The Council of Fiscal and Monetary Coverage has simply licensed the proposal of the Central Govt to condend the debt of the joint neighborhood communities. This has its beginning within the settlement reached between the Spanish Socialist Celebration (PSOs) and ESKUERRA Republikane de Catalunia (ERC) for making an investment Pedro Sanchez, in November 2023. years. Then the removing of 20% of Catalonia's debt with the location: 15 billion euros was once agreed.

Earlier than stirring generated in different autonomy for not unusual regimes, some with vital ranges of debt, the federal government clarified that the stated contract comprises different not unusual areas.

The proposal acknowledges that, because of the affect of the monetary disaster between 2010. and 2013. yr, self reliant joint not unusual regimes had been borrowed in extra. Right through those years, those areas agreed to finance via self reliant liquidity fund, an peculiar mechanism created via the central govt to liquidity in communities in very favorable rates of interest. Extension throughout this mechanism brought about an adoption-indictiveness that turned into an inaccessible go back to the monetary markets of the inner most communities.

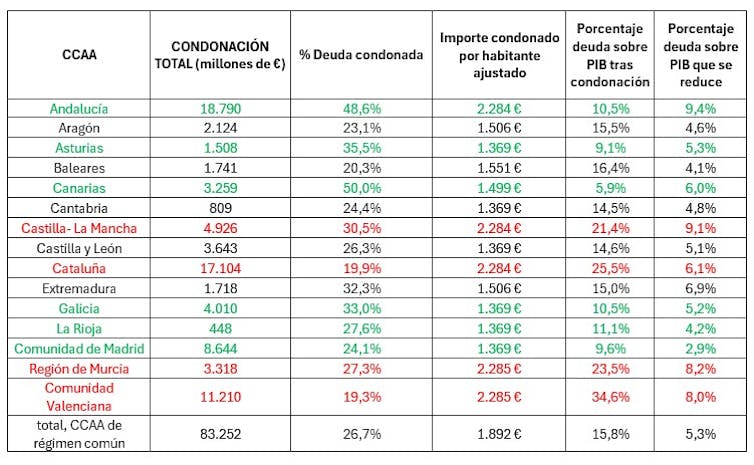

Personal elaboration in line with a record at the debt of CCAs in step with the deficiency protocol protocol printed via the Financial institution of Spain (2024)

Article 13 Natural legislation 2/2012 at the state of balance and fiscal sustainability implies implicitly that not unusual communities regime will have to have a share of debt of 13% of its gross home product (GDP). Since September 2024. yr, best Canary Islands, Madrid, Navarra and Basque Suggest, whilst Valencian Group, Catalonia, Castilla-Los angeles Mancha and Murcia area have a share of debt above 30% in their GDP.

A conduction proposal

The proposal introduced via the Govt is reviewed -indance throughout 2010. and 2013. of 80,360 million euros. With this determine, the phonacy is structured in 3 stages:

The primary segment: 75% of the fan is shipped in keeping with the slender method of the inhabitants. This method, which tries to measure self reliant spending via more than a few prices of offering services and products, has little or that means to the reasons that motivated over-indentivity of joint communities joint regime. Alternatively, it turned into the one function distribution criterion.

This primary segment supplies a median conduction of nineteen.33% of the present debt of the joint neighborhood communities. A few of the primary beneficiaries are Andalusia, Catalonia, Group of Madrid and Valencian Group.

2nd segment: The purpose is to reach a purpose of nineteen.33% of the typical debt that has been translated via those communities that didn’t arrive within the earlier segment. On this manner, they obtain further Quita Catalun (6,301 million euros), Valencian neighborhood (493 million), Murci's area (358 million), Castilla -Los angeles Mancha (170 million) and balearing islands (122 million).

3rd segment: The purpose is to extend (in line with function standards) for 11,505 million euros forgiving the debt. To do that, it follows two standards.

The primary criterion: the forgiveness of those communities will increase that it was once unfinished with the present financing style when it comes to tailored citizens. That is, with an index of lower than 100. This neighborhood will harmonize the tailored citizens of the Valencian Group, which is an affordable area won via essentially the most constant (2 € 284 in line with tailored resident). Probably the most destructive areas with present style are, Valencia, Murcia, Andalusia and Castilla-Los angeles Mancha area. Alternatively, Catalonia could also be concerned when the knowledge display that he has at all times been on moderate of the tailored resident. On this manner, they obtain Andalusian debt forgiveness (7,531 million), Castilla-Los angeles Mancha (1 804 million), Mursi area (972 million) and Catalonia (484 million).

2nd standards: Communities that alleviate their price range imbalance, carried out of their normative competencies, above moderate in taxes of herbal individuals (IRPF) advantages from an extra habits of 10% (corresponding to Aragon, canary islands). Then again, the ones underneath moderate advantages of an extra 5% (the case of Balearic islands).

With this proposal, Andalusia and Catalonia can be communities that almost all used debt removing (43% of the whole). Andalusia, Asturias, Galicia, Los angeles Rioja, Madrid, Canary Islands, Navarra and Basque Nation, would principally input the debt percentages which are absolutely legitimate for lending in monetary markets.

The debt coefficient at the GDP neighborhood is diminished, usually, 5.3%. Alternatively, areas corresponding to Valencian Group, Murcia, Catalonia or Castilla-Los angeles Mancha, will require further changes as a way to cross to monetary markets with out coping with prime possibility top class.

What will have to were carried out?

The prime quantity of debt of a few autonomy transformed Condars into an best sustainable answer so they may be able to get entry to monetary markets. Alternatively, which is mindful that the commercial cycle has been on regional price range since 2010. till 2018. yr, the seek for function reasons for debt is a fundamental criterion for averting long term rescue necessities when the monetary scenario is difficult.

On this sense, forgiving the self reliant debt leading to an inefficient investment machine, the honest and function criterion turns out. Alternatively, there are standards that may be regarded as more practical and environment friendly, with out advert hoc political part.

To steer clear of ethical possibility related to forgiveness as any scenario wherein it does no longer come to a decision might not be the end result of failure, dedication to tax adjustment, averting tax refusals that supported the communities.

Mavens have introduced the introduction of a transitional leveling fund to counterpoint the source of revenue of joint joint communities.

The agent proposed via the Govt, with out function standards and with out requiring the rest in areas for returns that collected upper ranges of money owed and will create imbalances in tax incentives. As well as, this measure will have to function a consensus agent in regards to the anticipated reform of the regional financing machine.

In the end, if the initiative progresses, the self reliant liquidity fund was once created throughout the Nice Recession, in an effort to steer clear of identical eventualities sooner or later. The reform of the Regional Financing Gadget could also be underway to ensure its long-term sustainability.