That is the second one in a two-part sequence. Learn section one right here.

Globalisation has all the time had its critics – however till not too long ago, they have got come principally from the left moderately than the correct.

Within the wake of the second one global struggle, as the arena financial system grew hastily beneath US dominance, many at the left argued that the features of globalisation had been unequally disbursed, expanding inequality in wealthy nations whilst forcing poorer nations to enforce free-market insurance policies reminiscent of opening up their monetary markets, privatising their state industries and rejecting expansionary fiscal insurance policies in favour of debt reimbursement – all of which principally benefited US firms and banks.

This used to be no longer a brand new fear. Again in 1841, German economist Friedrich Checklist had argued that unfastened business used to be designed to stay Britain’s international dominance from being challenged, suggesting:

When someone has bought the summit of greatness, he kicks away the ladder during which he climbs up, with a view to deprive others of the manner of mountaineering up after him.

By means of the Nineteen Nineties, critics of america imaginative and prescient of a world global order such because the Nobel-winning economist Joseph Stiglitz argued that globalisation in its present shape benefited america on the expense of creating nations and staff – whilst creator and activist Naomi Klein targeted at the destructive environmental and cultural penalties of the worldwide enlargement of firm firms.

Mass left-led demonstrations broke out, disrupting international financial conferences together with, maximum famously, the International Industry Group (WTO) in 1999. Right through this “battle of Seattle”, violent exchanges between protesters and police avoided the release of a brand new global business spherical that have been subsidized by means of then US president, Invoice Clinton. For some time, the mass mobilisation of a coalition of business unionists, environmentalists and anti-capitalist protesters gave the impression set to problem the trail against additional globalisation – with anti-capitalism “Occupy” protests spreading around the globe within the wake of the 2008 monetary crash.

A documentary in regards to the 1999 ‘batte of Seattle’, directed by means of Jill Friedberg and Rick Rowley.

In america, an additional critique of globalisation centred on its home penalties for American staff – particularly, task losses and decrease pay – and resulted in requires higher protectionism. Despite the fact that first of all led by means of business unions and a few Democratic politicians, this critique regularly won acquire in radical proper circles who antagonistic giving any position to world organisations just like the WTO, at the grounds that they impinged on American sovereignty. In keeping with this view, most effective by means of preventing international festival whose low wages undercut American staff may just prosperity be restored. Immigration used to be some other goal.

Underneath Donald Trump’s 2nd time period as US president, those criticisms had been remodeled into radical, deeply disruptive financial and social insurance policies – with price lists and protectionism at their center. In so doing, Trump – regardless of all his grandstanding at the global level – has showed what has lengthy been transparent to near observers of US politics and industry: that the American century of worldwide dominance, with the greenback as unrivalled no.1 foreign money, is drawing hastily to a detailed.

Even sooner than Trump first took place of business in 2017, america had begun to withdraw from its management position in world financial establishments such because the WTO. Now, the most powerful a part of its financial system, the hi-tech sector, is beneath intense force from China, whose financial system is already larger than america’s by means of one key measure of GDP. In the meantime, the vast majority of US electorate are dealing with stagnant earning, upper costs and extra insecure jobs.

In earlier centuries, when first France after which Nice Britain reached the tip in their eras of worldwide domination, those transitions had painful affects past their borders. This time, with the worldwide financial system extra intently built-in than ever sooner than and no unmarried dominant energy ready within the wings to take over, the affects may well be felt much more extensively – with very harmful, if no longer catastrophic, effects.

Why nobody is able to take america’s position

In relation to taking on from america as the arena’s main hegemonic energy, the one viable applicants with sufficiently big economies are the Eu Union and China. However there are robust causes to doubt that both may just take in this position – however the truth that in 2022, then US president Joe Biden’s Nationwide Safety Technique referred to as China: “The only competitor with both the intent to reshape the international order and, increasingly, the economic, diplomatic, military and technological power to do so.”

Every now and then Biden’s successor, President Trump, has sounded nearly jealous of the keep watch over China’s leaders exert over their nationwide financial system, and the reality they don’t face elections and bounds on their phrases in place of business. However a one-party, authoritarian political device which lacks criminal tests and balances is a key explanation why China will in finding it arduous to achieve the cultural and political dominance amongst democratic countries that is a part of attaining global no.1 standing – regardless of the affect it already wields in massive portions of Asia and Africa.

China nonetheless faces giant financial demanding situations too. Whilst it’s already the worldwide chief in manufactured items (hastily transferring into hi-tech merchandise) and the arena’s greatest exporter, its financial system continues to be very unbalanced – with a way smaller client sector, a susceptible assets marketplace, many inefficient state industries which are extremely indebted, and a slightly small monetary sector limited by means of state possession. Nor does China possess a world foreign money, regardless of its (restricted) makes an attempt to make the renminbi a really world foreign money.

The Insights phase is dedicated to top of the range longform journalism. Our editors paintings with lecturers from many alternative backgrounds who’re tackling quite a lot of societal and clinical demanding situations.

As I discovered on a reporting travel to Shanghai in 2007 to analyze the results of globalisation, there also are monumental variations between China’s wealthy coastal megacities – whose major thoroughfares rival New York and Paris – and the relative poverty within the inner, particularly in rural spaces. However just about 20 years on from that consult with, with the rustic’s expansion charge slowing, many university-educated younger persons are additionally discovering it arduous to search out well-paid jobs now.

In the meantime Europe – the one different contender to take america’s position as international no.1 – is deeply politically divided, with smaller, weaker economies to the east and south way more sceptical about some great benefits of globalisation, and more and more divided on problems reminiscent of migration and the Ukraine struggle. The demanding situations of accomplishing extensive coverage settlement amongst all member states, and the issue of who can talk for Europe, make it not likely that the EU as these days constituted may just start up and implement a brand new international global order by itself.

The EU’s monetary device additionally lacks the heft of america’s. Despite the fact that it has a commonplace foreign money (the euro) controlled by means of the Eu Central Financial institution, its monetary device is way more fragmented. Banks are regulated nationally, and each and every nation problems its personal executive bonds (even though a couple of eurobonds now exist). This makes it arduous for the euro to exchange the greenback as a shop of worth, and decreases the inducement for foreigners to carry euros as a substitute reserve foreign money.

In the meantime, any long term potentialities of a renewal of US international management glance in a similar fashion unpromising. Trump’s coverage of chopping taxes whilst expanding the scale of america executive debt – which now stands at US$38 trillion, or 120% of GDP – threatens each the steadiness of the arena financial system and the facility of america to finance this mind-boggling deficit.

US nationwide debt hits file excessive. Video: The Financial Occasions.

Tellingly, the Trump management displays no real interest in reviving, and even attractive with, most of the world monetary establishments which The us as soon as ruled, and which assisted in shaping the arena financial order – as US business consultant Jamieson Greer expressed disdainfully within the New York Occasions not too long ago:

Our present, anonymous international order, which is ruled by means of the WTO and is notionally designed to pursue financial potency and keep an eye on the business insurance policies of its 166 member nations, is untenable and unsustainable. The USA has paid for the program with the lack of business jobs and financial safety, and the largest winner has been China.

Whilst america isn’t, to this point, taking flight from the IMF, the Trump management has advised it to name out China for operating any such massive business surplus, whilst forsaking its fear about local weather alternate. Greer concluded that america has “subordinated our country’s economic and national security imperatives to a lowest common denominator of global consensus”.

International with out a international no.1

To know the possible risks forward, we should return greater than a century to the closing time there used to be no international hegemon. By the point the primary global struggle formally ended with the signing of the Treaty of Versailles on June 28 1919, the world financial order had collapsed. Britain, global chief over the former century, now not possessed the industrial, political or army clout to implement its model of globalisation.

The United Kingdom executive, pressured by means of the large money owed it had taken out to finance the struggle effort, used to be compelled to make primary cuts in public spending. In 1931, it confronted a sterling disaster: the pound needed to be devalued as the United Kingdom exited from the gold same old for excellent, regardless of having yielded to the calls for of world bankers to chop bills to the unemployed. This used to be a last signal that Britain had misplaced its dominant position on the earth financial order.

The Nineteen Thirties had been a time of deep political unease and unrest in Britain and plenty of different nations. In 1936, unemployed staff from Jarrow, a the town in north-east England with 70% unemployment after its shipyards closed, organised a non-political “hunger march” to London which turned into referred to as the Jarrow campaign. Greater than 200 males, dressed of their Sunday very best, marched peacefully in step for over 200 miles, gaining nice strengthen alongside the best way. But once they reached London, top minister Stanley 1st earl baldwin of bewdley disregarded their petition – and the boys had been knowledgeable their dole cash could be docked as a result of that they had been unavailable for paintings during the last fortnight.

The Jarrow marchers en path to London in October 1936.

Nationwide Media Museum/Wikimedia

Europe used to be additionally dealing with a serious financial disaster. After Germany’s executive refused to pay the reparations agreed within the 1919 Versailles treaty, pronouncing they might bankrupt its financial system, the French military occupied the German business heartland of the Ruhr and German staff went on strike, supported by means of their executive. The following combat fuelled hyperinflation in Germany. By means of November 1923, it took 200,000 million marks to shop for a loaf of bread, and the financial savings and pensions of the German heart magnificence had been burnt up. That month, Adolf Hitler made his first try to grab energy within the failed “Beer hall putsch” in Munich.

Against this, around the Atlantic, america used to be playing a duration of postwar prosperity, with a booming inventory marketplace and explosive expansion of latest industries reminiscent of automotive production. However regardless of rising as the arena’s most powerful financial energy, having financed a lot of the Allied struggle effort, it used to be unwilling to snatch the reins of worldwide financial management.

The Republican US Congress, having blocked President Woodrow Wilson’s plan for a League of International locations, as a substitute embraced isolationism and washed its arms of Europe’s issues. The USA refused to cancel and even scale back the struggle money owed owed it by means of the Allied countries, who in the end repudiated their money owed. In retaliation, america Congress banned all American banks from lending cash to those so-called allies.

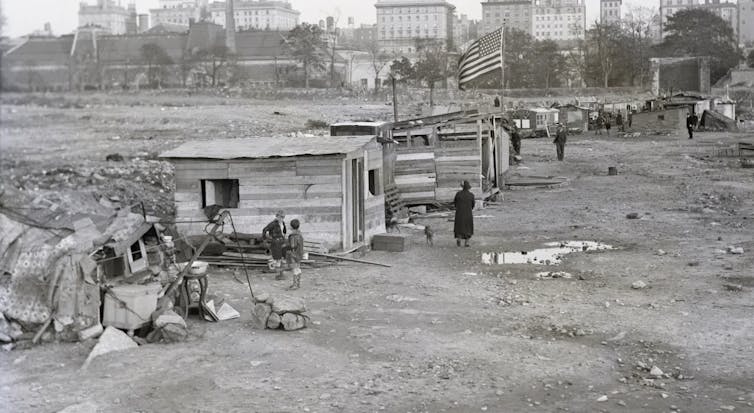

Then, in 1929, the prosperous American “jazz age” got here to an abrupt halt with a inventory marketplace crash that wiped off 1/2 its worth. The rustic’s greatest producer, Ford, closed its doorways for a 12 months and laid off all its staff. With 1 / 4 of the country unemployed, lengthy traces for soup kitchens had been observed in each town, whilst those that have been evicted camped out anyplace they may – together with in New York’s Central Park, renamed “Hooverville” after the hapless US president of that point, Herbert Hoover.

Hooverville in New York’s Central Park throughout the Nice Melancholy.

Hmalcolm03/Wikimedia, CC BY-NC-ND

In rural spaces the place the cave in in agricultural costs intended farmers may just now not make a residing, armed farmers stopped meals and milk vehicles and destroyed their contents in a useless try to restrict provide and lift costs. By means of March 1933, as President Franklin D. Roosevelt took place of business, all the US banking device had floor to a standstill, with nobody ready to withdraw cash from their checking account.

With its focal point in this devastating Nice Melancholy, america refused to get concerned about makes an attempt at world financial cooperation. With out a realize, Roosevelt withdrew from the 1933 London Convention which have been referred to as to stabilise the arena’s currencies – sending a message denouncing “the old fetishes of the so-called international bankers”.

With america following the United Kingdom off the gold same old, the ensuing foreign money wars exacerbated the disaster and additional weakened Eu economies. As nations reverted to mercantilist insurance policies of protectionism and business wars, global business shrank dramatically.

The location turned into even worse in central Europe, the place the cave in of the large Credit score-Anstalt financial institution in Austria in 1931 reverberated across the area. In Germany, as mass unemployment soared, centrist events had been squeezed and armed riots broke out between communist and fascist supporters. When the Nazis got here to energy, they presented a coverage of autarky, chopping financial ties with the west to increase their army system.

The industrial rivalries and antagonisms which weakened western economies cleared the path for the upward thrust of fascism in Germany. In some sense, Hitler – an admirer of the British empire – aspired to be the following hegemonic financial in addition to army energy, growing his personal empire by means of conquering and ruthlessly exploiting the assets of the remainder of Europe.

Bothered by means of rampant hyperinflation, Germans queue up with massive baggage to withdraw cash from Berlin’s Reichsbank in 1923.

Bundesarchiv/Wikimedia, CC BY-NC-SA

Just about a century later, there are some annoying parallels with that interwar duration. Like The us after the primary global struggle, Trump insists that nations america has supported militarily now owe it cash for this coverage. He desires to inspire foreign money wars by means of devaluing the greenback, and lift protectionist obstacles to offer protection to home business. The Nineteen Twenties used to be additionally a time when america sharply restricted immigration on eugenic grounds, most effective permitting it from northern Eu nations which (the eugenicists argued) would no longer “pollute the white race”.

Obviously, Trump does no longer view the loss of world cooperation that would enlarge the harmful financial results of a inventory or bond marketplace crash as an issue that are supposed to fear him. And in lately’s risky global, for the entire US’s previous failings as a world chief, that could be a very being worried proposition.

How america spoke back to the closing monetary disaster

As soon as once more, the foundations of the world order are breaking down. Whilst it’s imaginable that Trump’s way might not be totally followed by means of his successor within the White Space, the path of go back and forth in america will nearly definitely stay sceptical about some great benefits of globalisation, with restricted strengthen for any international financial laws or tasks.

We see equivalent scepticism about some great benefits of globalisation rising in different nations, amid the upward thrust of rightwing populist events in a lot of Europe and South The us – many subsidized by means of Trump. Fuelling those events’ strengthen are rising issues about source of revenue inequality, sluggish expansion and immigration which aren’t being addressed by means of the present political device – and all of which might be exacerbated by means of the onset of a brand new international financial disaster.

With the worldwide financial system and monetary device a ways larger than ever sooner than, a brand new disaster may well be much more serious than the one who happened in 2008, when the failure of the banking device left the arena teetering on the point of cave in.

The dimensions of this disaster used to be remarkable, however key US and UK executive officers moved boldly and hastily. As a BBC reporter in Washington, I attended the Space of Representatives’ Monetary Services and products Committee listening to 3 days after Lehman Brothers went bankrupt, paralysing the worldwide monetary device, to determine the management’s reaction. I be mindful the surprised glance at the face of the committee’s chairman, Barney Frank, when he requested US Treasury secretary Hank Paulson and US Federal Reserve chairman Ben Bernanke how much cash they could want to stabilise the placement:

“Let’s start with US$1 trillion,” Bernanke spoke back coolly. “But we have another US$2 trillion on our balance sheet if we need it.”

Documentary at the cave in of Lehman Brothers financial institution in September 2008.

In a while afterwards, america Congress licensed a US$700 billion rescue package deal. Whilst the worldwide financial system has nonetheless no longer totally recovered from this disaster, it might had been a ways worse – in all probability as unhealthy because the Nineteen Thirties – with out such intervention.

World wide, governments ended up pledging US$11 trillion to ensure the solvency in their banking methods, with the United Kingdom executive striking up a sum an identical to the rustic’s whole every year GDP. But it surely used to be no longer simply governments. On the G20 summit in London in April 2009, a brand new US$1.1 trillion fund used to be arrange by means of the Global Financial Fund (IMF) to advance cash to nations that had been coming into monetary problem.

The G20 additionally agreed to impose harder regulatory requirements for banks and different monetary establishments that will follow globally, to exchange the susceptible law of banks that have been one of the most major reasons of the disaster. As a reporter at this summit, I recall standard pleasure and optimism that the arena used to be in spite of everything operating in combination to take on its international issues, with the host top minister, Gordon Brown, in short sparkling within the limelight as organiser of that summit.

In the back of the scenes, america Federal Reserve had additionally been operating to comprise the disaster by means of quietly passing directly to the arena’s different main central banks just about US$600 billion in “currency swaps” to make sure that they had the greenbacks they had to bail out their very own banking methods. The Financial institution of England secretly lent UK banks £100 billion to make sure they didn’t cave in, even though two of the 4 primary banks, Royal Financial institution of Scotland (now NatWest) and Lloyds, in the end needed to be nationalised (to other extents) to stay the monetary device solid.

Then again, those rescue applications for banks, whilst a lot had to stabilise the worldwide financial system, didn’t lengthen to most of the sufferers of the crash – such because the 12 million US families whose properties had been now price lower than the loan that they had taken out to pay for them, or the 40% of families who skilled monetary misery throughout the 18 months after the crash. And the ramifications of the disaster had been even higher for the ones residing in creating nations.

A couple of months after the 2008 monetary disaster started, I travelled to Zambia, an African nation completely depending on copper exports for its foreign currency echange. I visited the Luanshya copper mine close to Ndola within the nation’s copper belt. With call for for copper (used principally in development and automotive production) collapsing, the entire copper mines had closed. Their staff, in one of the most few well-paid jobs in Zambia, had been compelled to go away their at ease corporate properties and go back to sharing with their kinfolk in Lusaka with out pay.

Zambia’s executive used to be compelled to close down its deliberate poverty relief plan, which used to be to be funded by means of mining earnings. The cave in in exports additionally broken the Zambian foreign money, which dropped sharply. This hit the rustic’s poorest other people arduous because it raised the cost of meals, maximum of which used to be imported.

The ripple results of the 2008 international monetary disaster quickly hit Luanshya copper mine in Zambia.

Nerin Engineering Co., CC BY-SA

I additionally visited a flower farm close to Lusaka, the place Dutch expats Angelique and Watze Elsinga have been rising roses for export for over a decade – using greater than 200 staff who got housing and training. As the marketplace for Valentine’s Day roses collapsed, their bankers, Barclays South Africa, abruptly ordered them to straight away pay off all their loans, forcing them to promote their farm and push aside their staff. In the end, it took a US$3.9 billion mortgage from the IMF and International Financial institution to stabilise Zambia’s financial system.

Will have to some other international monetary disaster hit, it’s arduous to peer the Trump management (and others that apply) being as sympathetic to the plight of creating nations, or permitting the Federal Reserve to lend primary sums to international central banks – except this is a nation politically aligned with Trump, reminiscent of Argentina. Least most likely of all is the theory of Trump operating with different nations to expand a world trillion-dollar rescue package deal to assist save the arena financial system.

Relatively, there’s a actual concern that reckless movements by means of the Trump management – and susceptible international law of monetary markets – may just cause the following international monetary disaster.

What occurs if america bond marketplace collapses?

Financial historians agree that monetary crises are endemic within the historical past of worldwide capitalism, and they have got been expanding in frequency for the reason that “hyper-globalisation” of the Seventies. From Latin The us’s debt disaster within the Nineteen Eighties to the Asia foreign money disaster within the overdue Nineteen Nineties and america dotcom inventory marketplace cave in within the early 2000s, crises have steadily devastated economies and areas around the globe.

These days, the best possibility is the cave in of america Treasury bond marketplace, which underpins the worldwide monetary device and is concerned about 70% of worldwide monetary transactions by means of banks and different monetary establishments. World wide, those establishments have lengthy looked america bond marketplace, price over $30 trillion, as a secure haven, as a result of those “debt securities” are subsidized by means of america central financial institution, the Federal Reserve.

An increasing number of, the unregulated “shadow banking system” – a sector now higher than regulated international banks – is deeply concerned within the bond marketplace. Non-bank monetary establishments reminiscent of non-public fairness, hedge price range, undertaking capital and pension price range are in large part unregulated and, in contrast to banks, aren’t required to carry reserves.

Bond marketplace jitters are already unnerving international monetary markets, which concern its unravelling may just precipitate a banking disaster at the scale of 2008 – with extremely leveraged transactions by means of those non-bank monetary establishments leaving them uncovered.

US bonds play a key position in keeping up the steadiness of the worldwide financial system. Video: Wall Side road Magazine.

Consumers of US bonds also are stricken by means of the Trump management’s plan to boost america deficit even upper to pay for tax cuts – with the nationwide debt now forecast to upward thrust to 134% of US GDP by means of 2035, up from 120% in 2025. Will have to this result in a standard refusal to shop for extra US bonds amongst jittery buyers, their worth would cave in and rates of interest – each in america and globally – would bounce.

The governor of the Financial institution of England, Andrew Bailey, not too long ago warned that the placement has “worrying echoes of the 2008 financial crisis”, whilst the top of the IMF, Kristalina Georgieva, stated her worries in regards to the cave in of personal credit score markets occasionally stay her conscious at evening.

A nasty state of affairs would develop even worse if issues within the bond marketplace precipitate a pointy decline within the worth of the greenback. The sector’s “anchor currency” would now not be observed as a secure retailer of worth – resulting in extra withdrawals of price range from america Treasury bond marketplace, the place many international governments grasp their reserves.

A weaker greenback would additionally hit US exporters and multinational firms by means of making their items dearer. But extremely, that is exactly the route advocated by means of Stephen Miran, chair of america president’s Council of Financial Advisors – who Trump seems to wish to be the following head of the Federal Reserve.

One instance of what may just occur if bond markets change into destabilised happened when the shortest-lived top minister in UK historical past, Liz Truss, introduced massive unfunded tax cuts in her 2022 price range, inflicting the price of UK gilts (the an identical of US Treasury bonds) to plummet as rates of interest spiked. Inside of days, the Financial institution of England used to be compelled to position up an emergency £60 billion rescue fund to steer clear of primary UK pension price range collapsing.

With regards to a US bond marketplace crash, alternatively, there are rising fears that america executive could be not able – and unwilling – to step in to mitigate such harm.

A brand new generation of monetary chaos

Simply as being worried could be a crash of america inventory marketplace – which, by means of ancient requirements, is these days hugely hyped up.

Large fresh will increase in america inventory marketplace’s total worth had been pushed nearly solely by means of the “magnificent seven” hi-tech firms, which by myself make up a 3rd of its overall worth. If their giant guess on synthetic intelligence isn’t as profitable as they declare, or is overshadowed by means of the luck of China’s AI methods, a pointy downturn, very similar to the dotcom crash of 2000-02, may just effectively happen.

Jamie Dimon, head of america’s greatest financial institution JPMorgan Chase, has stated he’s “far more worried than other [experts]” a few critical marketplace correction, which he warned may just come within the subsequent six months to 2 years.

Giant tech executives had been overoptimistic sooner than. Reporting from Silicon Valley in 2001 because the dotcom bubble used to be bursting, I used to be struck by means of the unshakeable trust of web startup CEOs that their percentage costs may just most effective pass up.

Moreover, their firms’ excessive inventory valuations had allowed them to take over their competition, thus restricting festival – simply as firms reminiscent of Google and Meta (Fb) have since used their extremely valued stocks to buy key property and attainable opponents together with YouTube, WhatsApp, Instagram and DeepMind. Historical past suggests that is all the time unhealthy for the financial system in the end.

With the industry and monetary worlds now ever extra intently related, no longer most effective has the frequency of monetary crises higher within the closing half-century, each and every disaster has change into extra interconnected. The 2008 international monetary disaster confirmed how bad this may also be: a world banking disaster precipitated inventory marketplace falls, collapses within the worth of susceptible currencies, a debt disaster in creating nations – and in the end, a world recession that has taken years to recuperate from.

The IMF’s newest monetary steadiness record summarised the placement in being worried phrases, highlighting “elevated” steadiness dangers on account of “stretched asset valuations, growing pressure in sovereign bond markets, and the increasing role of non-bank financial institutions. Despite its deep liquidity, the global foreign exchange market remains vulnerable to macrofinancial uncertainty.”

The IMF has warned about instability within the international monetary device. Video: CGTN The us.

I consider we could also be getting into a brand new generation of sustained monetary chaos throughout which the seeds sown by means of the demise of globalisation – and Trump’s reaction to it – in spite of everything shatter the arena financial and political order established after the second one global struggle.

Trump’s excessive and unevenly carried out price lists – aimed maximum strongly at China – have already made it tricky to reconfigure international provide chains. Much more being worried may well be the combat over the keep watch over of key strategic uncooked fabrics just like the uncommon earth minerals wanted for hi-tech industries, with China banning their export and america threatening 100% price lists in go back (in addition to hoping to take over Greenland, with its as-yet-untapped provide of a few of these minerals).

This war over uncommon earths, necessary for the pc chips wanted for AI, may just additionally threaten the marketplace worth of high-flying tech shares reminiscent of Nvidia, the primary corporate to exceed US$4 trillion in worth.

The fight for keep watch over of crucial uncooked fabrics may just escalate. There’s a risk that during some instances, business wars would possibly change into actual wars – simply as they did within the former generation of mercantilism. Many fresh and present regional conflicts, from the primary Iraq struggle aimed on the conquest of the oilfields of Kuwait, to the civil struggle in Sudan over keep watch over of the rustic’s goldmines, are rooted in financial conflicts.

The historical past of globalisation during the last 4 centuries means that the presence of a world superpower – for all its destructive facets – has introduced some extent of monetary steadiness in an unsure global.

Against this, a key lesson of historical past is {that a} go back to insurance policies of mercantilism – with nations suffering to grab key herbal assets for themselves and deny them to their opponents – is perhaps a recipe for perpetual war. However this time round, in an international filled with 10,000 nuclear guns, miscalculations may well be deadly if agree with and simple task are undermined.

The demanding situations forward are immense – and the weak point of world establishments, the restricted visions of maximum governments and the alienation of many in their electorate aren’t constructive indicators.

That is the second one in a two-part sequence. When you neglected it, learn section one right here.

For you: extra from our Insights sequence: