lies of their doable for portfolio diversification. We see little or no correlation between sneaker returns and the ones in conventional monetary markets (shares, bonds) or different collectibles. Our simulations display that together with footwear in a different portfolio, particularly for an investor in search of prime returns (or an “aggressive” profile), can considerably building up returns whilst controlling risk-taking.

Euronews, 2021. Dangers and potentialities

The sneaker marketplace, even if extra mature, remains to be younger and has its personal specifics. Liquidity stays restricted, the prime threat of counterfeiting and the loss of complete historic information will also be hindrances.

Moreover, making an investment in footwear is in accordance with cultural dynamics and converting personal tastes. The price of a fashion will depend on its reputation, rarity and collaboration with influential figures. A development reversal, a transformation in spouse symbol or an overabundance of “limited” fashions may erode the worth of exclusivity.

Making a bet on footwear can due to this fact be an effective way to diversify your portfolio… supplied you settle for that, like at the basketball court docket, the sport is speedy, infrequently chaotic and reserved for the bravest gamers.