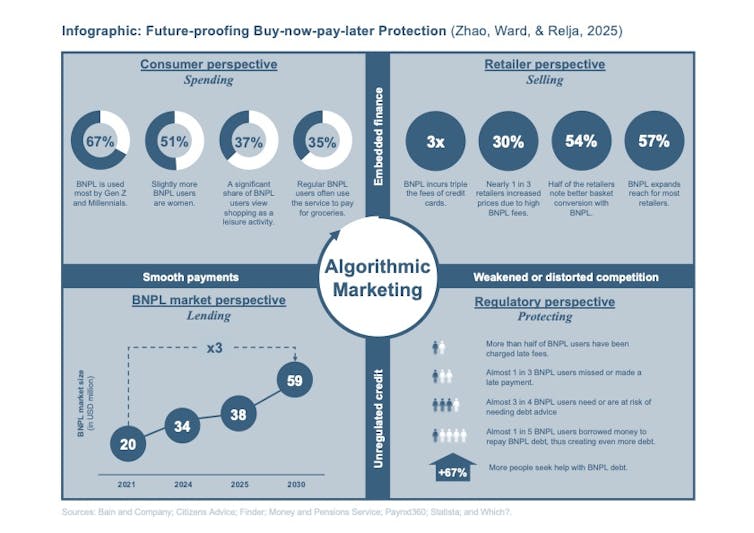

Many shoppers – particularly gen Z and millennials – use buy-now-pay-later (BNPL) to separate or defer bills. The varieties of purchases made with BNPL can vary from groceries and takeaway deliveries to luxurious pieces.

Just about 40% of standard BNPL customers believe buying groceries a recreational job. Simply having access to such credit score may just build up intake on this crew. It’s, subsequently, unsurprising that the United Kingdom BNPL marketplace is projected to triple from 2021 ranges through 2030.

With well timed repayments, this temporary credit score choice is loose from hobby and costs. As an unregulated provider, BNPL calls for minimum monetary exams, making sure that almost all purchases will likely be all of a sudden authorized.

A purchaser can gain pieces briefly with out paying the whole quantity prematurely – the BNPL supplier will pay the store for the products and recoups the volume from the patron via instalments.

So how do BNPL suppliers make their cash? Whilst they will rate shoppers past due charges and account prices, their number one earnings comes from taking a share of each and every BNPL transaction from the store and a provider price. This trade style is usual for fee products and services.

However outlets regularly pay a lot more for BNPL transactions – every now and then 3 times greater than conventional bank card processing. So that you can make sure that they make a benefit, BNPL suppliers deftly inspire shoppers to buy with outlets that use their products and services.

BNPL is a type of embedded finance – that means that it seamlessly integrates bills into store websites. Greater than part of shops are seeing higher conversion (extra other folks occurring to shop for after surfing) after they be offering BNPL. This additionally lets in many outlets to extend their marketplace, as BNPL makes merchandise out there to extra shoppers.

However there’s a catch. With upper BNPL charges, just about one in 3 outlets move those prices directly to shoppers via upper product costs on the checkout. Customers face upper costs, and but BNPL promotes affordability.

A wedding made in heaven?

On this situation, BNPL acts simplest as a credit score product. However in truth it’s greater than that. A number of suppliers have created buying groceries platforms selling outlets and providing simple reimbursement control.

This mix of straightforward budget, interesting buying groceries stories and technology-enabled reimbursement distinguishes BNPL. Our analysis signifies that BNPL may just reshape retail landscapes through weakening pageant.

Many BNPL suppliers be offering user-friendly web pages and apps, exceeding conventional monetary provider expectancies and influencing key mental determinants of BNPL use, comparable to viewing it so as to lower your expenses or being psychologically distanced from the act of borrowing.

As printed in our most up-to-date learn about, those platforms are visually interesting, spotlight quite a lot of manufacturers and be offering centered reductions. BNPL is simple to navigate, expands budgets and offers get entry to to credit score to those that may differently combat. Whilst BNPL seems to democratise credit score, its opaque nature too can provide pitfalls.

The bundle can advertise client spending, debt and over-consumption. Because of this, there was a upward thrust in past due charges. Greater than part of BNPL customers have incurred a price, one in 3 have ignored a fee and 3 in 4 are vulnerable to desiring debt recommendation. Others have borrowed to pay off BNPL debt.

BNPL choices could make the purchasing procedure seamless.

Tada Photographs/Shutterstock

This escalates when shoppers have a couple of agreements throughout suppliers, complicating debt control. Many BNPL customers really feel susceptible, weighing long-term financial savings towards advertising and marketing that encourages spending. Their skill to control this vulnerability impacts their monetary well being, wellbeing and self-image.

As considerations about BNPL debt upward thrust, regulators in nations comparable to the United Kingdom are addressing its monetary provider sides. Then again, they regularly forget suppliers’ ways for concentrated on shoppers and supporting their buying groceries behavior.

Doable legislation specializes in monetary attributes, together with affordability exams, however neglects the technological mechanisms that stay shoppers the usage of BNPL.

Our analysis means that BNPL’s good fortune rests on its efficient use of expertise, specifically synthetic intelligence and its algorithms. They streamline the mortgage procedure, permit repayments to be adapted to each and every client, assist consumers in finding what they’re on the lookout for and establish outlets, manufacturers and merchandise {that a} consumer may like. BNPL suppliers are technology-based retail platforms up to monetary establishments.

BNPL in numbers

Creator supplied (no reuse)

To give protection to shoppers, regulation like that proposed in the United Kingdom should deal with the technological middle of BNPL and the hazards of algorithmic advertising and marketing when designing retail websites. Those dangers may just come with centered store and product promotions that nudge purchasing behaviour, or construction a buyer’s reliance on delaying bills.

Proposed legislation specializes in the person credit score settlement between a consumer and supplier. This overlooks cumulative BNPL spending and its patience. What’s wanted is a holistic means taking into consideration that customers regularly input a couple of agreements directly. This impacts buying groceries behavior, budgeting and reimbursement behaviour.

Handiest through addressing this may increasingly shoppers be correctly safe. However rethinking BNPL may even imply pondering once more about who may well be a susceptible client. Conventional demographic elements fail to seize BNPL customers’ psycho-social traits – such things as materialism, impulsiveness and fiscal literacy. Those are extra influential than demographic markers on their utilization and reimbursement behaviour.

Regulators want to perceive who’s the usage of BNPL and why. Handiest then will they respect BNPL’s complete scope and marketplace affect and be capable to permit shoppers to have a wholesome dating with credit score.