That is the primary in a two-part sequence. Learn section two right here.

For almost 4 centuries, the sector financial system has been on a trail of ever-greater integration that even two international wars may no longer completely derail. This lengthy march of globalisation used to be powered via impulsively expanding ranges of global business and funding, coupled with huge actions of folks throughout nationwide borders and dramatic adjustments in transportation and conversation generation.

In keeping with financial historian J. Bradford DeLong, the worth of the sector financial system (measured at mounted 1990 costs) rose from US$81.7 billion (£61.5 billion) in 1650, when this tale starts, to US$70.3 trillion (£53 trillion) in 2020 – an 860-fold build up. Essentially the most extensive classes of expansion corresponded to the 2 classes when international business used to be emerging quickest: first all through the “long 19th century” between the tip of the French revolution and get started of the primary international battle, after which as business liberalisation expanded after the second one international battle, from the Fifties as much as the 2008 international monetary disaster.

Now, then again, this grand venture is at the retreat. Globalisation isn’t useless but, however it’s death.

Is that this a motive for party, or fear? And can the image alternate once more when Donald Trump and his price lists of mass disruption depart the White Area? As an established BBC economics correspondent who used to be founded in Washington all through the worldwide monetary disaster, I consider there are sound ancient causes to fret about our deglobalised long run – even as soon as Trump has left the construction.

The Insights segment is dedicated to fine quality longform journalism. Our editors paintings with lecturers from many alternative backgrounds who’re tackling a variety of societal and clinical demanding situations.

Trump’s price lists have amplified the sector’s financial issues, however he isn’t the foundation reason for them. Certainly, his manner displays a reality that has been rising for lots of a long time however which earlier US administrations – and different governments world wide – were reluctant to confess: particularly, the decline of the USA as the sector’s no.1 financial energy and engine of worldwide expansion.

In each and every technology of globalisation because the mid-Seventeenth century, a unmarried nation has sought to be the transparent international chief – shaping the foundations of the worldwide financial system for all. In each and every case, this hegemonic energy had the army, political and fiscal energy to put in force those guidelines – and to persuade different nations that there used to be no preferable trail to wealth and tool.

However now, as the USA beneath Trump slips into isolationism, there is not any different energy able to take its position and lift the torch for the foreseeable long run. Many of us’s pick out, China, faces too many financial demanding situations, together with its loss of a actually global forex – and as a one-party state, nor does it possess the democratic mandate had to acquire acceptance as the sector’s new dominant energy.

Whilst globalisation has all the time produced many losers in addition to winners – from the slave business of the 18th century to displaced manufacturing facility employees within the American Midwest within the Twentieth century – historical past displays {that a} deglobalised international may also be an much more unhealthy and risky position. The newest instance got here all through the interwar years, when the USA refused to soak up the mantle left via the decline of Britain because the nineteenth century’s hegemonic international energy.

Within the twenty years from 1919, the sector descended into financial and political chaos. Inventory marketplace crashes and international banking screw ups ended in popular unemployment and lengthening political instability, growing the prerequisites for the upward push of fascism. World business declined sharply as nations publish business limitations and began self-defeating forex wars within the useless hope of giving their nations’ exports a spice up. To the contrary, international expansion flooring to a halt.

A century on, our deglobalising international is prone once more. However to chart whether or not this implies we’re destined for a in a similar fashion chaotic and risky long run, we first want to discover the start, expansion and causes in the back of the upcoming death of this atypical international venture.

French fashion: mercantilism, cash and battle

By means of the mid-1600s, France had emerged because the most powerful energy in Europe – and it used to be the French who evolved the primary overarching idea of the way the worldwide financial system may paintings of their favour. Just about 4 centuries later, many facets of “mercantilism” were revived via Trump’s US playbook, which might be entitled How To Dominate the Global Economic system via Weakening Your Opponents.

France’s model of mercantilism used to be in line with the concept a rustic must publish business limitations to restrict how a lot different nations may promote to it, whilst boosting its personal industries to make sure that more cash (within the type of gold) got here into the rustic than left it.

England and the Dutch Republic had already followed a few of these mercantilist insurance policies, setting up colonies around the world run via tough monopolistic buying and selling corporations that aimed to problem and weaken the Spanish empire, which had prospered at the gold and silver it seized within the Americas. By contrast to those “seaborne empires”, the a lot higher empires within the east comparable to China and India had the interior assets to generate their very own income, that means global business – even though popular – used to be no longer vital to their prosperity.

French finance minister Jean-Baptiste Colbert, architect of mercantilism.

Metropolitan Museum of Artwork/Wikimedia

However it used to be France which first systematically carried out mercantilism throughout the entire of presidency coverage – led via the tough finance minister Jean-Baptiste Colbert (1661-1683), who have been granted unheard of powers to give a boost to the monetary may of the French state via King Louis XIV. Colbert believed business would spice up the coffers of the state and give a boost to France’s financial system whilst weakening its opponents, pointing out:

It’s merely, and only, the absence or abundance of cash inside a state [which] makes the adaptation in its grandeur and tool.

In Colbert’s view, business used to be a zero-sum sport. The extra France may run a business surplus with different nations, the extra gold bullion it would acquire for the federal government and the weaker its opponents would develop into if disadvantaged of gold. Underneath Colbert, France pioneered protectionism, tripling its import price lists to make overseas items prohibitively dear.

On the similar time, he reinforced France’s home industries via offering subsidies and granting them monopolies. Colonies and govt buying and selling corporations have been established to verify France may get pleasure from the extremely profitable business in items comparable to spices, sugar – and slaves.

Colbert oversaw the growth of French industries into spaces like lace and glass-making, uploading professional craftsmen from Italy and granting those new corporations state monopolies. He invested closely in infrastructure such because the Canal du Midi, and dramatically larger the dimensions of France’s military and service provider marine to problem its British and Dutch opponents.

World business presently used to be extremely exploitative, involving the pressured seizure of gold and different uncooked fabrics from newly found out lands (as Spain have been doing with its conquests within the New Global from the overdue fifteenth century). It additionally supposed profiting from the business in people, with massive earnings as slaves have been seized and despatched to the Caribbean and different colonies to provide sugar and different plants.

France to begin with loved good fortune within the Seventeenth century each on land and sea in opposition to the Dutch. However in the end, its state-run French Indies corporate used to be no rival to the ruthless, commercially pushed actions of the Dutch and British East India corporations, which delivered huge earnings to their shareholders and revenues for his or her governments.

Certainly, the massive earnings made via the Dutch from the A ways Jap spice business explains why that they had no hesitation in turning in their small North American colony of New Amsterdam, in go back for expelling the British from a small toehold of considered one of their spice islands in what’s now Indonesia. In 1664, that Dutch outpost used to be renamed New York.

After a century of warfare, Britain step by step received ascendancy over France, conquering India and forcing its nice rival to cede Canada in 1763 after the Seven Years battle. France by no means succeeded in absolutely countering Britain’s naval energy. Resounding defeats via fleets led via Horatio Nelson within the early nineteenth century, coupled with Napoleon’s defeat at Waterloo via a coalition of Ecu powers, marked the tip of France’s time as Europe’s hegemonic energy.

The fight of Trafalgar, off southwestern Spain in October 1805, used to be decisive in finishing France’s technology of dominance.

Yale Heart for British Artwork/Wikimedia

However whilst the French fashion of globalisation in the end failed in its try to dominate the sector financial system, that has no longer avoided different nations – and now President Trump – from embracing its ideas.

France discovered that price lists on my own may no longer sufficiently fund its wars nor spice up its industries. Its large model of mercantilism ended in never-ending wars that unfold around the world, as nations retaliated each economically and militarily and attempted to take hold of territories.

Greater than two centuries later, there’s an uncomfortable parallel with what the result of Trump’s never-ending tariff wars may carry, each with regards to ongoing warfare and the organisation of rival business blocs. It additionally displays that extra protectionism, as proposed via Trump, is probably not sufficient to restore the USA’s home industries.

British fashion: loose business and empire

The ideology of loose business used to be first spelled out via British economists Adam Smith and David Ricardo, the founding fathers of classical economics. They argued business used to be no longer a zero-sum sport, as Colbert had prompt, however that each one nations may mutually get pleasure from it. In keeping with Smith’s vintage textual content, The Wealth of International locations (1776):

If a overseas nation can provide us with a commodity less expensive than we ourselves could make, higher purchase it off them with some a part of the produce of our personal trade, hired in one of these manner that we have got some benefits.

As the sector’s first business country, via the 1840s Britain had created an financial powerhouse in line with the brand new applied sciences of steam energy, the manufacturing facility machine, and railroads.

Smith and Ricardo argued in opposition to the introduction of state monopolies to regulate business, proposing minimum state intervention in trade. Ever since, Britain’s trust in some great benefits of loose business has proved more potent and extra long-lasting than another main business energy – extra deeply embedded in each its politics and common creativeness.

This ironclad dedication used to be born out of a sour political combat within the 1840s between producers and landowners over the protectionist Corn Rules. The landowners who had historically ruled British politics subsidized top price lists, which benefited them however led to upper costs for staples like bread. The repeal of the Corn Rules in 1846 upended British politics, signalling a shift of energy to the producing categories – and in the end to their working-class allies after they received the precise to vote.

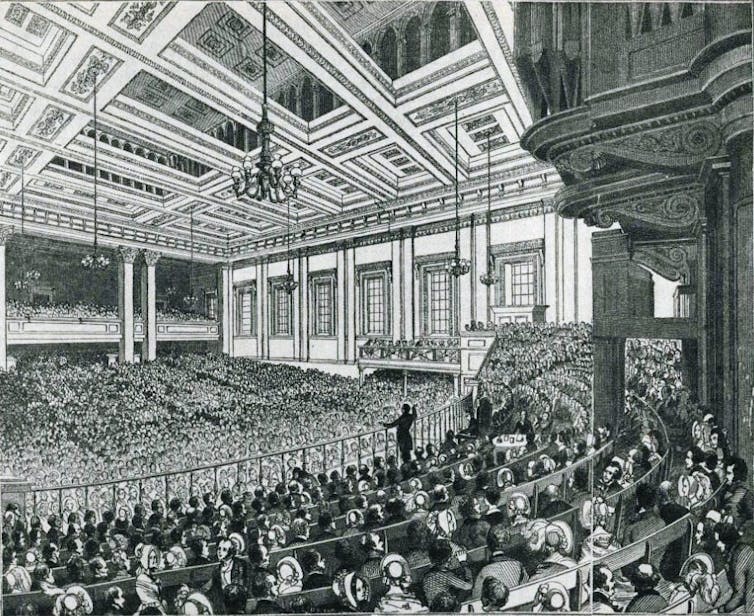

An Anti-Corn Regulation League assembly held in London’s Exeter Corridor in 1846.

Wikimedia

In time, Britain’s advocacy of loose business unleashed the facility of its production to dominate international markets. Loose business used to be framed as how one can carry dwelling requirements for the deficient (the complete opposite of President Trump’s declare that it harms employees) and had robust working-class strengthen. When the Conservatives floated the theory of forsaking loose business within the 1906 normal election, they suffered a devastating defeat – the celebration’s worst till 2024.

In addition to business, a central part in Britain’s function as the brand new international hegemonic energy used to be the upward push of the Town of London as the sector’s main monetary centre. The important thing used to be Britain’s embody of the gold usual which put its forex, the pound, on the middle of the brand new international financial order via linking its worth to a hard and fast quantity of gold, making sure its worth would no longer range. Thus the pound changed into the global medium of trade.

This inspired the advance of a robust banking sector, underpinned via the Financial institution of England as a reputable and faithful “lender of last resort” in a monetary disaster. The outcome used to be an enormous increase in global funding, opening get right of entry to to in another country markets for British corporations and particular person buyers.

Within the overdue nineteenth century, the Town of London ruled international finance, making an investment in the entirety from Argentinian railways and Malaysian rubber plantations to South African gold mines. The gold usual changed into a talisman of Britain’s energy to dominate the sector financial system.

The pillars of Britain’s international financial dominance have been a extremely environment friendly production sector, a dedication to loose business to verify its trade had get right of entry to to international markets, and a extremely evolved monetary sector which invested capital world wide and reaped some great benefits of international financial building. However Britain additionally didn’t hesitate to make use of power to open up overseas markets – as an example, all through the Opium Wars of the 1840s, when China used to be pressured to open its markets to the profitable business in opium from British-owned India.

By means of the tip of the nineteenth century, the British empire integrated one quarter of the sector’s inhabitants, offering a supply of inexpensive labour and safe uncooked fabrics in addition to a big marketplace for Britain’s manufactured items. However that used to be nonetheless no longer sufficient for its avaricious leaders: Britain additionally made certain that native industries didn’t threaten its pursuits – via undermining the Indian textile trade, as an example, and manipulating the Indian forex.

If truth be told, globalisation on this technology used to be about domination of the sector financial system via a couple of wealthy Ecu powers, that means that a lot international financial building used to be curtailed to give protection to their pursuits. Underneath British rule between 1750 and 1900, India’s percentage of worldwide business output declined from 25% to two%.

However for the ones on the centre of Britain’s international formal and casual empire, such because the middle-class citizens of London, this used to be a halcyon time – as economist John Maynard Keynes would later recall:

For center and higher categories … existence presented, at a low price and with the least hassle, conveniences, comforts and facilities past the compass of the richest and maximum tough monarchs of different ages. The inhabitant of London may order via phone, sipping his morning tea in mattress, the quite a lot of merchandise of the entire Earth, in such amount as he may see have compatibility, and somewhat be expecting their early supply upon his doorstep.

US fashion: protectionism to neoliberalism

Whilst Britain loved its century of world dominance, america embraced protectionism for longer after its basis in 1776 than all different main western economies.

The creation of price lists to give protection to and subsidise rising US industries had first been articulated in 1791 via the fledgling country’s first treasury secretary, Alexander Hamilton – Caribbean immigrant, founding father and long run topic of a record-breaking musical. The Whig celebration beneath Henry Clay and its successor, the Republican Birthday party, have been each robust supporters of this coverage for many of the nineteenth century. At the same time as US trade grew to overshadow all others, its govt maintained one of the most perfect tariff limitations on the planet.

Founding father Alexander Hamilton at the entrance of a US$10 be aware from 1934.

Wikimedia

Tariff charges rose to 50% within the Eighteen Nineties with the backing of long run president William McKinley, each to assist industrialists and pay for beneficiant pensions for two million civil battle veterans and their dependants – a key a part of the Republican voters. It’s no twist of fate that President Trump has festooned the White Area with photos of Hamilton, Clay and McKinley – all supporters of protectionism and top price lists.

Partially, the USA’s enduring resistance to loose business used to be as it had get right of entry to to an inside provide of apparently countless uncooked fabrics, whilst its impulsively rising inhabitants, fuelled via immigration, equipped inside markets that fuelled its expansion whilst conserving out overseas pageant.

By means of the overdue nineteenth century, the USA used to be the sector’s greatest metal manufacturer with the biggest railroad machine on the planet and used to be shifting impulsively to take advantage of the brand new applied sciences of the second one business revolution – in line with electrical energy, petrol engines and chemical substances. But it used to be most effective after the second one international battle that the USA assumed the function of world superpower – partially as it used to be the one nation on both sides of the battle that had no longer suffered critical injury to its financial system and infrastructure.

Within the wake of world destruction in Europe and Asia, the USA’s dominance used to be political, army and cultural, in addition to monetary – however the USA imaginative and prescient of a globalised international had some essential variations from its British predecessor.

The USA took a a lot more universalist and rules-based manner, specializing in the introduction of world organisations that will determine binding rules – and open up international markets to unfettered American business and funding. It additionally aimed to dominate the global financial order via changing the pound sterling with the USA buck as the worldwide medium of trade.

Inside of every week of its access in the second one international battle, plans have been laid to ascertain US international monetary hegemony. The USA treasury secretary, Henry Morgenthau, started paintings on setting up an “inter-allied stabilisation fund” – a playbook for post-war financial preparations which might enshrine the USA buck at its middle.

This ended in the introduction of the Global Financial Fund (IMF) and Global Financial institution on the Bretton Woods convention in New Hampshire in 1944 – establishments ruled via the USA, which inspired different nations to undertake the similar financial fashion each with regards to loose business and loose undertaking. The Allied international locations who have been concurrently assembly to ascertain the United International locations to check out to verify long run international peace, having suffered the devastating results of the Nice Despair and battle, welcomed the USA’s dedication to form a brand new, extra strong financial order.

How the 1944 Bretton Woods deal ensured the USA buck will be the international’s dominant currrency. Video: Bloomberg TV.

As the sector’s greatest and most powerful financial system, there used to be (to begin with) little resistance to this US plan for a brand new global financial order in its personal symbol. The reason used to be as a lot political as financial: the USA sought after to offer financial advantages to verify the loyalty of its key allies and counter the perceived risk of a communist takeover – in entire distinction to Trump’s mercantilist view these days that each one different nations are out to “rip off” the USA, and that its personal army may manner it has no actual want for allies.

After the battle in spite of everything ended, the USA buck, now connected to gold at a hard and fast charge of $35 according to ounce to ensure its steadiness, assumed the function because the loose international’s essential forex. It used to be each used for international business transactions and held via overseas central banks as their forex reserves – giving the USA financial system an “exorbitant privilege”. The strong worth of the buck additionally made it more straightforward for the USA govt to promote Treasury bonds to overseas buyers, enabling it to extra simply borrow cash and run up business deficits with different nations.

The prerequisites have been set for an technology of US political, monetary and cultural dominance, which noticed the upward push of worldwide admired manufacturers comparable to McDonald’s and Coca Cola, in addition to a formidable US advertising and marketing arm within the type of Hollywood. Most likely much more considerably, the comfortable, well-funded campuses of California would end up a super petri dish for the advance of latest pc applied sciences – subsidized to begin with via chilly battle army funding – which, a long time later, would result in the start of the big-tech corporations that dominate the tech panorama these days.

The USA view of globalisation used to be broader and extra interventionist than the British fashion of loose business and empire. Somewhat than having a proper empire, it sought after to open up get right of entry to to all of the international financial system, which would supply international markets for American services.

The USA believed you wanted international financial establishments to police those guidelines. However as within the British case, some great benefits of globalisation have been nonetheless inconsistently shared. Whilst nations that embraced export-led expansion comparable to Japan, Korea and Germany prospered, different resource-rich however capital-poor nations comparable to Nigeria most effective fell additional in the back of.

From dream to melancholy

Despite the fact that the legend of the American dream grew and grew, via the Seventies the USA financial system used to be coming beneath expanding force – specifically from German and Eastern opponents, who via then had recovered from the battle and modernised their industries.

Bothered via those perceived threats and a rising business deficit, in 1971 President Richard Nixon surprised the sector via saying that the USA used to be going off the gold usual – forcing different nations to endure the price of adjustment for the USA stability of bills disaster via making them revalue their currencies. This had a profound impact at the international monetary machine: inside a decade, maximum main currencies had deserted mounted trade charges for a brand new machine of floating charges, successfully finishing the 1944 Bretton Woods agreement.

US president Richard Nixon publicizes the USA is leaving the gold usual on August 15 1971.

The tip of mounted trade charges opened the door to the “financialisation” of the worldwide financial system, hugely increasing international funding and lending – a lot of it via US monetary corporations. This gave succour to the burgeoning neoliberal motion that sought to additional rewrite the foundations of the monetary international order. Within the Nineteen Eighties and ’90s, those coverage prescriptions changed into referred to as the Washington consensus: a algorithm – together with opening markets to overseas funding, deregulation and privatisation – that used to be imposed on creating economies in disaster, in go back for them receiving strengthen from US-led organisations just like the Global Financial institution and IMF.

In the USA, in the meantime, the expanding reliance at the finance and hi-tech sectors larger ranges of inequality and fostered resentment in huge portions of American society. Each Republicans and Democrats embraced this new international order, shaping US coverage to favour their hi-tech and fiscal allies. Certainly, it used to be the Democrats who performed a key function in deregulating the monetary sector within the Nineties.

In the meantime, the decline of US production industries sped up, as did the distance between the earning of the ones within the hinterland, the place production used to be founded, and citizens of the huge metropolitan towns.

By means of 2023, the bottom 50% of US voters gained simply 13% of general private source of revenue, whilst the highest 10% gained virtually part (47%). The wealth hole used to be even larger, with the ground 50% most effective having 6% of general wealth, whilst a 3rd (36%) used to be held via simply the highest 1%. Since 1980, actual earning of the ground 50% have slightly grown for 4 a long time.

The ground part of the USA inhabitants used to be affected by a surge in “deaths of despair” – a time period coined via the Nobel-winning economist Angus Deaton to explain top mortality charges from drug abuse, suicide and homicide amongst more youthful working-class American citizens. Emerging prices of housing, hospital therapy and college schooling all contributed to popular indebtedness and rising monetary lack of confidence. By means of 2019, a find out about discovered that two-thirds of people that filed for chapter cited scientific problems as a key explanation why.

The decline in US production sped up after China used to be admitted to the Global Industry Group in 2001, expanding The us’s hovering business and price range deficit much more. Political and industry elites was hoping the transfer would open up the massive Chinese language marketplace to US items and funding, however China’s speedy modernisation made its trade extra aggressive than its American opponents in lots of fields.

In the end, this period of in depth financialisation of the sector financial system created a chain of regional after which international monetary crises, harmful the economies of many Latin American and Asian economies. This culminated within the 2008 international monetary disaster, brought on via reckless lending via US monetary establishments. The arena financial system took greater than a decade to recuperate as nations wrestled with slower expansion, decrease productiveness and not more business than sooner than the disaster.

For many who selected to learn it, the writing used to be at the wall for The us’s technology of world domination a long time in the past. However it could take Trump’s victory within the 2016 presidential election – a profound surprise to many in the USA “liberal establishment” – to shed light on that the USA used to be now on an excessively other direction that will shake up the sector.

Making a foul state of affairs extra unhealthy

For my part, Trump is the primary modern day US president to totally perceive the tough alienation felt via many working-class American electorate, who believed they have been not noted of the USA’s immense post-war financial expansion that so benefited the in large part city American center categories. His most powerful supporters have all the time been lower-middle-class electorate from rural spaces who don’t seem to be college-educated.

But Trump’s key insurance policies will in the end do little for them. Top price lists to give protection to US jobs, expulsion of tens of millions of unlawful immigrants, dismantling protections for minorities via opposing DEI (range, equality and inclusion) programmes, and tremendously chopping again the dimensions of presidency may have more and more detrimental financial penalties at some point, and are not possible to revive the USA financial system to its earlier dominant place.

US president Donald Trump unveils his international tariff ‘hit list’ on April 3 2025. BBC Information.

Lengthy sooner than he first changed into president, Trump hated the eye-watering US business deficit (he’s a businessman, in any case) – and believed that price lists could be a key weapon for making sure US financial dominance might be maintained. Any other key a part of his “America First” ideology used to be to repudiate the global agreements that have been on the middle of the USA’s postwar way to globalisation.

In his first time period, then again, Trump (having no longer anticipated to win) used to be ill-prepared for energy. However 2d time round, conservative thinktanks had spent years outlining detailed insurance policies and figuring out key workforce who may enforce the unconventional U-turn in US financial coverage.

Underneath Trump 2.0, now we have observed a go back to the mercantilist viewpoint paying homage to France within the Seventeenth and 18th centuries. His statement that nations which ran a business surplus with the USA “were ripping us off” echoed the mercantilist trust that business used to be a zero-sum sport – somewhat than the Twentieth-century view, pioneered via the USA, that globalisation brings advantages to all, regardless of the appropriate stability of that business.

Trump’s tax-and-tariff plans, which prolong the tax breaks to the very wealthy whilst decreasing advantages for the deficient thru receive advantages cuts and tariff-driven inflation, will build up inequality in the USA.

On the similar time, the passing of the One Large Gorgeous Invoice is expected so as to add some US$3.5 trillion to US govt debt – even after the Elon Musk-led “Department of Government Efficiency” cuts imposed on many Washington departments. This provides force to the important thing US Treasury bond marketplace on the centre of the sector monetary machine, and raises the price of financing the massive US deficit whilst weakening its credit standing. Proceeding those insurance policies may threaten a default via the USA, which might have devastating penalties for all of the international monetary machine.

For the entire macho grandstanding from Trump and his supporters, his financial insurance policies are an illustration of American weak point, no longer energy. Whilst I consider his highlighting of one of the most ills of the USA financial system have been late, the president is impulsively squandering the industrial credibility and excellent will that the USA constructed up within the postwar years, in addition to its cultural and political hegemony. For folks dwelling in The us and in other places, he’s making a foul state of affairs extra unhealthy – together with for lots of of his maximum ardent supporters.

That stated, even with out Trump’s financial and societal disruptions, the tip of the USA technology of hegemonic dominance would nonetheless have came about. Globalisation isn’t useless, however it’s death. The troubling query all of us face now, is what occurs subsequent.

That is the primary of a two-part Insights lengthy learn on the upward push and fall of globalisation. Learn section two right here: why the following international monetary meltdown might be a lot worse with the USA at the sidelines.

For you: extra from our Insights sequence: