The African Credit score Company (AFCRA), carried via the African Union, has change into in 2025. The primary African monetary score company. A substitute for massive establishments reminiscent of usual and deficient, temper and Fitch?

Yr 2025 marks a milestone for African budget, with the predicted release of the African African Ranking Company (AFCRA), carried via the African Union. Deliberate in the second one part, this continental evaluation company objectives to supply tailored mortgage analyzes, harmonized to the industrial truth of the continent.

Credit standing is an evaluation of the capability of the transmitter – whether or not this is a corporate, a monetary establishment or state – to make amends for its money owed. It is a helpful decision-making device at the partial a part of capital providers. It’s an an identical mortgage passport introduced via the potential of get admission to to international capital. Within the context of the globalized financial system, this enlargement of get admission to to the marketplace is maximum regularly accompanied via decreasing financing prices, particularly in prefer of transmitters benefited via top rankings.

Alternatively, the talk stays alive. For years, Moody Global Companies, Same old & Deficient’s (S & P) or Fitch, which immediately have an effect on the prices of borrowing from the African nations, had been within the center of controversy. Whilst the continent seeks to draw extra traders, the query is needed: are those estimates designed to 1000’s of kilometers actually tailored to the original demanding situations and property of Africa?

International credit score uncommon oligopolis

Within the Nineties, the African monetary panorama marked a putting asymmetry: most effective South Africa is a Sovereign Notation athlete. Fifteen years later, in 2006. years, nearly part of 55 nations at the continent – 28 nations – remained invisible at the score map businesses. If the remaining critiques are as easy reviews, their affect is tangible: their notes immediately have an effect on funding selections and rates of interest that observe to African nations.

Six African nations challenged the degradation in their monetary word to international score businesses. Live performance

Their oligopolist domination raises complaint. Evalues that are supposed to cut back the asymmetry of knowledge between traders and nations, is regarded as too generic. Many African professionals and leaders criticize the methodologies of score thought to be irrelevant, as a result of they try to grasp the specifics of native economies. She targeted strongly on quantitative information, every so often biased, don’t all the time make justice to African realities. The loss of dependable native information complements this border, leaving themselves for better subjectivity and reviews carried out via professionals regularly a ways from the regional context.

Monday to Friday + week, obtain analyzes and deciphers from our professionals totally free for every other view of the scoop. Subscribe lately!

African chance top rate

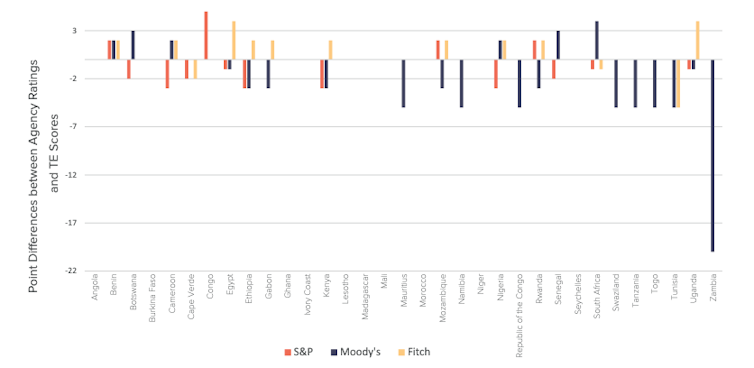

At the continent, frustration grows: that the “African risk of premium” is. It’s over the top, imposed via a score that is regarded as too severe, it will now not mirror financial and structural growth. The find out about of the United International locations Construction Program (UNDP) estimates that this overestimation of dangers will lead to further prices of a number of billion bucks a yr for African nations.

In line with this record, the underestimation of Sovereign Ratinges (S & P, Moody’s, Fitch) generates the yearly prices of $ 74.5 billion for home money owed, 30.9 billion neglected monetary functions for those money owed and 28.3 billion Euroobdi – bonds or claims from its period 28.3 billions of Euro-convenience.

Variation between 3 primary evaluation businesses and the result of the financial system buying and selling platform. UNDP

Critics refer to 2 sides:

Quantitative bias: Standardized fashions don’t all the time mirror native realities, particularly the affect of casual economies. They underestimate the elemental position of the diaspora within the financing of states. In line with 2024, in keeping with the International Financial institution record, Africans residing in a foreign country despatched $ 100 billion on a continent, an identical to six% of African GDP.

Qualitative gaps: Loss of contextual information ends up in subjective tests. In 2023. yr, Ghana rejected his notation of Fitchea, calling it “excluded from current reforms”. A couple of African nations have publicly rejected the grades they had been assigned to them within the remaining ten years.

L’Rentirating: Africa Africa Credit score Ranking (AFCRA)

Confronted with those borders, the solution used to be made in Africa: Developing African Africa (AFCRA) Company (AFCRA), Africans who concept Africans, Africans. They create an African Union, this initiative objectives to jot down the foundations of the sport.

The theory is to construct a community for research that follows the truth of the continent, its demanding situations, but in addition its regularly invisible property. Within the center of the undertaking: clear strategies, which can be negated via native information and customized signs. The tailor signs can contain the analysis of herbal assets, making an allowance for the casual sector and life like dangers of chance, and don’t understand. The objective is to get extra whole notices due to this contextual sensitivity.

Data asymmetry

The Company’s score historically represented as key actresses to mitigate imbalances within the markets. Their promise is to light up traders via assessing credit score dangers, enabling higher knowledgeable selections. This legitimacy, got for many years, is in keeping with a double pillar: consistent innovation of their research strategies and recognition Having their historic have an effect on on markets.

The anomaly nonetheless exists. The dominant financial type – the place issuers finance their score that suspects of suspicions of conflicts of hobby.

Our analysis enrolls this pressure to inspecting the evolution of the Company’s score sector, the theoretical basis of its lifestyles and chance related to the focus of presidency between a number of actors.

Remark exits, opacity of methodological standards and technicality of fashions used and nurtured each leisure as marketplace habit. The businesses are in keeping with quantitative signs – GDP, public debt, inflation – and qualitative – political chance, executive transparency -, whose weight varies, resulting in every so often inconsistent tests. As a way to fortify their credibility, it is vital to make a request: make it invisible legible, via clarifying the analysis procedure with out sacrificing their important complexity.

Methologies Ia and ESG

Fresh analysis explores the opportunity of synthetic intelligence methodologies (AI) and automated finding out to combine the criteria of the ESG (environmental, social and control) in chance evaluation. Those growth objectives to surpass the borders of conventional fashions via taking pictures the complexity between the ESG indicator and monetary dangers, with the purpose of strengthening the accuracy and reliability of chance evaluation for the promotion of the protrunction and sustainable capital distribution.

For Africa and Afcra, those approaches would emphasize the underestimated belongings, such because the resistance of the casual sector or positive institutional specifics. They might additionally permit them to higher perceive the advanced connections between the ESG standards and the monetary chance particular to the continent. The objective of AFCRA could be to create extra actual and custom designed estimates, decreasing the “African risk of premium”.

The growth in regional businesses is important growth in opposition to a extra balanced machine. As a way to be triumphant, the African governments will have to coordinate their efforts, give a boost to native tasks and identify a optimistic discussion with global businesses. Africa is taken in opposition to higher monetary sovereignty. Will Afcra be capable to take the problem?