The monetary measurement of pensions will have to no longer dim the opposite crucial measurement: the philosophy of the device. To verify its upkeep, the primary of cohesion will have to no longer be dimmed, however to the contrary, it’s revived.

The Non-Nazing of presidency Bairou rests and might be in accordance with the Capability of French and their representatives in parliament to regulate essentially the most tough device of cohesion within the nation: withdrawal of distribution. This cohesion, which is the results of the will to behave jointly to beef up the dwelling stipulations of all, is within the center of the French Social Type “.

Remark is important. Regardless of the most recent reform, the device stays in deficit, lately will stay someday: it merely implies that products and services are upper than perceived contributions. Or, another way, he mentioned that cohesion used to be too beneficiant and / or that the hassle of cohesion used to be inadequate. Subsequently, this “common good” used to be that the pension device should adapt to the advance in our society.

Cohesion dividend

To do that, we wish to maintain a discourse according to the philosophy of cohesion for the program, and to not transfer to an individualistic discourse in accordance with “acquired rights”, in keeping with which, in terms of the advantages received after social struggles, The rights can be inalienable and due to this fact sufficient for the brake, even preventing, any device reforms, which is immersed within the setting advanced.

Because the desk under presentations, sums of pensions which are experiencing each and every era (from those that started running within the Nineties, so long as those that began their occupation within the Nineties) years) are a long way exceeding the quantities of contributions paid. Subsequently, the euro contributed to retirement to go back from 6.26% for the initials of era in 1940. to 0.73% for era beginning in 1990. years. Years. This go back isn’t monetary source of revenue, but in addition a dividend of cohesion.

Stylized evolution of retirement contributions and advantages according to the 12 months of running on the planet of labor. Authors calculations

Supply: Inse information (2021), Cor (2024) and Cor (2023), Jane (2022) and the writer's budgets).

Variable amplitude cohesion

This cohesion will also be roughly necessary, relying at the evolution of contribution sources. Subsequently, people who began their occupation within the Nineteen Eighties will have the benefit of pensions 1.49 occasions upper than their contributions to the pension device. Certainly, the next generations, which fund their pensions have a bigger measurement (which extra approach expanding the sum of contributions) and to provide extra (upper salaries additionally build up and contributions).

However for the reason that Seventies, the selection of staff and manufacturing manufacturing in step with employee has declined. Certainly, within the Seventies there have been 3.1 workers for 1 pensioner, whilst within the 2020s there have been only one.47 workers for retirement. In the end, a person since 1960. had a median income at his 90% occupation top than what he began within the Nineteen Fifties, whilst the only used to be going to earn handiest 30% greater than what he began in 1980. years.

Steady adaptation

The sustainability of the pension device comes to steady adjustment of demographics and productiveness. The desk above indicates what has already been accomplished: contribution fee greater from 7% to twenty-five% within the quantity of 37.5 years to 43 years and length of 18 to 26, and the pension multiplied via 2.5.

To keep this cohesion between generations, making sure that retirees approaches the similar shopper items as those that paintings, it can be crucial to get sufficient fortune. Because the selection of contributions to scale back productiveness is all vulnerable, the sustainability of the pension device can’t be interpreted within the paintings effort of each and every, which will have to due to this fact be interpreted as a person contribution of each and every citizen to nationwide cohesion.

In France, with the typical pension years, in 61. 12 months in 2019. years and a life-time of 25 years to 60 years, the pensioner will have the benefit of 4 years since its German colleagues (see CR 2019). In fact, as a result of all careers don’t seem to be similar, the extension of the task of each and every will wish to remember those specifics.

Pensioner contribution

In the end, pensioners are extensively utilized: price range efforts that everybody shared that reform might be extra applicable via all. On the fiscal stage, 10% relief of source of revenue tax, in addition to diminished CSG from which you want to discuss retirees. In the case of pensions, whether it is indeniable that pensions should supply a minimal dwelling usual, it’s extra questionable than “living standards”: 10%, that have essentially the most pensions perceived 23.6% of all abnormal pensions (26.6)% if we believe Incomplete careers (see the picture under, in addition to Jejahov, 2019)

France 24, 2023.

Those effects recommend that pension cap will also be offered, with out making use of the device cohesion device. Certainly, cohesion can’t with out somebody and everybody's involvement should be noticed as a civil responsibility. Understand that the relief of disbursed pensions associated with the rise in task is without doubt one of the handiest measures to scale back executive debt with the preservation of expansion and no longer inequality (see Cepremap, 2024).

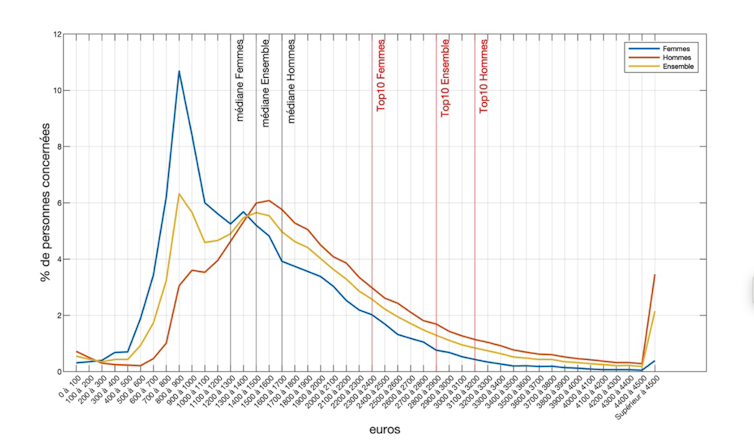

Distribution of uncooked subject matter pensions for people with complete occupation (jersey jersey, 2019)

Paintings in the end

Social companions, co-manageable of the program from its introduction, take into account that those ideas supply lengthy cohesion between generations: from 2018. years, further pensions controlled via surpluses. Decided on officers, particularly if they’re prone to cohesion, should depart their short-lived issues that their re-affairs constitute them to paintings at the long-term sustainability of the pension device via enforcing in want of prone effort. This could also be the involvement of extending the length of contributions and contributions from present retirees.

In the end, take into account that the extension of the task, started within the heart -1990, has no longer resulted in an build up in inaction between 55 and 64 years, the concept that those that had been unemployed between 55-60 years prior to retirement then compelled to proceed To be between 60 and 64 because of the decline in pension ages (see Zemmour, 2024).

The information display (see 2023 and Langot 2024), to the contrary, that could be a massive a part of the 55-59 and 60-year-old fee greater from 50% in 1995. 12 months in 1995. at 77% lately), which Lately, it’s behind schedule 62-64 years decline within the aged employment fee (55-59 employment charges greater from 11% in 2000. at 41%, figuring out that 47% of this age staff is already retired.

The approaching pension reforms should combine an build up in employment of the aged, which is socially very helpful (build up manufacturing, and, no longer conceivable from cohesion), and to not make this a precondition for the desired build up within the selection of years of subscription.