The fitting to be forgotten – this software that permits after remedy now not pronounces that you’ve got had a most cancers prior to now – does it facilitate get right of entry to to the mortgage, particularly actual property, for previous and previous sufferers? Sure, it reacts to a learn about taken with other people with the historical past of pediatric most cancers or breast most cancers, even though its results stay restricted in circumstances of breast most cancers. At the instance of “Pink October”, we take inventory.

What if the surviving most cancers was once now not sufficient to show the web page? In France since 2016. was once “right to forgotten” (underneath Article 190. 2016-41 of 26. January 2016. modernization of our well being machine) permits us to most cancers to now not point out their illness throughout the mortgage and borrower. This legislation, the pioneer in Europe, aimed to struggle invisible, however consistently monetary discrimination: issue in getting access to a mortgage because of most cancers historical past.

We did an extraordinary learn about to baptized Eločana, which has simply esteemed results in individuals are handled for breast most cancers or for various kinds of most cancers throughout adolescence.

Its effects display that, if the chance of assembly difficulties, it’s considerably falling, particularly in former sufferers in kids’s most cancers, there have been brakes for other people handled from breast most cancers. The promise of deletion of the scientific previous on occasion seems towards the complexity of person scenarios and the time wanted for use “the right to be forgotten”.

Supply: Sorbonne College (symbol to be used). For former sufferers, issue acquiring a loan

In line with the Nationwide Institute of Most cancers (Inca), 3.8 million other people in Continental France had a prognosis of most cancers throughout his existence. In 2023, a breast most cancers was once hit, and the survival price upper than many different most cancers, achieving 88% in 5 years throughout the duration 2010-2015. Kid carcinomas are rarer, with lower than 2,000 circumstances in step with 12 months in comparison to 15 years, however are related with regards to forecast, a five-year survival price expanding at 85% within the duration 2010-2016. Those vital survival charges building up new problems.

Get admission to to the mortgage, which particularly refers to younger previous most cancers sufferers, is the most important factor as a result of it could actually considerably have an effect on subject matter stipulations of existence and thus well-being. In line with the “history” of existence and heritage, “the survey on lack of confidence, one in France. Most effective mortgages is to one of the crucial 3 years of age, previously sufferers, a mortgage means is because of a subscription requirement now and then inaccessible mortgage insurance coverage.

If truth be told, because of the chance of repetition or long-term results of most cancers, insurance coverage firms can hesitate to use better bonuses, except for sure varieties of promises corresponding to new most cancers, and even refusing to safe an individual.

Most cancers can due to this fact create social inequalities, particularly in international locations corresponding to France, the place get right of entry to to mortgage is a prerequisite for the acquisition of housing, which limits the facility of former sufferers to get right of entry to assets.

Within the French survey Vinkin on residing stipulations after grownup cancers, 17% of other people attempted to get a loan or skilled mortgage inside of 5 years of prognosis. In a learn about in line with grownup cohorts healed from pediatric cancers, 31% of respondents stated they met with issue throughout their lives to get right of entry to a mortgage for loan after most cancers. Those difficulties had been first associated with declared a most cancers insurer, and rather a bit well being of the individual involved.

You do not need to claim your most cancers historical past for 5 years

Followed in 2016. years, the suitable to fail to remember that for ex-patient’s historical past after a undeniable duration (5 years for most cancers ahead of 21. December, ten years after the cancers that seemed after). A wonder means or closed wonder is conceivable ahead of that during sure circumstances described intimately within the reference networks followed by means of the Conference “to ensure and borrowed with a worsened health risk”, referred to as AERAS settlement.

In 2022. 12 months, Lemo’s Regulation (Regulation no. 2022-270. For fairer get right of entry to, more effective and extra clear to the Lender Insurance coverage marketplace) reduced to 5 years a duration of true proper to be forgotten, without reference to the age for prognosis. This legislation additionally got rid of well being questionnaires for sure loans.

What results of the suitable to be forgotten to get right of entry to the mortgage insurance coverage?

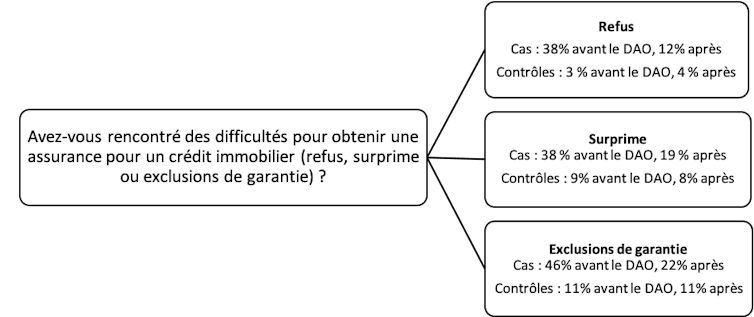

The eloic learn about aimed to guage the consequences of the suitable to be forgotten the relief of difficulties which might be former sufferers with cancers referring to get right of entry to to get right of entry to to debtors. Difficulties are outlined as though they pay a wonder, that have exclusions from guaranty or any insurance coverage proposal was once rejected by means of the insurer.

We’ve got asked that the participation of former sufferers handled for pediatric carcinoma or for breast most cancers, in addition to other people (witnesses “) with out the historical past of most cancers. Contributors had been most commonly mobilized in the course of the Butnelles platform and FCCSS COHORT.

The difficulties of getting access to the debtors who reported former sufferers and witnesses used to make use of the “pre” in the past “previously” in the past “before” in the past and evaluating the questionnaire-based questionnaire and in comparison between teams (following approach “before” “before-after “managed learn about” before “ahead of” before they are forgotten the group (“paired”). The quantity of assured capital and variables, the information assortment (information assortment, is stopped in 2022. 12 months and don’t be mindful the improvement of occasions in Lemoin legislation.

Problem get right of entry to to mortgage investigating after breast most cancers

The consequences display that the likelihood of getting difficulties in acquiring a mortgage reduced considerably after the adoption of the suitable to be forgotten. Of the 552 paired respondents, the difficulties in getting access to the mortgage insurance coverage reported 65% of circumstances towards 16% of witnesses ahead of the suitable to be forgotten for 35% of 15% of witnesses after the suitable to be forgotten. Those variations had been vital statistically when all members had been concerned.

But if the analyzes made the variation in the kind of most cancers, we understand that the effects don’t seem to be vital for the subpopulation of other people handled within the breast most cancers, even though we spotted a vital relief in issue ahead of and after the legislation. The detailed result of this Learn about funded by means of the Nationwide Institute of Most cancers (INCA_15900) are to be had right here in loose accinis.

Forms of difficulties signed in on the request of the Borrower in line with circumstances and witnesses, ahead of and after the adoption of the suitable to oblivion (supplied), elocan studio, paired trend (n = 552). The writer is supplied (with out use)

In conclusion, 5 years after the truth of the suitable to oblivion, there’s a vital relief within the percentage of former sufferers with most cancers present in difficulties. Alternatively, hindrances remained in the usage of this proper, particularly for other people handled in adults with adults who had to wait ten years ahead of they may get pleasure from it. If truth be told, ladies infiltrated by means of breast most cancers maximum steadily needed to wait ten years after the top of remedy, this era was once decreased to seven years since 2019. years for sure varieties of breast most cancers (so flooded most cancers “stadium and”.

The brand new Regulation on Lemoini, wherein the relief of all cancers are undertaken till 5 years after the top of remedy, which envisages the abolition of well being questionnaires underneath sure stipulations, is a big advance. As well as, the Aeras Conference continues to put up reference networks that let for attention of scientific development.

In 2024. years 8 different Ecu international locations (Belgium, Cyprus, Spain, Italy, Netherlands, Portugal, Romania, Slovenia followed or carried out law impressed by means of French oblivion. A number of associations of sufferers in Europe referred to as for a prolongation of the suitable to fail to remember all Ecu international locations.

You’re going to to find additional info at the eloča learn about on its website online.

This analysis paintings was once carried out with collaboration Morgan Michel, Aurelie Bourmaud, Moreno Ursino, Asma Janah, Tienhan Sandrine Dabakuio Ionly, Emerline Assogba, Nadia Haddi, Florent de Vathaire.