When the entire, unexpurgated diaries of the Conservative MP Sir Henry “Chips” Channon have been revealed in 2021, those disarmingly frank accounts of his aristocratic existence in mid-Twentieth century Britain led to a stir. They published the interior ideas of a famend social climber and rightwing snob, whose political profession by no means recovered from his document as an appeaser of Nazi Germany.

Having married into the Guinness circle of relatives fortune, Channon revelled within the booty of landed wealth: the joys at buying a rustic area, Kelvedon Corridor in Essex; the glitter of lower glass within the lavish dinner events he hosted; extravagant bejewelled items for his many fanatics; the whirl of high-priced Ecu vacations and chauffeur-driven vehicles. One diary access describes Channon and buddies partying with Nazi leaders together with Hermann Göring whilst in Berlin for the 1936 Olympics.

However there may be an intriguing counterpoint to his bare love of wealth. All the way through the later Nineteen Thirties underneath a Conservative-led coalition executive, taxes started to upward thrust to pay for Britain’s rearmament in preparation for struggle. Writing about then-chancellor Sir John Simon’s “staggering” first struggle price range overdue in 1939, Channon recalled:

There was once a pant when he mentioned that source of revenue tax can be 7/6 [37.5p] within the £. The crowded Space [of Commons] was once dumbfounded … Higher surtax, decrease allowances, raised tasks on wine, cigarettes and sugar, considerably higher dying tasks. It’s all so dangerous that one can handiest make the most efficient of it, and reorganise one’s existence accordingly.

This and next tax will increase had a large impact on Channon’s lavish way of life. All the way through the second one global struggle, his Kelvedon property was once repurposed as an army sanatorium – a part of the large-scale promoting off of landed estates that modified the face of rural Britain (as evoked in Evelyn Waugh’s Brideshead Revisited). But Channon’s angle to those privations was once pragmatic: he would simply must pay the additional and get on along with his existence as perfect he may.

It’s now extensively recognised that our present occasions undergo uncanny parallels with the Nineteen Thirties – from the upward thrust of authoritarian regimes to large pressures on public spending within the context of unstable financial stipulations. But in contrast to that pre-war duration, nowadays’s proposals to boost taxation on excessive earning and wealth are being met with large pushback – every so often amounting to hysteria – from portions of society and the media.

The Dialog and LSE’s World Inequalities Institute have teamed up for a different on-line tournament on Tuesday, November 18 from 5pm-6.30pm. Sign up for professionals from the worlds of industrial, taxation and executive coverage as they talk about the tricky alternatives dealing with Chancellor Rachel Reeves in her price range. Join unfastened right here

Relatively than the pragmatism that Channon and plenty of of his rich contemporaries displayed, some public remark means that expanding tax at the rich is similar to infringing the herbal order of items. The brand new Labour executive’s adjustment of inheritance tax in autumn 2024 to deliver farm belongings into line with different belongings was once met with protests at the streets.

The similar yr, reforms to finish tax exemptions for “non-domiciled” UK citizens (those that declare their everlasting house is outdoor the United Kingdom) – to begin with introduced by means of Conservative chancellor Jeremy Hunt – provoked a flurry of (most commonly unsubstantiated) claims that the world super-rich can be leaving the United Kingdom for higher pastures out of the country.

No matter came about to the stoicism of the wealthy, ready to shoulder their tasks for social wellbeing within the face of urgent financial and political demanding situations?

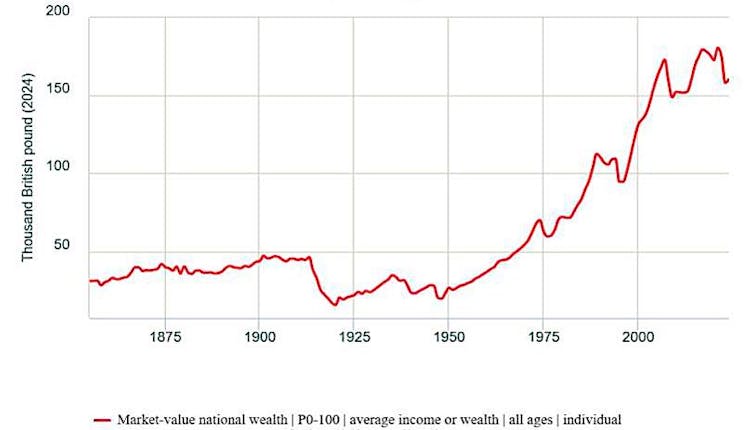

Most likely the important thing distinction between Channon’s time and our personal is published in two graphs which display dramatic adjustments within the distribution and level of wealth held in Britain during the last century. On the time Channon was once writing, wealth belongings consistent with head have been hugely smaller than they’re now – having declined because the early Twentieth century, most commonly because of wartime depredation. Alternatively, from the Fifties on, they started a exceptional ascent.

From the break of day of human historical past, it took many millennia for the imply quantity of wealth consistent with Briton to equate to £50k – reached someday within the Seventies. But a trifling 40 years after that, this private wealth determine had tripled:

UK private wealth through the years:

Moderate UK per-capita wealth, 1855-2024.

Global Inequality Database, CC BY-NC-SA

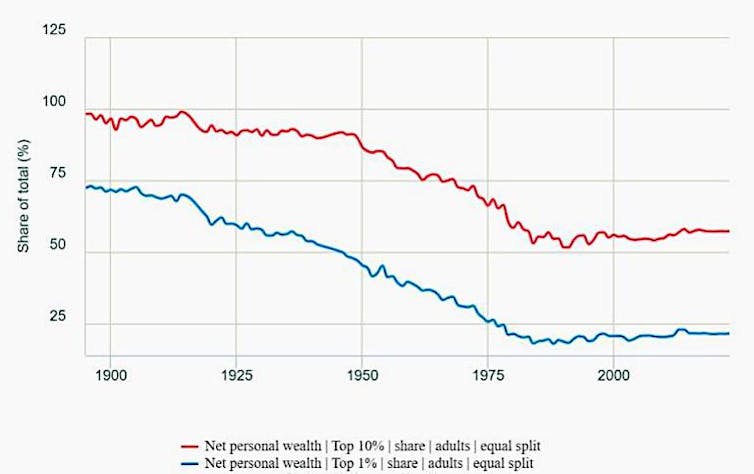

This dramatic upward thrust in UK wealth possession was once matched by means of a metamorphosis in who owned it. In Channon’s time, the highest 1% wealthiest other folks owned an astonishing 50% of the United Kingdom’s general – which is smart of his stoicism. He knew smartly sufficient that only some upper-class other folks like him had really extensive wealth, whilst extensive numbers of Britons lived in straitened stipulations and may now not realistically pay extra tax. When the going were given difficult, there was once little possibility however for other folks like him to cough up.

Since then, the wealth proportion held by means of the highest 1% has greater than halved, shedding to round 20% of the overall. And the United Kingdom’s wealthiest 10% now owns slightly below 60% – down from 90% in Channon’s day:

UK wealth inequality through the years:

UK wealth inequality, 1895-2023.

Global Inequality Database, CC BY-NC-SA

At the face of it, those two graphs seem to inform a contented and revolutionary tale. The United Kingdom, like many wealthy nations, has turn out to be a lot wealthier, and those advantages are being extra extensively unfold. What’s to not like?

If truth be told, many influential economists – together with members to the Institute for Fiscal Research’ influential Deaton Overview – have known the build-up of personal wealth as a being concerned development for Britain. The place the huge build up within the country’s wealth over the last 75 years will have been invested for the nice of the country, it’s been in large part squirrelled away into inner most arms, inflating the wealth of the United Kingdom’s higher and center category to the detriment of society as an entire.

As a sociologist, I’ve lengthy researched the affect of sophistication inequalities on British society – and the way category, gender, racial and regional divides are mutually reinforcing.

I’m now more and more involved by means of the way in which the build-up of personal wealth belongings intensifies those inequalities – doubtlessly to snapping point. Left unchecked, I imagine Britain’s “wealth timebomb” will magnify the present ruptures in society – already mirrored in the upward thrust of indignant populist political actions – leaving a calamitous legacy for long run generations.

As UK chancellor Rachel Reeves’s choices for attainable will increase in wealth and different taxes are debated forward of a extremely expected price range on November 26, I’d argue that such discussions must now not be framed purely in technical phrases – of what’s an effective approach of elevating price range for the general public handbag with out harmful UK prosperity.

There’s a a lot broader cultural politics of wealth that wishes addressing. Specifically, it’s time to stress-test the apparently fashionable view that wealth must be handled fully as a personal just right, and does now not include any social duties.

This concept results in the deeply dysfunctional view that wealth belongings are unfastened to be gathered, spent and handed on by means of their house owners with scant encroachment within the type of taxation. Chips Channon can also be criticised for plenty of issues – however even he didn’t accept as true with that.

The marriage of Henry ‘Chips’ Channon and Honor Guinness in London, July 1933.

Smith Archive/Alamy

The collective effort of generations

The recent reluctance to tax wealth, in Britain and plenty of different wealthy nations, is in reality very extraordinary. All over historical past, maximum societies have noticed this type of useful resource redistribution as completely affordable.

One in all William the Conqueror’s first acts after the Norman invasion of 1066 was once to fee the Domesday guide to systematically document the landed belongings of his newly conquered land. In poorer societies, wealth shares have been probably the most viable belongings to tax.

All over British historical past, inner most wealth holders have been frequently sanctioned for flouting not unusual norms of “reciprocity” and equity for the individuals who labored for them. Within the aristocratic landed estates that made up Britain’s primary type of wealth till the early Twentieth century, house owners have been nonetheless underneath robust ethical power to function them for the broader public just right.

In a similar way, in a robust production financial system like Britain’s, it was once uncontentious to treat wealth derived from proudly owning factories and companies as some more or less social product – the results of earnings from the frequently gruelling lives of many employees. The ones lucky to own extensive shares of wealth have been typically anticipated to take some more or less social duty for his or her employees.

A couple of Nineteenth-century philanthropists have been particular in regards to the public worth of personal wealth. Maximum famously, American metal multi-millionaire Andrew Carnegie’s Gospel of Wealth impressed a thorough liberal critique of wealth that influenced Britain’s Liberal executive (1905-15) to champion the taxation of excessive ranges of personal wealth. This changed into a central guideline of latest liberalism within the early Twentieth century, as described by means of Britain’s first ever sociology professor, Lionel Hobhouse:

The filthy rich businessman who thinks that he has made his fortune fully by means of self-help does now not pause to imagine what unmarried step he will have taken at the highway to his luck however for the ordered tranquillity which has made industrial building conceivable: the protection by means of highway and rail and sea, the hundreds of professional labour, and the sum of intelligence which civilisation has positioned at his disposal … The innovations which he makes use of as a question after all, and that have been constructed up by means of the collective effort of generations of fellows of science and organisers of trade.

American industrialist Andrew Carnegie impressed a thorough liberal way to wealth in Britain.

Granger Historic Image Archive/Alamy

Protecting this concept of “common wealth” prolonged to Tory radicals too – together with the Victorian cultural critic John Ruskin, who in 1860 famously wrote “there is no wealth but life” – stating:

That nation is the richest which nourishes the best numbers of noble and glad human beings. That guy is richest who, having perfected the purposes of his personal existence to the maximum, has the widest useful affect, each private and by way of his possessions, over the lives of others.

The duration from the overdue Nineteenth century, when Britain loved world dominance thru its blended business and army power, additionally noticed robust political currents at house. Those emphasized the desire for municipal possession of facilities equivalent to electrical energy, gasoline, water and plenty of different public construction initiatives – with town of Birmingham offering some of the influential fashions.

Such public-spirited benevolence emphatically didn’t lengthen to Britain’s colonial possessions – which have been automatically handled as uncivilised territories to be raided, despoiled and exploited for the advantages of their colonial grasp. However at house, there was once a transparent figuring out amid the wealthy elite of the desire for his or her wealth to play a task in construction a better-functioning society for all who lived in Britain – maximum of whom didn’t personal any of it.

There have been frequently spiritual and ethical ideals underlying those perspectives. However because the case of Chips Channon suggests, there was once additionally a self-interested popularity that the rich themselves benefited from recognising the social function of wealth, in its skill to assist create an informed, ordered staff and calm, respectful society. What, then, has came about to this collective imaginative and prescient of wealth?

The upward push of ‘ordinary’ wealth

By means of the early twenty first century, wealth was once not the keep of the gilded few in the United Kingdom. Impressed particularly by means of top minister Margaret Thatcher’s 1979-90 Conservative executive, the possibilities of mass possession of wealth belongings – beginning with your home – was once held out as a practical risk for many Britons.

This main shift was once echoed in lots of wealthy nations. French economist Thomas Piketty regards nowadays’s “proprietarian middle class”, who revel in the advantages of wealth belongings most often tied up of their houses and pension price range, as a key characteristic of modern capitalism.

In Britain, the percentage of owner-occupiers rose from round 38% of UK homes in 1958 to 70% by means of 2003 – propelled largely by means of Thatcher’s cut-price “right to buy” council homes scheme. But this got here at a price for others. The thinktank Commonplace Wealth has estimated this scheme value British taxpayers £200 billion with regards to the wealth or source of revenue that might were to be had to native councils had they’d offered at complete marketplace worth or retained the houses – equating to “one of the largest giveaways in UK history”.

UK top minister Margaret Thatcher beverages tea with the circle of relatives who’ve simply turn out to be Larger London Council’s 12,000th council area consumers, August 1980.

PA Photographs/Alamy

A 2d main type of “ordinary” wealth is tied up in pension price range, providing long run rewards for other folks enrolled in occupational or different sorts of pension schemes. For the reason that this wealth is handiest realisable from age 55 (emerging to 57 in 2028), it may well seem extremely hypothetical for more youthful other folks. Nevertheless, The Answer Basis calculates that pension belongings are actually the one greatest wealth inventory throughout UK families.

Pensions and belongings have modified the cultural politics of personal wealth. It’s not noticed because the prerequisite of the privileged few.

However on the similar time, the country’s “common” wealth has been stripped again because of privatisation, diminished welfare advantages, and the build-up of nationwide debt – which (with the exception of public sector banks) has risen from not up to 30% of UK GDP in 1993 to only underneath 100%.

This has created a public-to-private wealth cycle. Straitened public products and services – partly the results of nationwide and native executive cuts and a discount in infrastructure funding – make peculiar inner most wealth appear a lot more necessary as a buffer towards attainable shocks equivalent to in poor health well being, redundancy and care wishes. Because of this, preserving dangle of this inner most wealth feels essential to very large numbers of other folks.

Its cultural enchantment may be comprehensible. Non-public wealth can also be noticed because the product of private endeavour like hanging down a deposit to shop for a area or paying right into a pension scheme. For individuals who have grafted to obtain a modest wealth maintaining (or aspire to take action), the concept wealth is a collective and social product can really feel alien.

Actually, alternatively, the Thatcherite, neoliberal type which championed the democratisation of wealth was once by no means a sustainable imaginative and prescient – as it didn’t supply a viable, long-term approach of setting up cultural norms of social reciprocity. Certainly, even prior to Thatcher’s reign as top minister led to 1990, the wealth stocks of the highest 1% and 10% had stopped declining – and they have got been just about flatlining, perhaps even edging up reasonably, ever since.

Simply as the United Kingdom’s general wealth started to upward thrust at document charges, the democratisation of wealth reached its limits. Politically and economically, a brand new wall was once established. Insurance policies ever since have prioritised the ones other folks with wealth who most often even have probably the most political and cultural affect. And overwhelmingly, this doesn’t come with younger other folks.

The United Kingdom’s wealth ‘timebomb’

Whilst Britain’s inner most wealth is extra extensively shared amongst other folks than within the early Twentieth century, its distribution remains to be extraordinarily unequal – way more so than source of revenue. The Answer Basis (RF) calculates that part of UK households haven’t any internet wealth in any respect, with money owed outweighing belongings for 40% of families.

Given the ongoing upward development in area costs, the possibilities of having at the belongings ladder for other folks on this “wealthless” part are far flung. On the similar time, inner most rents have climbed considerably, with the United Kingdom per 30 days reasonable emerging from £948 in January 2015 to £1,286 in August 2024.

In the meantime, since 2009, maximum of the advantages of quantitative easing – designed to spice up the United Kingdom financial system within the wake of the 2008 world monetary disaster and later COVID – have leached into the arms of the already rich, with out percolating right down to the remainder of society. The RF’s sober abstract is that wealth good points “flowed disproportionately to older, asset-rich households and homeowners in certain parts of the country (particularly London). The result is a wealth landscape that is both highly unequal and harder to climb.”

Protesters outdoor London’s Royal Change display towards the United Kingdom executive’s bailout of banks throughout the worldwide monetary disaster, October 2008.

Alex MacNaughton/Alamy

This proliferation of wealth additionally intensifies different inequality. A up to date record I co-authored for the Runnymede Accept as true with demonstrates the astonishing intensity of the racial wealth divide. Black African and Bangladeshi families have handiest 10% of the wealth that white British families revel in. There also are marked gender wealth divides, particularly because of pension wealth – as a result of males are much more likely to be the beneficiaries of occupational pension schemes.

All that is within the context of a UK financial system this is extensively recognised as stagnating. Are the 2 connected? Nearly surely.

There’s now an influential frame of idea which emphasises the structural barriers of “asset economies” or “rentier capitalism”, wherein financial returns are essentially pushed by means of passive rent-seeking behaviour. For the ones with wealth, why spend money on a dangerous new start-up scheme (their very own or any individual else’s) when they are able to revel in risk-free “passive” returns on their current belongings?

In keeping with the RF, 53% of the rise in UK family wealth between 2010-22 was once because of the passive results of asset fee inflation (equivalent to being beneficiaries of area fee rises) quite than lively funding – be that paying off money owed or taking advantage of entrepreneurial graft.

This bias in opposition to passive wealth is helping provide an explanation for each Britain’s stagnating financial system and the static nature of personal wealth. In combination, they’re storing up a large problem to any concepts of intergenerational equity, as younger other folks’s long run possibilities more and more rely on which aspect of the wealth fence they have been born on.

The paintings of sociologists equivalent to Sam Friedman has demonstrated how the possibilities of working-class youngsters achieving the highest ranges {of professional} and managerial employment are restricted by means of a pervasive “class ceiling”. In a similar way, the possibilities of younger adults obtaining wealth rely more and more on whether or not their very own folks are rich.

As austerity politics has eroded collective public provision, persons are pressured again directly to their very own financial assets, if they have got them. In a society the place the purchase of personal wealth appears to be the social norm, it’s comprehensible how a mentality of “pulling up the drawbridge” can take dangle. On this technology, the enchantment of populist actions has taken dangle – spawning a politics of mistrust and hate.

It’s transparent the United Kingdom has reached the bounds of Thatcher’s “democratisation of wealth” schedule. It’s unrealistic to be expecting the wealth internet to unfold any wider. And due to this fact, I imagine it’s now necessary (and pressing) to problem the traditionally anomalous, unsustainable view that the rewards of personal wealth must handiest be loved by means of the ones lucky sufficient to own it.

However what does this imply for the nuts and bolts of taxation coverage?

The case for introducing a wealth tax. Video: Monetary Instances.

Why wealth must be taxed extra

For Rachel Reeves and her successors at No.11 Downing Boulevard, the monetary room for manoeuvre may be very limited. When making an allowance for tax adjustments, chancellors should first scan the monetary markets to imagine how their price range and different coverage choices may have an effect on the bond markets and broader monetary steadiness of the United Kingdom financial system.

Nevertheless, there are robust technical explanation why wealth must be taxed extra.

For the reason that really extensive inner most source of revenue is in keeping with returns to capital (within the type of lease, proportion dividends and so on), it kind of feels fully logical to regard this as an identical in taxation phrases.

But while higher-rate taxpayers pay source of revenue tax 40% (emerging to 45%), capital good points are taxed at between 24% and 32% (with some capital good points, particularly the ones which accrue on an individual’s number one belongings, now not taxed in any respect). That is merely inconsistent.

It’s extensively recognised that the valuables tax machine wishes reforming, both thru revaluing council tax or by means of editing stamp accountability on newly bought homes. Ditto pension taxation – as an example, by means of ditching the triple-lock machine which will increase the state pension each and every April by means of the best of 3 measures: reasonable profits expansion, inflation or 2.5%.

We’re within the lucky place that an excessive amount of background analysis has been performed to display the feasibility of wealth taxation – and to dispel the average objections, from the intended complexity in their assortment to tips that many of us will depart the rustic must a wealth tax be imposed at the very wealthy. (Behavioural research of what number of rich other folks do in reality depart a rustic after the creation of tax reforms displays it’s extraordinary to take action.) In all circumstances, the proof towards those taxes is skinny and simply countered.

In the meantime, world wide, increasingly mainstream economists equivalent to Gabriel Zucman now champion arguments for taxing wealth head-on. In his proposals for an across the world coordinated usual taxation for ultra-high-net-worth folks, the edge for paying this tax is about very excessive: at 2% of the belongings of buck billionaires.

France debates the proposed ‘Zucman’ wealth tax. Video: France 24.

Defenders of personal wealth every so often painting wealth taxation as a socialist undertaking, opening the door to a couple more or less full-blown communist revolution. However this sort of pigeonholing is just improper: the case for taxing wealth has traditionally come from the political mainstream.

Nevertheless, to make a powerful case within the present local weather, you will need to lengthen the research past purely technical, financial arguments (which maximum critics of such taxes are reluctant to do). In the end, for wealth taxation to turn out to be politically palatable calls for giant cultural and social questions of the individuals who personal it in very extensive amounts.

Excessive vs peculiar wealth

We live in a exceptional duration of human historical past. The whole quantity of personal wealth has mushroomed in fresh many years, in Britain and the world over. At the face of it, this seems to testify to a couple astonishing human growth in a shockingly brief period of time.

But I doubt many readers of this newsletter are feeling this feeling of private development – even those that have benefited (immediately or not directly) from the democratisation of wealth since Channon gleefully revelled in his upper-class bubble within the mid-Twentieth century.

Even lots of the ones with “ordinary” ranges of wealth don’t essentially really feel smartly off. Wealth sunk into pricey belongings or pension financial savings can radically devour into different residing bills. Which leads me to a very powerful conclusion in regards to the wish to center of attention on taxing wealth itself – now not simply the source of revenue from wealth.

For many of us, wealth isn’t merely about cash. It conjures up the potential of main a “good life” and having the ability to flourish at some point – now not handiest your self however your offspring and wider circle of relatives. That is very true, and comprehensible, relating to the theory of having the ability to are living in owner-occupied belongings. Even in the United Kingdom’s maximum eyewatering belongings areas, many of those house owners of peculiar wealth are nonetheless a global excluding the ones whose inner most wealth can also be labeled as “extreme”.

Taxing the latter by way of a “whole wealth” tax has a transparent benefit in setting up the argument head-on that very extensive quantities of personal wealth must have some public goal. Even Channon recognised this.

However as exponents of limitarianism emphasise, handiest the ones whose wealth is above a undeniable threshold must be prone to the sort of tax. The 2020 Wealth Tax Fee calculated that surroundings a threshold at £500,000 consistent with yr would carry round £260 billion, if charged at 1% consistent with yr for 5 years. Atmosphere the edge a lot larger at £2 million, thus affecting kind of 2% of Britons, would nonetheless carry £80 million.

Those figures (regardless that short of updating) point out the potential of elevating public price range in an affordable approach, with out descending into rancour and political name-calling. By means of surroundings a suitable threshold, it may be obviously established that peculiar wealth don’t need to be taxed – in order to not alienate the big numbers of people that understandably worth the protection their wealth shares supply.

Most likely most significantly, it will repair the necessary concept that non-public wealth involves social tasks. When the augmentation of wealth is pushed by means of passive processes equivalent to asset fee inflation – as such a lot of it’s nowadays – then it’s definitely a stretch to view this as down in your personal efforts on my own.

Even those that achieve their wealth by means of entrepreneurial force and aptitude nonetheless want the improve of the broader social infrastructure that educates, treatments and helps their employees and consumers. We wish to revive the cultural politics of not unusual wealth, prior to the timebomb explodes.

The Dialog and LSE’s World Inequalities Institute have teamed up for a different on-line tournament on Tuesday, November 18 from 5pm-6.30pm. Sign up for professionals from the worlds of industrial, taxation and executive coverage as they talk about the tricky alternatives dealing with Chancellor Rachel Reeves in her price range. Join unfastened right here

For you: extra from our Insights collection: