Do financial failures, like disaster Cowvi-19, have an have an effect on on monetary funding conduct? It strikes with an excessive drop in worth, are traders much less susceptible to making an investment then? Within the middle of the research, the frequency of macroeconomic failures is perceived. The extra we overestimate, the extra cautious we’re on the subject of monetary investments. However the parade exist!

Macroeconomic failures are characterised by way of deep and lasting slopes of gross home product (GDP), more than 10% over a protracted length. They’re the results of wars, monetary crises, pandemic or climatic failures. Even supposing they’re hardly ever happening, they’ve nice penalties on the earth economic system. Earlier analysis has proven that those “rare catastrophes” performed a very powerful position in figuring out urge for food for the danger of monetary traders. On the other hand, the best way during which financial actors understand this disaster stay poorly perceive.

This text investigates the belief of frequency of macroeconomic failures and affect selections on monetary investments. It additionally analyzes the unfold of details about previous macroeconomic failures, questioning if it permits folks to higher assess the frequency of those catastrophes and cause them to extra environment friendly funding selections.

Essential cognitive bias

The belief of uncommon occasions is matter to behavioral bias because of their rarity in financial historical past and occasions imprints on minds when settled. So, earlier than the disaster happens, folks continuously generally tend to underestimate the chance of this sort of match. However after a unprecedented match came about, the danger belief is continuously exaggerated, with trust that new failures are inevitable.

This phenomenon will also be defined by way of a “recession”, a cognitive group that attaches over the top significance to contemporary and outstanding occasions, as proven by way of exploration of Tver and Kahneman.

The disaster and its penalties and its penalties at the global economic system have imagined the find out about of macroeconomic failures. Now not most effective is the pandemic brought about a impressive decline in monetary markets, but additionally modified the belief of choices on financial dangers and folks. In keeping with contemporary research, individuals who have skilled vital losses all over the well being disaster thus shape extra pessimistic expectancies referring to financial restoration and are extra prone to be dangerous investments, leading to a vital drop in financial savings.

Systematic overestimation of failures

To raised know how folks revel in frequency of macroeconomic failures, an experimental find out about with monetary incentives used to be carried out in 2023-2024 with two teams of contributors in France: 346 Finance specialists and 590 non-professional folks from the overall inhabitants. The concept is the fundamental find out about of those two populations is that monetary wisdom and follow will probably be a very powerful provision of bias in perceptions and fiscal selections of people.

The historic frequency of macroeconomic failures is outlined as quite a lot of failures within the historic pattern of greater than 6,000 actual observations of GDP consistent with capita from 1870. to 2021. Out of 42 nations in numerous areas of the arena. This pattern is in accordance with the historic knowledge set of Barro and Ursu (2008), by way of 2021. years during which the chance is the chance of the episode of crisis 3% consistent with 12 months.

The result of the find out about display that contributors systematically overestimate the historic frequency of macroeconomic failures. On reasonable, non-Knowledgeable assessed that the frequency of macroeconomic failures in historic knowledge pattern used to be 21.8%. Even specialists overestimated crisis frequency, with a mean estimate of 15%.

Determine 1 – reasonable evaluate (and 95% reliability period) frequency of macroeconomic failures

The writer’s chart, which is the writer who submitted unfinished in dangerous monetary property

This overestimity had the effects for the contributors’ funding selections. Members, in the second one step, distribute a certain quantity between risk-free property, reporting with low yield and dangerous manner, providing prime go back to the loss of macroeconomic failures and a unfavourable go back in case of crisis. The imaginable phenomenon of the crisis used to be decided by way of randomly unresolved drawing calibrated to the frequency of macroeconomic failures within the historic pattern.

The consequences display that the overestimity of the frequency of macroeconomic failures said contributors to spend money on dangerous property, lowering the win.

The position of conversation

Confronted with this marked overestimation of macroeconomic failures by way of two teams of contributors, it’s requested to keep in touch on the true frequency of those excessive occasions or assist correcting mistakes in evaluate and after all enhance decision-making in monetary funding?

To reply to this query, the find out about integrated 3 knowledge remedies. The primary of them consisted of informing contributors that 3 macroeconomic failures had been noticed on 100 historic knowledge with greater than 6,000 observations from the database. The second one has given extra actual knowledge to contributors who point out that 30 macroeconomic failures had been noticed on 1,000 historic knowledge. The 3rd remedy used to be very similar to the primary, but additionally supplied contributors with a short lived description of 3 particular, contemporary and sticking out macroeconomic failures: Greece debt disaster (2008-2013) and Pandemic episodes of Cavid-19 in the UK and Spain.

The aim of this remedy used to be to check whether or not folks react in a different way when receiving knowledge on occasions in time and geographically.

Prefected perceptions

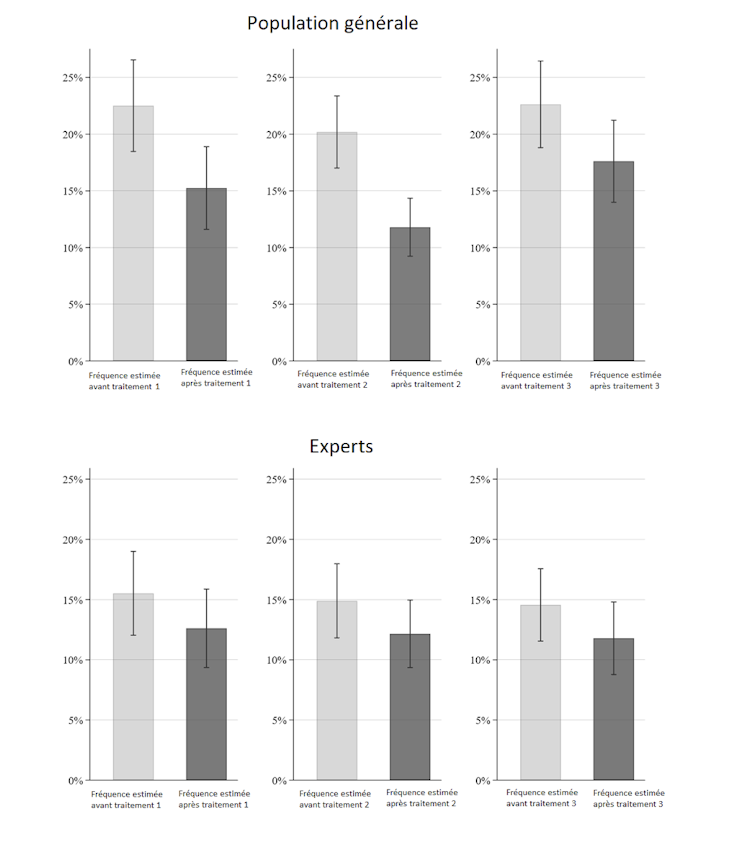

The consequences confirmed that, certainly, offering contributors in knowledge at the historic frequency of macroeconomic failures lets them evaluate their belief of this frequency in the fitting course. After receiving knowledge, specialists and non-experts revised their estimates, as two charts had been confirmed underneath. Due to this fact, they put aside maximum in their funding in dangerous property.

Determine 2 – Comparability of evaluate of the frequency of macroeconomic failures in response to knowledge remedy for common inhabitants and for the inhabitants of specialists (reasonable and reliability periods at 95%)

Graphics that authors submitted by way of authors

On the other hand, if the accuracy of the supplied knowledge didn’t have a vital have an effect on at the evaluate of the fertilization of failures, each for non-professionals, knowledge introduced in a identical and urban approach had a distinct have an effect on on non-experts. The latter weighed to offer extra weight to contemporary occasions and that, due to this fact, much less diminished their evaluate of the frequency of macroeconomic failures after the reception of knowledge in comparison to different circumstances.

BANKUE DE FRANCE, 2021. Implications for monetary conversation

The result of this find out about have vital sensible implications referring to monetary conversation. Communique at the historic frequency of macroeconomic failures can considerably have an effect on the perceptions of this sort of excessive selections on menace and fiscal investments on account of it.

Offering quantitative knowledge on macroeconomic failures can enhance their belief of traders and cut back inadequate information in dangerous assets, particularly amongst non-experts. On the other hand, the have an effect on of this conversation will depend on the best way the tips is gifted and the general public geared toward. The precision of the tips does no longer seem to be as the most important as a connection with outstanding and up to date examples, particularly for the overall inhabitants.