Monday, 1. September, Top Minister Francois Bairou starts consultations with primary political leaders about his price range draft for 2026. 12 months. Some other imaginable price range? Are we able to each cut back debt, with out breaking expansion, whilst decreasing inequalities?

This 12 months, the French state pays 68 billion pursuits on monetary markets. Along with this restricted expenditure, it’s going to pay 91 billion euros greater than income: overall its prices with out hobby fees will likely be 1,627 billion euros, when only one,535 billion revenues will accumulate. Due to this fact, 159 billion euros (91 + 68) will wish to “find” in 2025. 12 months, then 170 billion euros in 2026. years, if not anything adjustments to public monetary control.

Heavier debt control

To oppose the adjustments proposed through Govt Bairou, some say the extent of public debt isn’t an issue. They’re proper, however best in a definite context: if the rise in wealth used to be created in France once a year at some point enough to atone for hobby payable once a year. Forecasts for 2025. 12 months point out that the rate of interest on debt will likely be 2.2%, whilst expansion will likely be best 2%. Due to this fact, there will likely be a necessity for financing for approximately 7 billion euros in 2025. years.

Even though state bills that exclude hobby fees equivalent revenues, extra revenues created in 2025. could be 7 billion euros less than pursuits that are meant to come with public debt. This may occasionally robotically build up the debt / GDP dating (debt, higher through its pursuits, expanding quicker than GDP). For 2026, an build up in rates of interest and a depressing global context does no longer consider that financial expansion is upper than rate of interest stabilization, despite the fact that prices exclude hobby prices are equivalent to public revenues.

Due to this fact, the cyclical context (low expansion and lengthening rates of interest) will have to maintain the extent of debt: the higher, the higher the prime rate of interest with regards to the expansion price will create new investment wishes, after which exploding debt. This expanding the weight within the hobby is plain that there are approaching penalties: on the similar stage of source of revenue, euro devoted to it can’t be used to finance college, well being, protection or transfers to families.

If you don’t vote, if it refers back to the state of public price range and the quantity of price range efforts that will likely be ensured that they’re higher, it does no longer seem to be established economically. Then again, the tracks offered through the Top Minister 15. July will also be modified, particularly to mix debt aid and the preservation of financial expansion. The latter is the whole thing wanted as a result of it will possibly give a contribution to decreasing debt weight.

Price range for expansion that reduces inequalities

Whilst decreasing the associated fee between prices that exclude hobby and public income prices, in order that debt accounting will have to no longer build up, those amendments will have to then proceed the double goal:

Give a boost to expansion, because it facilitates public finance control through financing pursuits

And include financial inequalities to take measures to maximum authorized within the opinion.

Those price range measures will have to be calibrated through progressively decreasing the deficit, a minimum of 40 billion euros in 2026. years, and is then decided through a host that will likely be diminished to three% in 2029. In response to Ecu duties in France. For those measures to be efficient, they will have to goal the aid of intake and revenues will increase to scale back expansion a minimum of and no longer will increase inequalities.

Cut back prices, to not build up samples

The opinions made through the ceperap and the i-one of the final two budgets proposed through the governments Barnier and Bayrou (see the notes of cetremap and i-map), have proven that two kinds of measures very much cut back expansion: at the one hand, cuts within the working bills of the state and the Communities, and at the Different Hand, The Levies of Samples, The Latter Plates Discounts They Motive.

Then again, decreasing transfers listed to paintings income (retirement and unemployment advantages) permit the deficit lower and beef up expansion. In reality, this financial savings will have an effect on seniors that may, compensate, take out in their financial savings if they’re retired or longer to paintings if they’re nonetheless energetic.

Those measures may even beef up the call for for returning surplus financial savings, most commonly the ones over 60, in keeping with Oversea, nonetheless too low in France, nonetheless too low in France, continues to be too low in France, nonetheless too low. With a purpose to no longer be to excavate inequalities, transfers of assist, similar to minimal age, as a result of all of the older ones don’t have any financial savings or alternatives to increase their job.

Graph 1: Construction since 1995. years of public expenditures and revenues (within the proportion of GDP). The diversities initially of each and every presidential mandate are in proportion level, similar to minimal distinction (inexperienced) and most distinction (in orange)

Supplied through the creator who spends the purpose? Proper previous imbalances

Respecting the price range body proposed through the Bairou executive, the price range amendments will have to additionally right kind positive previous imbalances. Ancient traits in public spending and state revenues point out, in contrast to too a part of 0.4 proportion issues, whilst prices stay at upper than 3 issues above their 51% of GDP and prices) constitute 51% of GDP and prices. Working after expanding prices through expanding the furnishings, so it kind of feels that as of late don’t glance evident as of late.

France 24 – 2025.

Opening negotiations that the Top Minister proposes will have to permit higher goal measures that cut back prices. To behavior this negotiation, decided on measures will have to first, beef up expansion and include financial inequalities through selling those that build up family intake and employment price, positive prices that experience already skilled pattern.

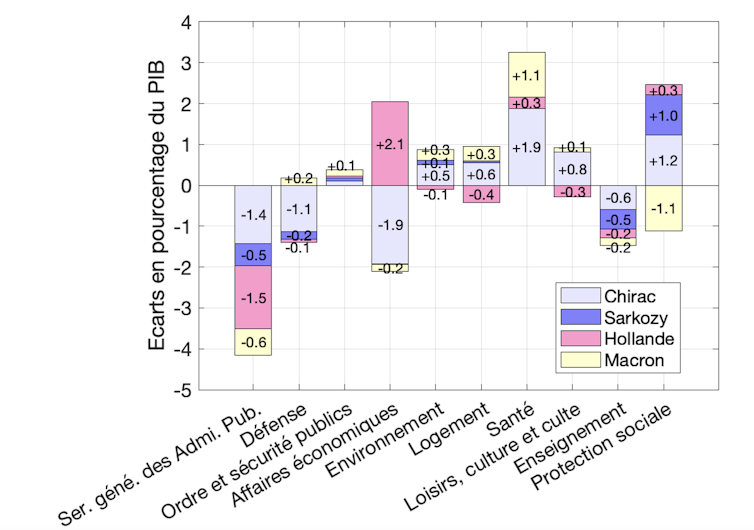

Graph 2 displays that if the continual drop in prices devoted to the functioning of the state is also justified (-4 issues), which is unusually, contrasting, particularly, with a continuing build up in line with the consistent build up within the consistent build up in well being (+ 3.3 issues). If the power to beef up expansion and incorporates inequalities, it might be suitable to scale back the beef up of financial affairs seen right through the Presidency E. Macrons – as he additionally had the case at some stage in F. Hollande -, but additionally incorporates a percentage of social coverage since 1995. years, but additionally that it is a part of the 1995. years, but additionally that he can also be within the participation of social welfare intake since 1995. years. Relative efforts prior to now made and their influences on expansion.

Graph 2: Construction of the Presidential Mandate of State Bills (as a proportion of GDP) through posts

The creator is supplied (with out use)

Studying: All through President J. Chirac, N. Sarkozi and F. Hollande, social coverage prices higher through 1.2, 1 and zero.3 proportion issues (in a complete build up in 2.5 issues) and diminished 1.1 issues right through the Presidency E. Macrons.