Within the run-up to the 2024 election, long run high minister Keir Starmer labelled wealth advent Labour’s primary challenge. “It’s the only way our country can go forward,” he declared. “We should nourish and encourage that – not just individuals but businesses.”

Starmer was once proper, in idea. However wealth advent is a slippery idea. Crucial for financial and social growth, it may possibly additionally paintings towards each. It’s subsequently important to differentiate between “good” and “bad” wealth.

In keeping with one definition, will increase in “good” wealth come from innovation, funding and extra productive industry strategies. Such task boosts financial resilience, social energy and the dimensions of the industrial cake.

Examples come with funding in clinical and medical generation – but additionally, crucially, within the actions that offer important on a regular basis products and services and items to maintain our day by day lives. Enhancements within the high quality of native retail outlets, shipping, products and services for kids, grownup care and respectable hospitality all amplify a rustic’s sources in ways in which see the good points shared extensively throughout society.

Alternatively, over the last half-century, a emerging percentage of monetary task in the United Kingdom and different wealthy international locations has been attached with “bad” wealth accumulation, which actively hampers and harms a rustic’s possibilities.

The Dialog and LSE’s World Inequalities Institute have teamed up for a different on-line match on Tuesday, November 18 from 5pm-6.30pm. Sign up for mavens from the worlds of industrial, taxation and executive coverage as they speak about the tough alternatives going through Chancellor Rachel Reeves in her price range. Join unfastened right here

Unhealthy wealth is particularly related to non-productive or low social-value actions geared to private enrichment. In Britain and in different places, a long time of privatisation and wider tax, receive advantages and fiscal financial insurance policies have

fuelled emerging inequality whilst handing a lot of the command over sources to company boardrooms, most sensible bankers and the very wealthy – with harmful results for societies and economies alike.

A central supply of unhealthy wealth has been a upward push within the degree of monetary “extraction” or “appropriation”. This happens when capital house owners use their energy to seize over the top stocks of monetary good points via task which weakens financial energy and social resilience. Examples come with the rigging of monetary markets and manipulation of company steadiness sheets, a spread of anti-competitive gadgets corresponding to the upward push in competitive acquisitions and mergers, and the skimming of returns from monetary transactions – a procedure Town of London buyers like to name “the croupier’s take”.

Unhealthy wealth may be the made from passive task unrelated to benefit, ability or prescient risk-taking. Over half of of the rise in family wealth in the United Kingdom since 2010 has come from emerging asset costs – specifically in terms of estate – moderately than from extra productive task. This implies an enormous quantity of that wealth is trapped in estate and different property which don’t seem to be to be had for reinvestment within the financial system.

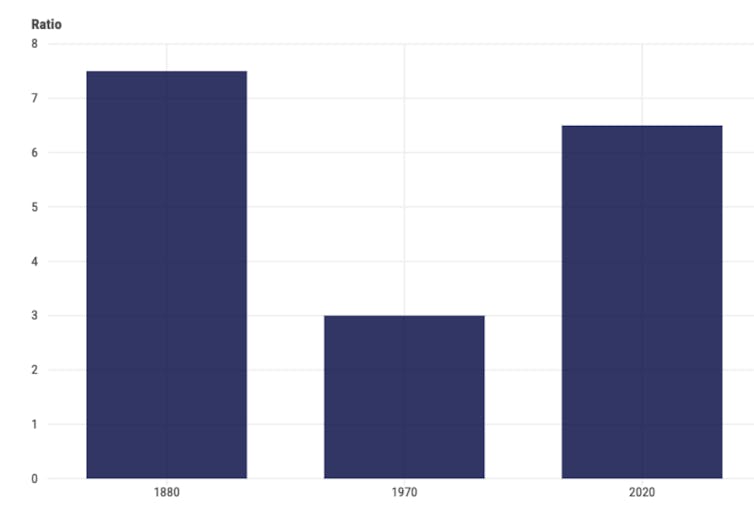

Britain’s financial file because the 2008 monetary disaster has been dismal, with a cave in within the charge of monetary expansion amid a lot hand-wringing about its “productivity puzzle”. But over the similar length, personal wealth holdings have surged. In general, UK wealth – comprising estate, bodily and fiscal property – is now greater than six occasions the dimensions of the rustic’s financial system, up from 3 times within the Nineteen Seventies. Different wealthy international locations have observed identical developments.

UK wealth compared to measurement of its financial system:

UK wealth as a ratio of GDP, 1880-2020.

International Inequality Record 2022, CC BY-NC-SA

This surge in ranges of private wealth isn’t the made from extra dynamic and cutting edge economies and file charges of funding. As a piece of writing in UK monetary funding mag MoneyWeek argued in 2019, an excessive amount of private wealth is the results of “mismanaged monetary policy, politically unacceptable rent-seeking, corruption, asset bubbles, a failure of anti-trust laws, or some miserable mixture of the lot”.

It’s those actions which account for the burgeoning financial institution accounts of the already super-rich. All over the world, from the mid-Nineteen Nineties to 2021, the highest 1% of wealth holders captured 38% of the expansion in private wealth, whilst the ground 50% gained simply 2%. In the United Kingdom, the typical wealth of the richest 200 other folks grew from 6,000 occasions the typical particular person in 1989 to 18,000 occasions in 2023.

One of the crucial vital results of the upward push of unhealthy accumulation, and the related surge within the focus of private wealth, has been the way in which opulence and many take a seat beside social shortage and rising impoverishment. It has introduced a vital shift in how nationwide sources are used – clear of assembly fundamental must serving the calls for of company elites, a rising billionaire magnificence, and personal markets.

“The test of our progress is not whether we add more to the abundance of those who have much,” declared US president Franklin D. Roosevelt all the way through his 2nd inaugural deal with in January 1937. “It is whether we provide enough for those who have too little.”

Via maximum metrics, Britain and lots of different rich international locations are failing that take a look at.

The second one inauguration of Franklin D. Roosevelt as US president in January 1937.

Smithsonian Establishment/Nationwide Portrait Gallery by means of Wikimedia, CC BY

‘Money is like muck’

A key reason behind Britain’s low personal funding, low productiveness and sluggish rising financial system is the disproportionate percentage of the emerging benefit ranges of Britain’s largest firms that has long past in bills to shareholders and bosses lately. Dividend bills in the United Kingdom and globally have a great deal outstripped salary rises during the last 40 years. In 2020, mixture dividend payouts by means of the FTSE 350 firms made up some 90% of pre-tax income.

Continuously, those heightened dividend bills were financed via borrowing, thus undermining company energy. In terms of Thames Water – stripped of a lot of its price by means of an competitive benefit technique by means of its out of the country house owners – this has introduced near-bankruptcy.

In the meantime, a long way from the promise of a property-owning society, huge sections of the United Kingdom inhabitants have – out of doors of pension provision – no, or just a minimum, stake in the way in which the financial system works. The ones with few property lose out from emerging estate costs and better rates of interest on financial savings.

How a country’s productive sources – land, labour and uncooked fabrics plus bodily, social and highbrow infrastructure – are owned and used is vital to its productive energy, social steadiness, and distribution of existence possibilities. “Money is like muck – not good except it be spread,” wrote the English thinker and statesman Francis 1st Baron Beaverbrook in 1625.

In the United Kingdom, the extra egalitarian politics after the second one global battle ended in a extra equivalent sharing of personal wealth, and a miles upper degree of public possession of key utilities and land. Then in 1979, newly elected high minister Margaret Thatcher introduced her power for a “property owning democracy”. The providence good points from council space gross sales and the promoting of cut-price stocks in her nice privatisation bonanza to begin with benefited many strange other folks.

However lately, the steadiness sheet seems markedly other. Whilst the sale of council properties to begin with boosted ranges of house possession in the United Kingdom, the collection of first-time house consumers is now lower than half of its mid-Nineteen Nineties charge. Because of this, the speed of house possession has shriveled from a height of 71% in 2000 to 65% in 2024, with essentially the most marked decline amongst the ones elderly 25-34.

Getting at the housing ladder is now closely depending on having wealthy oldsters. The percentage of younger other folks elderly 18-34 residing with their oldsters reached 28% in 2024 – a vital upward push because the millennium.

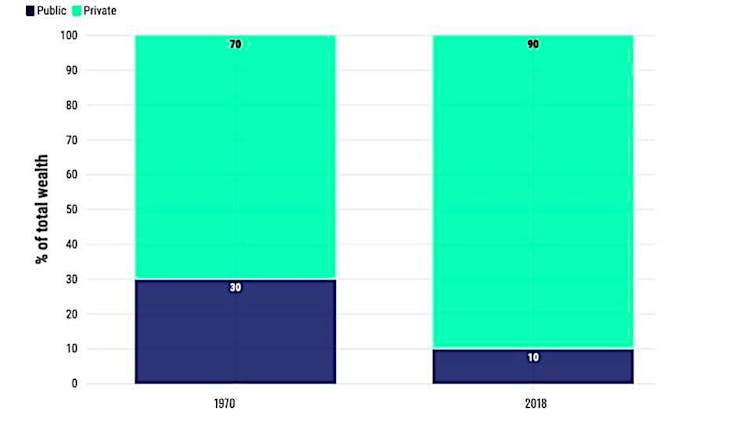

On the identical time, lately’s a lot more closely privatised financial system has eroded Britain’s holdings of commonplace wealth. Publicly owned property as a percentage of GDP have fallen from round 30% within the Nineteen Seventies to a couple of 10th. This is without doubt one of the predominant reasons of the deterioration in the United Kingdom’s public price range, whilst handing extra regulate over the financial system to non-public corporate house owners.

How public possession of UK property has shriveled:

Share of UK property held publicly and privately, 1970 vs 2018.

Paying for a Decade of Nationwide Renewal (Compass), CC BY-NC-SA

Six tactics to show unhealthy wealth into excellent

The French economist Thomas Piketty has argued that lately’s type of company capitalism has a herbal, built in tendency to generate ever-growing ranges of inequality – “a fundamental force for divergence”, as he termed it.

When the go back on capital from dividends, pastime, rents and capital good points exceeds the whole expansion charge, asset holders gather wealth at a quicker charge than that at which the financial system expands, thereby securing an ever-greater slice of the pie – and leaving much less and no more for everybody else.

In his 2014 e book, Capital within the Twenty-First Century, Piketty presented an necessarily pessimistic conclusion that breaking this inequality cycle has simplest came about throughout historical past via battle or severe social warfare. In keeping with critics, he changed this place and now turns out to simply accept that there are democratic mechanisms for turning in extra equivalent societies – regardless of the undoubted hurdles of implementation.

Suppressing the profiteering and over the top returns that experience pushed upper ranges of inequality is without doubt one of the largest demanding situations of our time. However such an alignment of expansion and charges of go back on capital was once widely completed within the post-war generation, and there are a number of routes for attaining such convergence once more – even in lately’s very other stipulations.

1. Shift the tax center of attention from source of revenue to wealth

Regardless of the size of lately’s wealth increase, Britain’s tax gadget remains to be closely biased to income. Source of revenue from paintings is taxed at a mean of round 33% and wealth at lower than 4%. Via political inertia, the United Kingdom tax gadget has did not meet up with the rising significance of wealth over source of revenue in the way in which the financial system operates, and does little to dent the rising focus of wealth holdings on the most sensible.

In her first price range in October 2024, the chancellor, Rachel Reeves, took steps to boost income via adjustments to inheritance and capital good points tax (the income made on promoting stocks or estate instead of your own home). However those have been too modest to change the imbalance within the taxation of wealth and income.

Chancellor Rachel Reeves delivers her first price range in October 2024.

Kirsty O’Connor/HM Treasury by means of Wikimedia

A extra elementary shift could be to reform the present gadget of council tax with a bigger collection of tax bands on the most sensible. Nonetheless according to 1991 estate values, that is possibly the least defensible tax in Britain. Families in poorer spaces pay greater than families within the richest.

In Burnley, the everyday family can pay some 1.1% of the worth in their house in council tax yearly. In a regular estate in Kensington and Chelsea, it’s 0.1%. One of the best selection could be to switch council tax and stamp accountability – the tax at the acquire of houses – with a unmarried revolutionary or proportionate “property tax”. Any severe reform calls for a protracted late estate revaluation and an extension within the collection of tax bands.

A modest and phased upward push in capital taxation would additionally assist to get a divorce lately’s wealth concentrations and cut back the passive – and steadily malign – function performed by means of wealth holdings. Even small adjustments would liberate budget which might be used to reinforce social infrastructure from colleges to hospitals.

One such trade, as really helpful by means of the Place of job for Tax Simplification, will have to be to boost the charges on capital good points tax in order that they’re equivalent to source of revenue tax charges. In 2024, 378,000 other folks paid UK capital good points tax value a complete of £12.1 billion – a lower of nineteen% at the earlier 12 months.

Measures to restrict asset inflation may just come with extending the Financial institution of England’s remit on inflation to restrict rises in estate costs, that have ended in traditionally top rents and priced a emerging percentage of younger other folks out of house possession.

2. Cut back how a lot wealth will get handed on

“A power to dispose of estates forever is manifestly absurd,” the Scottish economist Adam Smith declared 250 years in the past. “The Earth and the fulness of it belongs to every generation, and the preceding one can have no right to bind it up from posterity. Such extension of property is quite unnatural.”

Economist Adam Smith (1723-1790).

Wikimedia

Regardless of Smith’s exhortations, beginning and inheritance stay essentially the most tough signs throughout maximum international locations of the place you find yourself within the wealth stakes and the trend of existence possibilities.

Importantly, inheritance does little to spice up productive task. Upper ratios of inheritance in wealth holdings – and up to date a long time have observed an upward shift – have a tendency to be related to diminished financial dynamism. Property tied up in huge wealth swimming pools are steadily little greater than “dead money”: idle sources that may be put to make use of investment public products and services or productive funding.

But, helped by means of mild taxation, social privileges proceed to be passed on in perpetuity. Simplest 4.6% of deaths in the United Kingdom ended in an inheritance tax fee within the 2023 monetary 12 months, contributing a tiny 0.7% of all tax receipts.

Round 36% of all wealth is saved in estate, and there’s a robust public attachment to other folks keeping their inherited housing wealth – even amongst those that don’t seem to be beneficiaries. Partially, inheritance tax is extensively perceived as unfair as a result of the way in which the richest are in a position to keep away from it.

Of other folks born in the United Kingdom within the Eighties, the ones within the poorest 5th by means of wealth will revel in a mean 5% spice up to their lifetime source of revenue via inheritance, when put next with 29% for the highest 5th. Obviously, the ones at the incorrect facet of this hole can be left even additional in the back of by means of the tip in their lives.

And the divide is widening sharply. The size of intergenerational wealth switch is on a steeply upward pattern, with projected ranges of inheritance set to dwarf all earlier wealth transfers within the coming decade. Little of this procedure contributes to extra productive task, with one in all its number one and malign results being to gas upper space costs.

3. Introduce a ‘whole wealth’ tax

Any other much-debated possibility could be to levy a brand new tax on complete wealth holdings, moderately than simply the income those property generate. An annual 1% tax on wealth over £2 million – affecting some 600,000 other folks in the United Kingdom – may just elevate round £16 billion a 12 months, in step with the 2020 Wealth Tax Fee record.

Such taxes could be more straightforward to levy on motionless property like constructions and land taxes than on liquid property, corresponding to monetary holdings. However this complexity isn’t insurmountable – and neither is public opinion. The sort of measure might be offered politically as a “solidarity tax” to assist pay for key under-resourced however top social-value products and services – corresponding to a correct social care gadget and progressed products and services for kids.

Whilst many governments were cautious of the political response to raised taxes on wealth, YouGov’s most up-to-date survey suggests round three-quarters of the general public now strengthen one of these tax, with greater than half of strongly supporting it.

The Inequality Disaster – a chat by means of the object’s writer, Stewart Lansley, in March 2013. Video: RSA.

4. Building up public possession of utilities and products and services

Tackling inequality and profiteering additionally require a better degree of commonplace and social possession. Britain is a closely privatised and marketised financial system. Few different advanced international locations have passed over such regulate of key utilities to non-public companies.

Privatised in 1989, Britain’s water trade has been became a potent instance of profiteering. Below personal possession, it has delivered leaky and unrepaired pipes, the unlawful dumping of sewage spills into rivers and seashores, and twenty years of under-investment largely as a result of the disproportionate percentage of income stepping into dividend bills to most commonly out of the country house owners.

Any other vital pattern has been the non-public takeover of a spread of public products and services – from social care to kids’s products and services. In keeping with the Festival and Markets Authority (CMA), the United Kingdom has “sleepwalked” right into a dysfunctional gadget with in style profiteering in privately run kids’s properties. It discovered working benefit margins averaging 22.6% from 2016-20, pushed by means of escalating fees and cost-cutting.

Those examples of unhealthy accumulation have hollowed out probably the most UK’s maximum important industries. A mixture of public and social possession and a lot more efficient law are essential to show those industries into efficient carrier suppliers moderately than money machines for traders.

Regulatory reforms also are had to average the way in which some markets paintings. The CMA means that anti-competitive behaviour and “oligopolistic structures” are hallmarks of a emerging quantity of industrial task. For instance, it has accused the United Kingdom’s seven biggest housebuilders of collusion on problems from pricing to advertising and marketing.

Worth gouging – when companies exploit emergencies such because the COVID pandemic and Russia’s invasion of Ukraine to fee excessively top costs for crucial items – is any other space ripe for harder intervention.

5. Determine voters’ wealth budget

Along larger social possession, all voters want to be given a extra direct stake within the good points from financial task. As one heckler put it all the way through the Brexit referendum: “That’s your bloody GDP, not ours.”

One path could be to construct fashions of “people’s capital” via a brand new process of asset redistribution to people. This may lengthen the primary of source of revenue redistribution that has been probably the most primary, if now a lot weakened, pro-equality tools of the post-war generation. A medium to long-term plan could be to create a number of nationwide and native “citizens’ wealth funds”, owned jointly by means of all on an equivalent foundation.

At the beginning complicated by means of the British economist and Nobel laureate James Meade, such budget could be created by means of the state however owned by means of society, with returns dispensed both as common dividends or as funding in public products and services. The sort of fund might be financed from a mixture of resources together with long-term executive bonds; the switch of a number of extremely business state-owned enterprises, such because the Land Registry, Ordnance Survey or Crown Property; a part of the proceeds from upper wealth taxes; and new fairness stakes in huge firms.

Anchorage, capital of the United States state of Alaska, which operates an enduring fund for its voters.

TripWalkers/Shutterstock

Possibly essentially the most notable instance of citizen-owned capital is the Alaska Everlasting Fund. This was once created in 1976 from oil revenues and successfully owned by means of the entire US state’s voters. It has since paid out a extremely widespread annual dividend which averages about US$1,150 (£875) a 12 months.

The United Kingdom has its personal instance: additionally in 1976, the Shetland Islands Council established a charitable believe from “disturbance payments” paid by means of oil firms in go back for operational get right of entry to to the seas across the islands. The returns from this believe were used to fund social initiatives, from recreational centres to strengthen for the aged.

Any other risk is to determine a countrywide pension fund that might in the end pay for the price of state pensions. Australia’s Long term Fund, as an example, is an independently controlled sovereign wealth fund to fulfill long run civil carrier pension tasks. Established in 2006 by means of receipts of AUS$50 billion (£20 billion) from the sale of Telstra, the nationwide telecoms corporate, it has since been supplemented by means of direct executive grants and is projected to achieve a price of AUS$380 billion by means of 2033.

The United Kingdom executive has introduced the Group Wealth Fund, a £175 million initiative aiming to “transform neighbourhoods with long-term financing”. Operating with native communities the initiative will fund initiatives in native communities throughout England. Regardless of its modest price range, this establishes the primary of jointly owned social budget. That is funded via the federal government’s Dormant Property Scheme, which unlocks outdated financial institution accounts and different monetary merchandise which were left untouched.

6. Unfold get right of entry to to the country’s property throughout society

Any significant redistribution of wealth throughout society calls for a set of deep structural reforms from bettering get right of entry to to reasonably priced housing to lowering ranges of company extraction.

One of the crucial vital problems is discovering tactics of extending get right of entry to to property to all voters as a situation of democratic alternative. The Kid Accept as true with Fund, presented by means of New Labour in 2005, was once an formidable try to deal with wealth inequality by means of giving each and every kid a modest monetary stake – a type of citizen’s inheritance. But the scheme was once abolished in 2010 by means of the incoming coalition executive.

Within the match, it simplest completed a modest affect. Reasonable payouts when kids reached 18 have been round £2,000, with 1 / 4 of all accounts being forgotten or misplaced. The required shift in family saving conduct tended to be restricted to extra prosperous oldsters paying additional into the believe budget, that means the coverage strengthened probably the most inequalities it had aimed to problem.

Chancellor Alistair Darling hosts a kids’s birthday celebration at No.11 Downing Boulevard to mark the primary Kid Accept as true with Fund bills in September 2009.

Lewis Whyld/PA Photographs/Alamy

Daring selections required

Whilst contemporary years have observed a rising debate in regards to the affect of ever upper concentrations of wealth in the United Kingdom, few proposals for actual trade – past a trifling tampering on the edges of inheritance and capital good points tax – are but at the political schedule. A few of these measures would take longer to succeed in, and a few, corresponding to voters’ wealth budget, are extra formidable and doubtlessly transformative than others. All will require daring selections by means of executive.

Within the run-up to her much-anticipated November 26 price range, the chancellor has hinted that upper taxes at the rich can be “part of the story” – even supposing a manifesto-busting upward push within the base charge of source of revenue tax may be at the playing cards.

By contrast, Reeves has dominated out a standalone wealth tax, and there seem to be no plans for extra radical measures to rein in over the top profiteering. Which means that the wealth hole is almost definitely set to widen.

But historical past suggests the theory of restricting top concentrations of wealth is a long way from utopian. Limits operated fairly successfully amongst international locations together with the United Kingdom and US within the post-war a long time, via a mix of law, extremely revolutionary taxation and adjustments in cultural norms.

The perfect private fortunes have been extra modest partially as a result of the damaging impact of battle at the measurement of asset holdings. There was once additionally a brand new social and cultural local weather that do not need tolerated lately’s towering fortunes, and which allowed the post-war revolutionary tax programs to be maintained for many years.

Restructuring the method of wealth accumulation isn’t going to be simple politically. The protests over the adjustment to inheritance tax in 2024, specifically its affect on farmers, demonstrates how delicate those problems are – in particular when stoked by means of the ones in the hunt for to make political capital out of pro-equality reforms.

However Britain stands at a ancient second. Failure to take on mounting wealth-driven inequality can have damaging penalties for the social and financial steadiness of generations to come back. Amid emerging public nervousness in regards to the long run and a in style sense that the financial system is “rigged” towards strange other folks, a extra formidable political schedule that addresses inequality and financial stagnation may just win public backing, if any executive is courageous sufficient to check out.

The Dialog and LSE’s World Inequalities Institute have teamed up for a different on-line match on Tuesday, November 18 from 5pm-6.30pm. Sign up for mavens from the worlds of industrial, taxation and executive coverage as they speak about the tough alternatives going through Chancellor Rachel Reeves in her price range. Join unfastened right here

For you: extra from our Insights collection: