Calling American citizens to “Drilling”, Donald Tramp is the oil trade champion. Who will receive advantages? The overall end result within the international marketplace, in addition to within the uncooked subject material marketplace, is determined by the reactions of each and every birthday party. However the coherence of the Power and Business Coverage of the White Space.

Throughout his inaugural speech 20. January 2025. yr, Donald Tramp showed that the USA would once more turn into a “rich nation, and liquid gold under our feet will help us with this.” Those phrases are rarely unexpected, as a result of all through its marketing campaign now, the United States president repeatedly used the Republican slogan “Lumber, darling, in 2008. years, to suggest a plan for mass intensification in case of re-election. .

On this context of a state of emergency power situation this is D. The Tramp declared the primary day of his time period, what penalties of oil markets may just His coverage be geared toward an important building up in crude oil manufacturing in the USA?

Strengthening American Petroleum energy

The USA, the second one biggest shopper of power and the second one biggest CO2 broadcaster, once more changed into a number one oil manufacturer because the mid-2010. The rising dynamics in their manufacturing of crude oil noticed from the top of 2000 (Determine 1) – particularly because of the exploitation of unconventional oils – it has enabled them from 2017. take the location of main producers from Saudi Arabia and Russia.

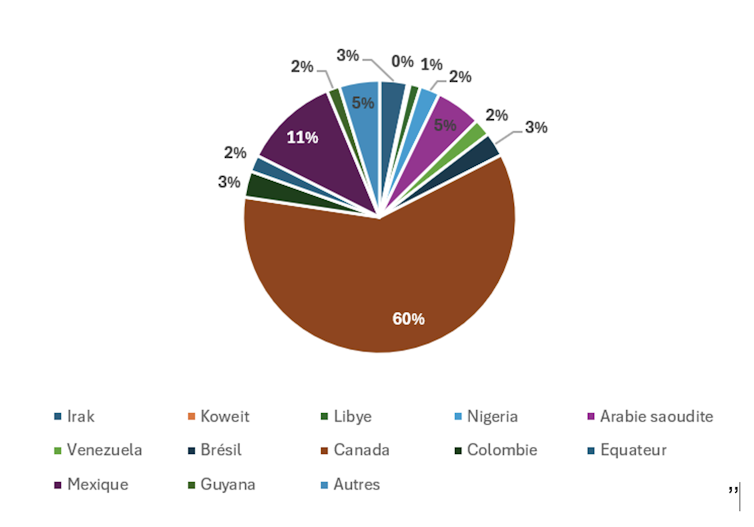

Even though the USA is the sector's biggest shopper of crude oil, their imports had been considerably decreased. In 2023. they imported 6.5 MBD, of which just about 60% have been simplest from Canada (Determine 2). Not up to 16% of U.S. shares come from international locations organizing oil export international locations (OPEC), not up to 10% from the Persian Bay international locations, which is a historic low stage.

Determine 1: Petroleum manufacturing in the USA (1920-2024) in thousands and thousands of barrels in step with day

The creator is supplied (with out reuse)

Supply: EIA, 2024

Smaller habit from Saudi oil

It’s attention-grabbing to note that the 2 international locations that have been on the goal of exterior coverage – Mexico and Canada – because of problems associated with immigration or possible territorial conquests, additionally the ones equipped by means of 70% of U.S. stations.

Making improvements to the power sovereignty of the USA and their now dependence on international locations similar to Saudi Arabia (about 5.5% in 2023, in comparison to greater than 17% of the yr previous) its weight and marketplace energy in oil markets and their family members with Center Jap international locations.

Determine 2: The biggest oil providers in the US 2023

The creator is supplied (with out reuse)

Supply: EIA, 2024

Accumulation of uncertainty within the international marketplace

D. The tramp needs to fee American oil markets comes within the context of uncertainty within the sector:

medium-term uncertainty in regards to the possible height call for introduced by means of the Global Power Company (IEA) on the finish of the last decade (decade later for the OPEC); uncertainty just for 2025. yr because of imaginable oils of oil; Very momentary uncertainty the place costs are disrupted with a large number of elements.

In point of fact, together with very tough climate in the USA, additional relief of American oil shares on the lowest stage of 2022. 12 months, in addition to the revision of the relief of oil forecasts IE for 2025. Considerably raised costs crude oil. After achieving the height in mid-January, costs are Faded, which is speeded up by means of inauguration D. Tramp and uncertaints that experience brought about quite a lot of presidential decrees available on the market.

New imbalances?

The present marketplace worry arises particularly from present steadiness audits and be offering expectancies and insist. In its newest record on oil markets, due to this fact revised the excess of provide for 2025. (About 0.7 MBD in comparison to 1 MBD previous), a controversy building up in wintry weather call for and imaginable relief within the first months of the yr. . The IEA additional assesses that the strengthening of the sanctions of Iran and Russia may just totally rebalance the 2025 marketplace. Withdrawal of manufacturing from those two international locations. In his newest anticipation practices, the American Ministry of Power for its phase envisages a marketplace with a gentle surplus, emphasizing sturdy present geopolitical uncertainty.

Simplest the OPEC supplies marketplace deficit with call for expansion projection of virtually 1.45 MBD in 2025. (in comparison to 1 MBD for IEA and 1.3 for the United States Division of Power) and a 1.5 MBD be offering projection. On this context, further American manufacturing out there would theoretically incorrectly imbalancing. Certainly, this appears to be the second one factor lately is already within the surplus given other estimates. The projections of the United States Division of Power, made earlier than inauguration, on the other hand, display just a small building up on this manufacturing all through 2025. (About 13.5 MB / d) and over 2026. (13.6 Mb / d).

Threats to international business

The oil issue can’t be remoted from different present financial problems. At the one hand, the commercial context was once noticed in China (primary issue that contributes to the expansion of call for for oil) does no longer inspire optimism, and however, the commercial global stays suspended from the Tariff Coverage equipped by means of the USA consistent with its primary buying and selling companions. The new CEPII notice displays that an building up in customs to import from all international locations by means of 60% resulted from a discount in international exports of three.4% by means of scale and an international GDP of 0.5%, which inevitably affected the oil oil.

The 2 international locations that may be maximum suffering from this coverage could be China and the USA, which might be in opposition to Donald tramp pursuits that deliberate all through their inauguration

“The American dream will come back and progress like never before …”

France 24. January 2025. Buying and selling Oil Coverage?

Want D. The tramp to hurry up the manufacturing of crude oil on American territory faces the targets that paintings right here as contradictory on the subject of power and business politics. To start with, this is a stimulating relief in power costs within the American marketplace with a view to struggle inflation. This impact, on the other hand, will have to no longer be reimbursed by means of expanding the costs of different uncooked fabrics and shopper items to which the rise in customs would essentially affect. Alternatively, power lately represents just a small proportion in the fee index in the USA (not up to 6.5%), whilst intake of products (with out power and meals) is rising by means of virtually 18%.

On this context, business coverage D. The tramp would totally thwart his want to distribute the buying energy to his voter frame. As well as, in low value environments, incentives for oil manufacturers to extend manufacturing would essentially be decreased. Alternatively, the uncertainty frightening the tramp management is not going to provide the context of steadiness for manufacturers except they consider an excellent coverage of subsidies.

OPEC Response

Alternatively, right here, even supposing they’ve fallen for a number of months, rates of interest stay prime and aren’t anticipated that the United States Central Financial institution will make any profound adjustments because of present financial and geopolitical uncertainty. After all, American producers would no longer be proof against the response very similar to the OPEC in 2014., ie expanding manufacturing to decrease costs and thus exclude them from the marketplace, as a result of they’ve a lot upper manufacturing prices.

Given the contradictions which might be inherent within the coverage equipped by means of the tramp management, may just no longer be a winner: neither shopper nor manufacturer. The one sure bet issues the environmental penalties of “proformic” insurance policies and imaginable penalties of leaving the USA from Paris Agreements – will different international locations practice this time?

All in all, D. Tramp might be came upon as a dealer of geopolitical possibility, which inspires fragility and worth instability in petroleum markets.