In 2025. The explosion of Chinese language families is a supply of significant vulnerability or evolution that related to different nations? Resolution in graphics and figures.

Because the 2000s, the rise within the debt of Chinese language families is impressive. In keeping with CEIC, the entire quantity of this debt multiplied for just about twenty of 2007. years. He reached about $ 11,500 billion within the first quarter of 2025. Years.

This fast build up is an important exchange within the monetary conduct of Chinese language families, and in advance permeated tradition right through the commercial transition of its nation, consistent with Guan MA and Wang II economists. An unseen pattern in global panorama, educated in elements particular to the financial system this is all the time converting.

Host in China (in hundreds of billions of bucks). CEIC information

In spite of information for explosive debt, other signs disclose the danger restricted handiest to a part of families, the ones with the bottom source of revenue.

Between evolved and respected nations

The Chamber in GDP percentages in GDP % larger from 18.8% in 2007. at 60% in China fourth quarter 2024. years against the financial institution of global rules.

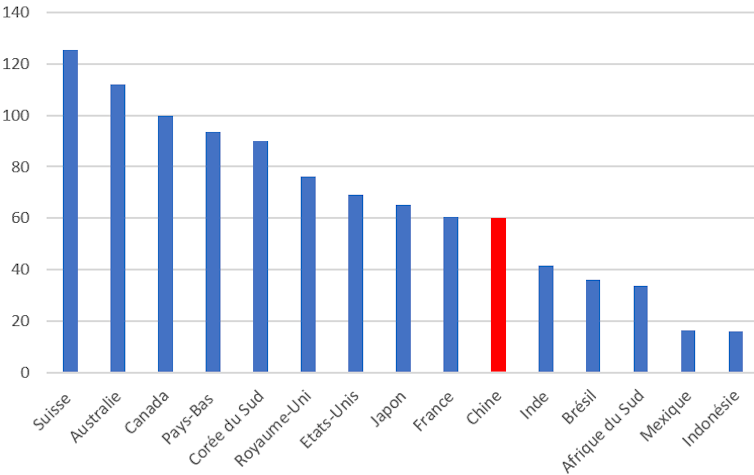

If this determine stays moderately modest in comparison to economies, in Australia, Canada, South Korea, the Netherlands and Switzerland Correction / GDP debt ratios between 90 and 130% – is way upper than different rising economies. The host in Indonesia and Mexico is not up to 20%, whilst the rankings of Brazil, India and South Africa are between 30 and 45%. This putting distinction emphasizes the original Chinese language scenario, between evolved and respected economies.

Do-it-yourself debt in% of GDP (4½ quarter 2024). Financial institution of global rules

Some other key indicator of the family sustainability is a debt courting in comparison to to be had web source of revenue. Due to this fact, it lets in for a comparability of the mortgage with a investment capability. China The ratio used to be between 55% and 80% in 2013. years, between 80% and 110% in 2017 years and 115% on the finish of 2023. Years.

Align those newest information to the USA and Median OECD nations, the place the connection is met about 110% in the similar length. Even if the determine of China remains to be less than nations reminiscent of Australia, Canada, South Korea, Norway or Switzerland coming near or exceeding 200% of to be had source of revenue -, a pointy build up larger higher debt in terms of family source of revenue.

Hukou (inside passport), actual property and virtual finance

Stretching family debt is the results of mixtures of monetary, institutional and social elements. Two elements are very important:

Those two elements replicate the promotion of the federal government possession of homes and fiscal markets lately. Analysis in rising economies – together with China – recognized different elements reminiscent of demographics, source of revenue and wealth of families, training or perhaps a feeling of well-being.

Monday to Friday + week, obtain analyzes and deciphers from our mavens totally free for some other view of the scoop. Subscribe nowadays!

The Chinese language case-specific issue is a Hukou machine. This housing recording is topic to a number of reforms. In lots of massive towns, get entry to to consistent Hukop is dependent upon prerequisites reminiscent of belongings, tax contribution and participation in ability promotion systems. Those necessities might impact the conduct for lending families, as a result of possession of homes used to be continuously a precondition for acquiring the standing of an everlasting previous scenario.

HUNT AVAILABLE HOUSES

The mortgage ratio to price (the ratio of in a position worth), which measures the scale of the loan in comparison to the values of belongings, unearths that the debt of Chinese language families turns out moderately secure on the macroeconomic stage. The truth is extra complicated. Research display that Mala -in -in -in -Rose families are in particular prone. They may be able to enjoy nice difficulties in honoring their money owed – too giant in terms of their investment capability – particularly in case of falling source of revenue or the cost of their belongings.

The complexity of interpretation of debt / earnings ratio in China in Article (115% on the finish of 2023), method and definitions of to be had source of revenue, which fluctuate consistent with assets. Due to this fact, exact evaluation of the particular burden for weighing prone families is tricky to stay heavy. In keeping with the Monetary Evaluate Monetary Company FITCRACTS, the share of unprofective loans of intake – overdue for cost or has somewhat likelihood to compensate in China lately. At 3%, it stays low in global comparability.

Most of these parts replicate the danger contained, but in addition a undeniable uncertainty with the rise of various lines and difficulties in interpretation.

Distinguish a brief and long-term

The fast build up within the family debt raises problems associated with the have an effect on on intake and, increasing, to financial enlargement. In contemporary analysis, quick and long-long differentiated results had been analyzed.

Within the quick time period, the rise within the mortgage can inspire family intake. What’s it for? Since people use credit score to finance purchases that might no longer come up with the money for to come up with the money for otherwise. Client loans at the moment are an expanding a part of the entire debt of Chinese language families.

Within the center and long-term cut-off date, upper ranges of debt may end up in decreasing intake, families devoted to maximum in their source of revenue within the provider in their debt. This evolution may decelerate home call for and make contact with into query the rebials of China against the expansion of intake, figuring out it’s nonetheless structurally low in China.

Whilst China develops on this complicated monetary panorama, political resolution – to discover a subtle steadiness between the stimulation of intake and upkeep of families on sustainable ranges, particularly for low source of revenue. The evolution of the Chinese language financial system, formed actual property markets, virtual price range and socio-economic adjustments, will proceed to persuade the debt within the family within the future years.