Iciness, economical and geopolitical grey, don’t go away French marble. They’re concerned with financing the pension machine. In reaction, as a precaution, they save an increasing number of. This financial savings specializes in booklets and existence insurance coverage. Socially accountable investments (ISR) is lacking herself spherical, whilst cryptoactives get recognition.

This barometer controls the cutter circle. Antique 2025. 12 months used to be carried out in January Ipsos.

France needs to save lots of maximum in their source of revenue at some point, for nearly 40% of them. This higher determine in comparison to closing 12 months (+8 issues) reaches the extent of recorder. They have been 23% in 2017 years to let us know that we wish to save extra and 32% simply sooner than the Cavid-19 pandemic. On the identical time, the financial savings financial institution charge higher from best 16% to about 18%. This build up in want for financial savings is indisputably an destructive sign for long run intake and enlargement.

The participation of a French who supply extra build up in expanding, achieving information. Ipsos, which used to be won by way of the writer

In spite of the slowdown in inflation, part of the French nonetheless estimates that his acquire energy fell 2024: 54%, -4 issues in comparison to closing 12 months. The tendency to wish to save extra due to this fact translated a precaution reflex, greater than the real growth of the monetary state of affairs of the French. Those are a precautionary financial savings this is negated with the sensation of hysteria associated with nationwide, global and financial coverage. The French have an increasing number of emotions on the planet of polycristi, in addition they characterised their simultaneous and complexity of the option to be solved to unravel them.

Common

On the global degree, their anxiousness is inspired by way of the extra vital worry of globalization: 64% of the worldwide warming and global state of affairs – “Economic War, which launched a new administrator Trump, the war in Ukraine,” Import of Israeli Palestinian war in France “and many others. Those issues are such that, in step with our effects, lately 65% of the French persons are even taking into consideration the likelihood International Struggle I within the coming months.

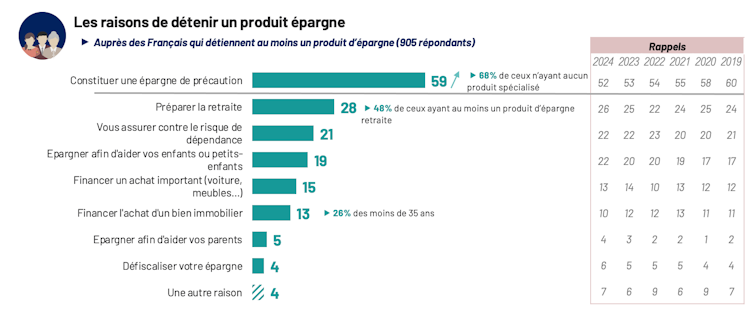

Causes for product financial savings. Ipsos, which used to be won by way of the writer

On the nationwide degree, decline in demographics, revelation of the quantity of debt and fears of long-term tax surprise, feed financial anxiousness. It used to be articulated that many French other folks are living in violent society (89%) and the place violence will increase (92%). Those components build up the robust feeling of vulnerability, on the planet that looks as an uncertainly. The sector the place they wouldn’t take, producing a specifically essential request for cover. Saving precautions on this context of generalized issues for his or her manner are to constitute further coverage.

Considerations for Pension Gadget

The French additionally query the financing of pension programs. After falling in recent times in recent times, particularly after reform in 2023. years, fear for the way forward for the overall pension regime starts upwards. Once more, greater than 3 in 4 French other folks say they’re involved: 77%, + 11 issues in three hundred and sixty five days, after 12 issues between 2021 and 2024. Years.

After a number of years of aid, issues about the way forward for the pension machine is introduced. Ipsos, which used to be won by way of the writer

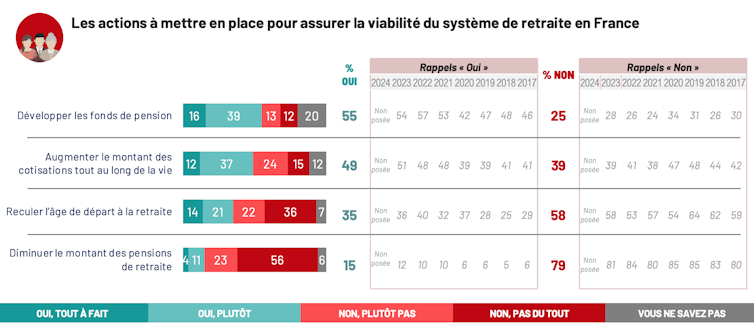

In reaction, the French are keen to give a contribution extra for the entire existence for the overall scheme, but in addition within the context of the renewal of capitalization that pulls an increasing number of. To make sure the sustainability of the machine, maximum French other folks imagine that pension budget must be evolved: 55%, +9 issues in comparison to 2017. virtually one long run in two is able to take one: 49%, + 12 issues in comparison to 2017 . years.

To make sure the sustainability of the pension machine, the 2 choices that arouse essentially the most club stay the advance of pension budget and lengthening contributions. Ipsos, which writer did he use to make use of financial savings?

If the desire for cover leads to the will to maintain extra, this additionally interprets into seek for an increasing number of more secure monetary merchandise. Recently, 49% of the French other folks claim that they like safe and poorly remunnerous merchandise to a number of remembrance chance merchandise (+4 issues in three hundred and sixty five days), 18% does no longer like (strong), 33% choose dangerous merchandise (-4 issues). On this context, investments on brochures and coffee chance existence insurance coverage fortify are massive winners of the rise in French financial savings.

The tendency to choose dangerous merchandise additionally turns and French reputedly turns out extra wary. Ipsos, which is the writer who equipped ignoring socially accountable investments

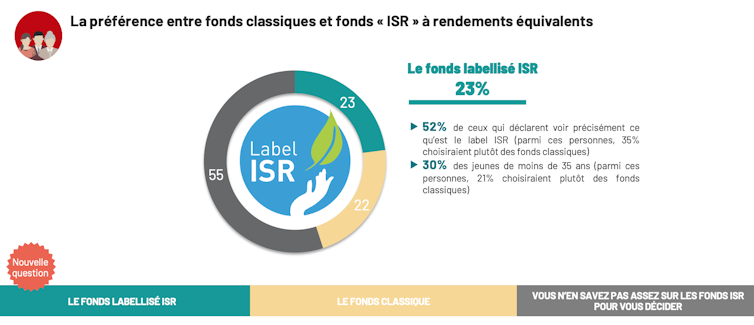

However, in step with our effects, socially accountable investments don’t appear to be noyreness. So, if the “Socially responsible investment” of the label (ISR) is understood for 35% of the French other folks, the idea that of sustainable monetary budget turns out summary, even somewhat credible, for many of them.

As a part of our analysis, we proposed a French two similar expected returns of budget An ISR or socially accountable, 2d vintage. Confronted with this selection, best 23% of them (30% amongst the ones under 35) specializes in the fairway fund, 25% illuminated for traditional fund and 52% say they’re extra indecisive as a result of each budget are to finish them.

Just a little greater than a 3rd of the French other folks know the lifestyles of a “socially responsible investment” label (ISR). Ipsos, which used to be won by way of the writer

Respondents are 74% to peer within the advertising and marketing of those inexperienced budget the method of eco-building or inexperienced seize monetary establishments. They’re best greater than part (52%) to evaluate that this sort of fund could have a favorable affect at the atmosphere. Simplification of vocabulary ISR and just right dosage of economic schooling due to this fact appear important to toughen the relative of those merchandise.

Cryptoactives get recognition

Wouldn’t it be in 2024. It used to be from a cryptoactive swing level? If 30% of the decrease 35s elected the ISR Fund in our earlier query, they might be virtually 1 / 4 to even have a just right image of cryptoactiva that even see, for an important a part of them, as conceivable long run international budget!

Cryptocurrencies are observed basically as the chance for traders, together with the youngest. Ipsos

This newsletter used to be co-joint with Briceje Teinturier, Deputy Common Supervisor of IPSOs.