Actual Madrid’s Board of Administrators offered the accounts for the 2024/2025 season to its consultant companions on Sunday, November 23, all the way through the Atypical Normal Meeting.

Final season, the white membership accomplished a report turnover due to the brand new Santiago Bernabeu stadium. Then again, the accounts additionally display the rising monetary possibility the membership is taking by means of achieving remarkable monetary debt.

Essentially the most convincing knowledge is the quantity of source of revenue. The turnover of the membership amounted to just about 1.2 billion euros, consolidating the expansion of latest years. This expansion is in part defined by means of the truth that the reconstruction of the stadium from the 2024/2025 season was once the primary during which it was once absolutely practical after the works.

Managed group of workers prices

Spending on group of workers is beneath 50% of earnings (44%), whilst 4 seasons in the past it was once 73%. This stage is easily beneath the utmost threshold of 70% imposed by means of UEFA and LaLiga financial regulate laws.

Source of revenue and expenditure of body of workers. Progressed advantages

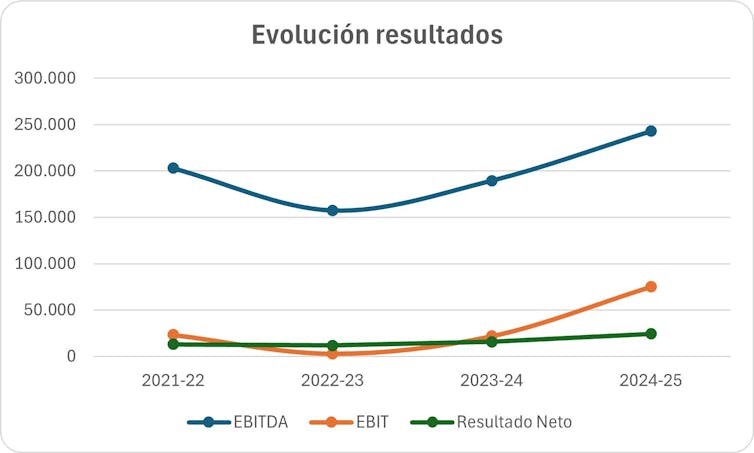

The great evolution of source of revenue and bills led the membership to reach a gross running benefit (EBITDA) of greater than 240 million euros and a internet running benefit of 75 million euros. This is a rise of virtually 250 p.c in comparison to the former yr, when it amounted to 21 million euros.

Gross running benefit mainly displays the preliminary capability an organization has to generate money via its actions. EBITDA is what a membership is left with after deducting direct and oblique prices (akin to wages, products and services, repairs, kits, workplace provides, and many others.) from all its source of revenue (from tv rights, price ticket gross sales, business source of revenue and stadium control), however prior to paying taxes, pastime on debt, depreciation and amortization.

Those effects display how the sure impact of the actions on the new Bernabeu is being felt, although it’s nonetheless no longer operating at complete capability.

Effects. Debt: a large possibility at some point

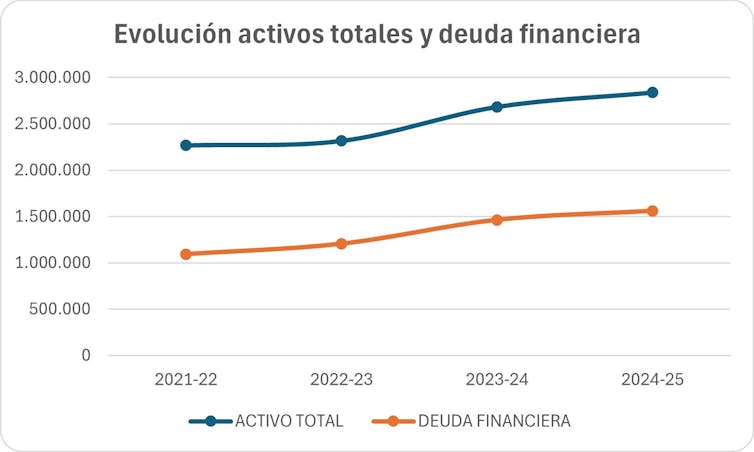

Madrid has a debt of virtually 1.6 billion euros to renovate its stadium. This, in conjunction with different quantities pending cost, raised the membership’s overall debt above €2.2 billion, similar to just about 80% of its overall property.

On the similar time, it has a complete of 542 million euros in receivables (cash owed to it by means of exterior entities for credit score gross sales of goods or products and services, akin to quantities due for assortment for broadcasting rights, sponsorships or participant transfers) and within the treasury (liquidity it must tackle its per month bills, taxes, invoices, pastime, and many others.).

The pastime larger to 44 million euros. This build up was once predictable as a result of, when the principle works at the stadium have been finished, the membership stopped capitalizing the pastime (at the accounts proven all the way through the works, it didn’t report it as an expense, however added it to the full value of the brand new stadium) and started to report in its accounting the price of pastime at the debt and depreciation of the stadium (reflecting the depreciation of four/222 classes of its price).

Overall property and monetary debt.

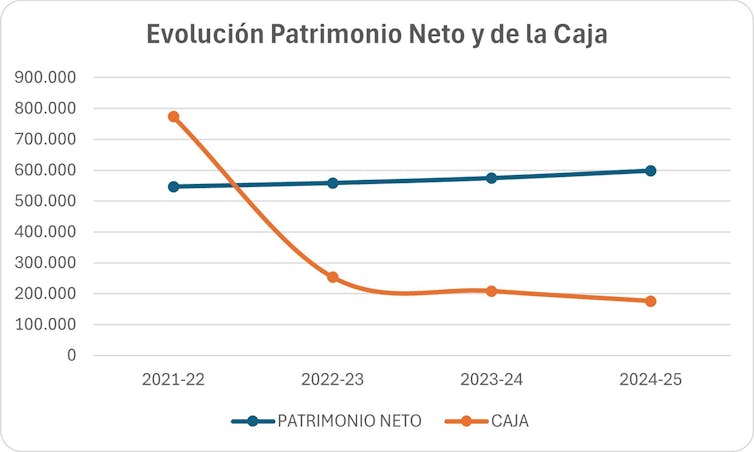

After deducting monetary bills and taxes, the membership ended the season with a internet benefit of €24 million, doubling the benefit it made 4 seasons in the past. This consequence allowed the membership to extend its internet value to just about 600 million euros.

Then again, operating capital (a monetary indicator that displays the facility of an organization to fulfill its repayments and temporary duties) and treasury were decreased on account of the truth that in earlier seasons the membership had liquidity of loans nonetheless unused to pay for works.

Operating capital is unfavorable by means of nearly 360 million euros, and money in hand has diminished to 176 million euros as of June 30, 2025.

Web value and money. Profitability and debt

To finish the research of those annual accounts, it is crucial to give an explanation for some coefficients used to inspect the corporate:

Actual Madrid’s monetary debt over gross running consequence (debt/EBITDA) reaches 6.4 instances. Even though prime, it was once decreased from 7.7 instances the former season. This ratio measures the membership’s skill to pay its debt and this determine means that it will want all the gross benefit of the trade for 6 years to repay mentioned debt.

Go back on gross sales (ROS) rose to six.5%, nearly double what it was once 4 seasons in the past. ROS measures what proportion of gross sales earnings is transformed into benefit and displays your potency in producing benefit from your process. Because of this this season Actual Madrid controlled to reach a internet running consequence (prior to pastime and taxes, as we noticed previous) of 6.5 euros for each 100 euros of gross sales.

Monetary profitability (ROE) larger to 4%, however continues to be beneath that of the 2021/2022 season. ROE, which measures the profitability received with shareholders’ cash, is calculated by means of dividing internet benefit by means of shareholders’ fairness (shareholders’ fairness, reserves and retained profits). This indicator displays how a lot benefit the membership makes for each euro invested by means of participants and lets in us to evaluate whether or not the entity is the usage of the ones assets neatly.

In combination, those signs display that the primary complete yr of the brand new Bernabeu has allowed Actual Madrid to recoup, no less than partially, the chance it took with the debt vital to finance the operation. Robust earnings expansion and price regulate stepped forward the membership’s profitability. Now the problem is to take care of this development with a purpose to be certain financial steadiness within the coming seasons, in an an increasing number of tough aggressive context.

Finances and long term technique

For the 2025/2026 season, the membership deliberate an source of revenue of on the subject of 1.25 billion euros and a internet benefit of 10 million euros (14 million not up to in 2024/2025). This aid is, amongst different expenditure diversifications, a result of an build up in monetary expenditure to just about EUR 50 million.

Actual Madrid’s technique comes to financing its accounts with long-term debt, believing that the operational expansion of the brand new Bernabeu will permit this financing style to be sustained.

Actual Madrid plans to proceed to make use of new companies within the stadium (live shows and track gala’s, particular occasions akin to the hot NFL sport, and many others.) that don’t seem to be but at complete capability.

Of the standards to believe

Actual Madrid opted for a technique according to an formidable funding plan financed by means of long-term debt, with the conclusion that the operational expansion of the brand new Bernabeu will maintain this expansion style.

Alternatively, the context of Ecu soccer is an increasing number of tough. As an example, the Premier League doubles the source of revenue of LaLiga, and its large golf equipment have further monetary give a boost to from global traders.

Those two problems elevate a key query: will the present plan be sufficient to take care of Madrid’s carrying and financial management, or will it must discover new techniques of investment that might turn out to be its personal construction?