The announcement of the Common Price lists, which was once matter to Trump within the Lawn of the White Area, was once a tale in regards to the wolf and sheep. The American president introduced that wolves (price lists) and different international locations (sheep) had been with worry within the frame.

Uncertainty was once no longer such a lot in case the kind of tariff was once carried out (which has already been discounted), however in case it’s going to be more than or not up to anticipated markets.

And afternoon, after the closure of Wall Boulevard, Trump introduced a long-masoned announcement of common price lists – who had been in any case converting based on the international locations and reached 50% – and the decree is “Economic Release” Day “of the US.

Massive wave

This announcement has created tsunami in world markets. Falls replicate uncertainty and worry of world financial slowdown. The principle explanation why is that price lists are worse for some areas corresponding to Asia and Europe, which essentially the most pessimistic forecasts had been assessed.

The rapid results are disgusting for monetary markets. Within the first part operations the day after the announcement, indices DOV Jones (tracking the efficiency of the inventory marketplace 30 biggest corporations in the US is a number one decline with lack of greater than 4.5%.

This response displays the troubles of traders to the damaging have an effect on of price lists in world business and world economic system. As well as, he confirms unhealthy information that Trump made up our minds to harden (greater than anticipated) his tariff charges in opposition to 3rd international locations, a lot of them thought to be usa to allies and pals to few months. Uu.

Evolution of the associated fee S & P500 (above) and NASDAK 100 (underneath) index between January and April 2025.

Make investments

Amongst corporations suffering from corporate, corporations are corporations with a robust external part (both by way of exporting or uploading parts and completed items).

Waterfall impact

It was once already observed later, on Monday, 7. April, Chinese language reaction (who was once on Friday, April 4, introduced a tariff of 34% on all American merchandise) led to innovative marketplace cave in as they open in Asia, Europe and The usa.

This world response underlines mutual connection of economic markets and the magnitude of the have an effect on of American industrial coverage. If we see evolution within the final 3 months of a few Ecu and Asian indices, this cave in has been showed the world over.

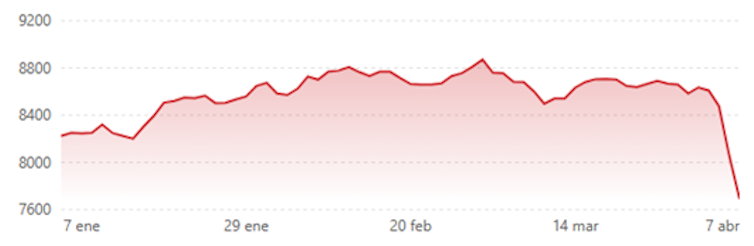

Evolution IBEX-35 Index costs (above) and FTSE 100 (underneath) -europian examples – between January and April 2025.

Make investments

Evolution of Nikkei 225 (above) indices and dangle seng (underneath) – Asian examples – between January and April 2025.

Making an investment and the way is the group protects?

Given the volatility of the marketplace for worry of Trump insurance policies, gold performed a an important position as a protected haven for traders, which resulted in its value stage fulfillment of report ranges to $ 3,255 in line with oz. (about 2,900 euros in line with oz.).

In an unsafe and risky monetary setting, wealth calls for steadiness, and gold is perceived as protected investments within the face of marketplace fluctuations and conceivable financial penalties of business struggle.

Evolution of gold value between January and April 2025. Making an investment

As well as, the monetary markets of the international locations below struggling a US tariff attack could seem as a safe haven for world traders who flee lack of confidence and losses that those taxes may just purpose their wealth.

What sort of analysis in regards to the matter writes

Contemporary research of the damaging have an effect on at the markets of the Industrial Struggle 2018-2019. In between the US and China presentations that tariff bulletins led to important and lasting falls in stocks costs. As an example, days in an instant after the announcement, 11.5% in line with cent, which is similar to the capital worth of roughly 4.1 billion bucks within the American marketplace.

The decreasing had been large and constantly happened with every new tariff advert, indicating that those reactions aren’t because of a easy response to sudden occasions. As well as, corporations that had been immediately uncovered to China – had been already via exports or imports – they’d better falls in a short while and confronted even worse financial effects.

Financial penalties within the heart and long-term

In 2025. further penalties may well be anticipated to regulate their expectancies in regards to the results of money go with the flow corporations (and, subsequently, their worth).

Within the above-mentioned investigation, it was once decided that the economic struggle with China since 2018-2019. It produced a discount in the USA get advantages close to 3%. The mirrored image of the marketplace trust that price lists have long-lasting and side effects on long term financial enlargement and enlargement.

This implies that if the placement does no longer give a boost to – as an example, the prime common charges that introduced and markets would possibly supply for a good better aid in productiveness and financial steadiness, which might additional sharpen the associated fee drop and affect pricing.

Recession and unemployment

As markets regulate their expectancies, the commercial penalties of common price lists will develop into extra visual. Economists warn that the likelihood of monetary recession will increase, a conceivable build up in unemployment in the US that would succeed in 7.5% (early April 2025. years was once 4.2%).

As for inflation and existence prices, price lists will build up import prices, which is able to lead to upper costs for customers. This would result in an build up in inflation, affected the acquisition of energy properties and scale back intake. Within the context of already prime inflation, it might additional go to pot the commercial state of affairs.

The firms that rely on imported inventories will face upper prices, which is able to scale back their benefit margins. This focuses on technological and client corporations that experience already observed important falls of their movements. Volatility in markets may just result in a discount in industry funding, affect long-wiring financial enlargement.

Unsure long term

American Common Price lists introduced numerous side effects in world monetary markets. As traders and firms adapt their expectancies – and that the development of the development – the instability will almost certainly proceed.

On this context, it will be significant that answerable for financial insurance policies (central banks and governments) are searching for some way of mitigating the have an effect on and inspire financial steadiness.

Given the scale of a damaging have an effect on on semi-world luggage and the uncertainty created within the world economic system, “the day of liberation” would quite name the demolition day.

If the wolf arrived!