Non-payment of arcanzas, injury to Panama and leaving the rental of the order … The Uncle Member isn’t in a position to make amends for its credentials. What courses with?

In 2025. French public debt is now culminating at nearly 3,300 billion euros and fees of pastime on 59 billion euros. Mirobal Suma, which agines purple fabric injury, ie to be incapacity to honor claims. Financial literature at the shortcomings of sovereign bills is wealthy in lectures.

In style concept: Defects basically have an effect on or increase international locations, whilst huge countries are spared. The Fitch Monetary Evaluation Company confirms in its remaining file of 27. March 2025. That the primary countries retained its 0 historic pace of wear, emphasizing their robustness within the face of marketplace volatility. The best file centered lately.

Then again, it’s sufficient to have a look at a little of that we take into account that the checklist of lacking international locations does now not distinguish the primary powers and small countries throughout their historical past. Previously hundred years, we will be able to checklist South Africa, Egyptian, Nigeria, Argentina, Brazil, Venezuela, Mexico, Philippines, Japan, Iraq, Philippines, Sri Lanka, Sri Lanka, Germany, Austria, Greece, Poland, and so forth. It is usually 3 on the planet, however 3 of its sovereign responsibilities … 1933. Years.

What courses can I be informed from him?

Sovereign defect in debt

Sovereign shortcomings that seem when the rustic does now not pay all its monetary responsibilities, together with charge of pastime, in line with his collectors. The Cost Preset might precede the respectable announcement for the Executive or happens with no formal remark.

The reasons that lead the land on sovereign flaws are more than one. We basically point out persistent financial stagnation, characterised by way of low expansion, repetitive funds deficits and structural imbalances in present accounts, in addition to over the top ranges of debt. Negligence of indicators of precursors performs a decisive function, comparable to the simple financial coverage this is aimed toward selling financial enlargement and lighting fixtures of debt inflation or depreciation of native forex inflation or depreciation of native forex.

Arguments in prefer of lack are ceaselessly according to lowering debt debt, relief of capital homes, maintaining foreign currency reserves, in addition to the wish to negotiate debt.

Sovereign defect in the US

When the US is lacking in its lengthy early 1840s, no person would believe that the rustic would enjoy a an identical episode lower than a century later!

The time between 1840. and 1842. used to be probably the most hanging and sudden cave in within the historical past of the US. The 19 twenty-six states are at the default. Explanation why: Evaluation of the price of the development of the channel, has ended in the buildup of colossal money owed. Within the 1830s, American international locations agreed on those money owed to finance infrastructure tasks and the development of channels, of essential for financial building. The financing of those tasks has came about basically by way of the problem of state bonds.

Monday to Friday + week, obtain analyzes and deciphers from our mavens without cost for some other view of the scoop. Subscribe lately!

We and century, throughout the similar 12 months, the USA govt refused to settle gold because of Panama because of the contract from 1903. 12 months, Arkanzas used to be lacking its lengthy and golden situation suspended the brand new President Franklin Roosevelt.

Rigidity at the Inventory Trade in the place to begin

Economists ceaselessly decide the black crash at the Inventory Trade on Thursday, which came about 24. October 1929. years, as a kick off point for a super American despair. On the height of despair, 1933. 1 / 4 of the operating inhabitants within the nation, or 12.83 million folks, is unemployed. The source of revenue of the employee’s income who controlled to stay their task fell by way of 42.5% between 1929. and 1933. Years. Stagflation, an extraordinary phenomenon wherein the financial system concurrently suffers from sturdy inflation, normal and sustainable worth will increase and occasional, prevails.

Abandonment

Since 1930., the US is going through a large leakage of gold. Confronted with the concern of forex cave in and monetary establishments, banks and traders demanded increasingly gold in alternate for bucks.

With a view to stabilize this lack of valuable steel and stabilized the nationwide financial system, the American government in April 1933. made up our minds to droop their convertibility. They restrict bucks homeowners, whether or not American or international, flip their forex into gold. This measure places the tip of gold, the financial machine in power since 1879. 12 months, the place the forex supported gold.

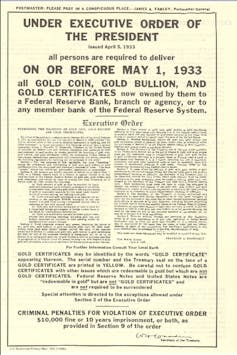

The order issued Franklin D. Roosevelt 1933 years throughout the Nice Despair, tough US electorate to go back their gold. VikimediaCommons

On the similar time, President Roosevelt orders the alternate of all portions and gold certificate value greater than $ 100 for different sorts of cash. He forces all homeowners of gold cash, golden ingots and gold certificate to go back them to federal reserves earlier than 1. Might. The fee is about to $ 20.67 in step with ounce. 10. Might 1933 12 months, the USA govt accumulated $ 300 million in gold items and $ 470 million in gold certificate.

The US unilaterally restructures its debt and surrender their responsibilities in opposition to their credentials. They require a golden charge, by way of adopting the solution of the Congress that abolishes the golden clauses within the contracts. The latter stipulates that the borrower will have to make amends for the greenback credentials or has the similar weight and the similar fineness as they’re borrowed. The defect in gold charge, materialized with revocation to the greenback legal responsibility of convertibility in gold, adopted in 1934. Devaluation of the greenback worth. It passes the go with the flow of gold with 20.67 to $ 35 … Devaluation of 41%.

Error in line with Panama

The anxious relationships of the Uncle Earth by myself with Panama don’t give from lately.

In 1933, the unilateral restructuring of American debt in gold created some other failure, in line with Panama. It’s materialized by way of cancellation of golden clauses found in all debt agreements, together with the ones involving international credentials. This ends up in a bargain of 41% of this debt. The American government refuse to pay for the scheduled date of charge in gold bats, the forex listed on gold and is used as a logo of Panama financial sovereignty.

This partial rejection of debt in opposition to Panami creates exceptional political tensions between two international locations. Via 1936. 12 months, the American govt in the end paid the sum agreed within the golden balboa.

Arkansas defect

Two earlier errors are accompanied by way of the similar 12 months, from Arkansas. This situation, severely struck nice despair, may just not recognize their infrastructural responsibilities.

Within the Twenties, Arkansas knowledgeable the responsibilities to finance the development of the freeway, assured belongings taxes. Provision of tax income, mixed with expanding debt to Wall Boulevard banks, makes it unattainable debt services and products. As early as 1932. 12 months, the state may just not face $ 11 million bills in the primary and pastime. After a failed rate try in 1932. 12 months, Arkansas proposed new stipulations, he rejected credentials. The legislative resolution, directed to consolidate responsibilities in a brand new quantity, used to be additionally rejected.

Zinc mine deserted in Arkansas. The one American state lacked its sovereign debt throughout the Nineteen Thirties disaster. VikimediaCommons

Arkansas then suspends the charge of pastime and capital to a number of million bucks in securities. He was the one American state missing his sovereign debt throughout the Nineteen Thirties disaster. Till the tip of the Nineteen Thirties, he controlled to go back to the credit score marketplace, however at many extra restrictive stipulations. Those stipulations come with an building up in tax and waiver from the state to keep watch over their freeway source of revenue, a dive carrier assigned.

Can historical past be repeated?

The projection of the long run is a mild workout, and the loss of sovereign charge all the time ends up in prices.

On the subject of the US, the wear may just query the standing of greenbacks as a pole of the world financial machine. Some are already bearing in mind a selective malfunction within the American rainbow.

The selective sovereign fault happens when the state makes a decision to not recognize a few of its money owed whilst proceeding to compensate others. This technique reduces debt throughout keeping up the a part of investor believe.

It’s going to simplest be the long run for us …