Again to the longer term. The time shuttle is very important for figuring out the possible penalties of customs tasks, which used to be 2025. Years of recent Trump management. This is why we go back to the results of those that imposed throughout their first time period, 2018 and 2019 years.

2018. and 2019. Below the primary Trump management, customs had been influenced by means of the imports of sun panels, washing machines, metal, metal product, from many merchandise from China, India and Europe: scientific units, telephones, chemical compounds, textiles, olive oil.

With which benefits? In its statements, 2025. Donald Trump awarded a number of goals of customs tasks: Rebolling industry stability, reindastry within the nation and activity advent within the manufacturing sector. It emphasizes the rise in public earnings from the federal state, on the identical time emphasizing the want to sanction China as a result of its apply that is regarded as an unjust apply.

The president of america hopes to draw direct overseas investments (FDI), which might attempt to bypass the imposed tariff obstacles. This argument that jumps the tariff reminds that the corporate can determine subsidiaries in america to steer clear of prime customs price lists.

For Donald Trump, customs taxes are taxes on overseas exporters, to not its fellow voters. They aren’t legitimate on families and American corporations, which, due to this fact, must now not see the costs of products they purchase.

If bearing in mind the potential for business reprisals, reduces the results, for the reason that opposite numbers that america will workout more likely to beef up his weight in negotiations.

Let’s examine what used to be from those other targets underneath Trump 1 Management.

The prevalence of deficit

Let’s get started with the industry stability (Graph 1). The American deficit higher with $ 870 billion in 2018. at 1.173 billion in 2022. years, then 1,203 billion 2024. Years. If the imports skilled a slight decline in 2018, and specifically 2020-year-old Covvi-19-, then the expansion pattern persisted.

Graph 1. Business stability of america since 2015 to 2024. Years. American Global Business Fee

Exports recorded equivalent construction with a much less marked building up on the finish of the length. A number of the components that had been ready to play a job: evolution of greenbacks. Along with the decline in imports, the call for for foreign currency echange decreases – comparable to Chinese language Yuan, Indian Roupie or Euro -, which promotes the consideration of the buck. The more potent buck is an identical to dearer American merchandise for foreigners. End result: A decline in exports from the Uncle Sami nation.

No affect on native employment

Now to peer the affect of Trumpet 1 Customs on reindustrialization. Economists David Writer, Anne Beck, David Dorn and Gordon Hanson assessed the results of the 2018-2019 on the degree of zones (spaces the place they are living and paintings) and they’ve now not had the primary Trump management affect on the native degree.

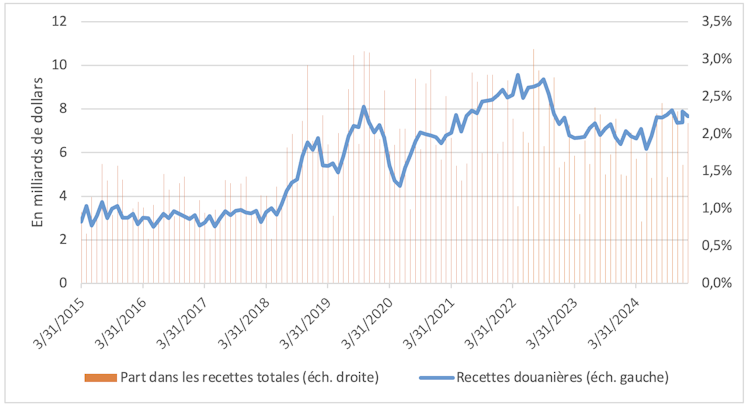

A low customs recipe

Graph 2. Customs revenues from the Federal State from 2015 to 2024. years. American fiscal knowledge

As for customs recipes, they higher smartly since Would possibly 2018. years, then in Would possibly 2019. (Graph 2). On the other hand, they constitute just a small a part of the Federal State revenues: about 1% in 2018 yr, 2% in 2019 years, a ways at the back of source of revenue from family source of revenue or receive advantages. Expanding customs revenues might be accomplished, however just for the cost of important distortions. We’ve got proven that the customs regulation that maximizes customs source of revenue could be tax of about 80% on imports of all merchandise from all international locations. It’s an identical to simply 800 billion greenbacks, or 15.3% of overall source of revenue from the federal state in 2024. Years.

Expanding inflation

As for inflation, the topic delicate to america, customs it will likely be sped up. How? Inland will increase within the inner that can almost certainly generate, each for families and for firms that purchase items wanted for his or her task. Empirical analyzes display that customs tasks are in worth of products imported by means of america in 2018-2019. Corporations immediately impact the upward push of those customs to their services. In different phrases, costs earlier than Customs have now not declined.

Monday to Friday + week, obtain analyzes and deciphers from our mavens totally free for some other view of the scoop. Subscribe lately!

The prices of those rights have utterly paid US families. Mari Amiti, Stephen J. Redding and David E. Weinstein concludes that Customs Trump 1 Management higher the common worth of produced items in america for 1 p.c level. FAJGELBAUM, Goldberg, Kennedy and Khandelval explorations conclude that this can be a whole passage. Lack of actual source of revenue for families and corporations that purchase imported merchandise amounted to $ 51 billion … or 0.27% of the American GDP.

Decreasing Chinese language imports, expanding Indian, Vietnamese and Mexican imports

As for Customs Customs, the a part of which is about according to Article 301 of the 1974 tariff stocks. Yr, they didn’t totally succeed in their objective. They had been created to sanction China after the American investigation of Chinese language Govt politics associated with generation transfers. In accordance to a couple observers, one more reason: to cut back habit from American price chains in terms of this nation.

If the lower in Chinese language exports in American imports of products diminished, evolution in price isn’t transparent. American imports from China higher from 2016. till 2016. till 2016. till 2016 and 20. and 2020. years, after which higher 2022 once more. Years. At that date, 536 billion greenbacks have reached once more and about 430-440 billion within the subsequent two years.

Alternatively, American imports obviously obviously higher between 2018. and 2024. From India – from 54 to 87 billion in Mexico – from 344 to 506 billion – and from Vietnam – from 49 to $ 137 billion. All the way through the length, China’s percentage in American imports thus fell from 21.5% to 13.4%, whilst cumulative that the opposite 3 international locations rose by means of 16.9% to 22.3%.

Circumvent

What’s a possible cause of those figures? Chinese language corporations may just set up factories in those international locations to make (or collect or handed there) merchandise historically produced in China, to accomplish them into america. This technique bypassing US Customs at the items from China.

Alfaro and Chor researchers discovered that Chinese language corporations have invested extra, particularly in Vietnam and Mexico. This second coincides with the taxation of america of discretionary customs on import from China. In addition they spotted the destructive connection between the diversities of China in American imports within the Sector and Vietnam, but additionally India Chinese language exports to america on the identical time in the similar sector in the similar sector of those 5 international locations in america.

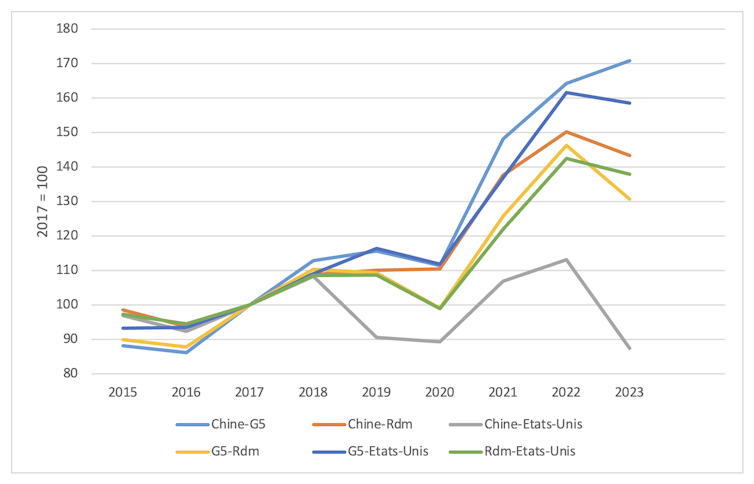

Graph 3. Export evolution in price since 2015 to 2023. Years. CEPII, which delivered writer

The position of the connector (G5) performed by means of India, Indonesia, Malaysia, Mexico and Vietnam will also be spotted from Graphics 3. Between 2018. and 2020. years, Chinese language exports in america necessarily fall into america, greater than the remainder of the sector in america. Chinese language exports in a gaggle of 5 Connection Nations (G5) develop impulsively, greater than the ones to the remainder of the sector. The full international exports from China used to be now not lowered after customs underneath the primary Trump management. By contrast, they higher by means of 32% between 2017 and 2021. years.

On the identical time, we follow the redistribution of Chinese language exports, particularly on connectors (G5). As for this ultimate, they considerably higher exports to america, 62% between 2017. and 2022. years, parallel, their exports in the remainder of the sector higher most effective by means of 46%.

Are america much less depending on China 2021. In comparison to 2017? Obviously, if we imagine an immediate connection, much less if oblique relationships are taken into consideration.

Trumpista citizens uncovered to customs

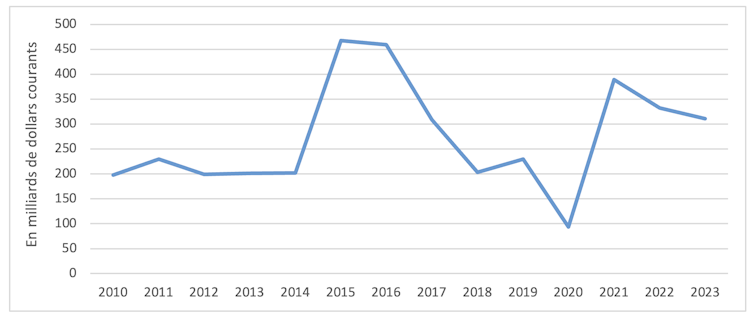

In any case, with regards to argument that leap to tariff and have an effect on of customs to overseas funding in america, no research attempted to measure it. Simplest flows (chart 4), in those overseas investments, there are somewhat dropful investments since 2016. yr, with the exception of 2021. years.

Graph 4. International direct funding in america since 2010 to 2023. years. Unctstatat

What we all know is that the prices of middleman items seem in investor choices. On this regard, tasks on metal and aluminum don’t play in want of setting up corporations that want those items in its manufacturing procedure.

An issue that would justify the verdict to ascertain customs: their recognition, particularly with the ones running in sectors the place those rights are imposed. The researchers of the Nationwide Bureau of Financial Analysis (NBER) indicate that the population of the areas that had been maximum uncovered to Customs are much more likely to vote for the repository of Donald Trump in 2020. Years.

The argument that he had now not made the latter in his statements to justify his “Pricemania”, however which can have been measured.